By Alfonso Esparza

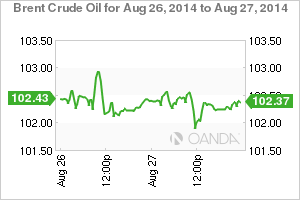

- Crude rose after US gas inventories shrank by 960,000 barrels

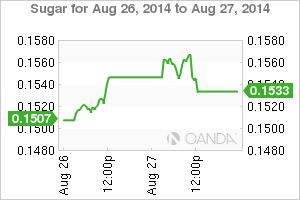

- Sugar Lobby in US wins higher import duty as global supply pushes prices down

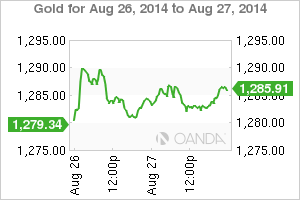

- Gold supported by geopolitical risk and USD weakness

|  |

|  |

The Energy Information Administration published the official US gasoline and crude inventory data. Refineries increased their output while gasoline stocks decreased. Crude stocks increased in Cushing, Oklahoma but the fall of 960,000 barrels of gasoline was in line with expectations.

Brent futures gained on a choppy trading day. The debate on Scottish independence has put some of the spotlight on energy as both sides are arguing about the potential of the North Sea fields.

The Buzzard oil field was due maintenance which reduced supply in Europe since July and will be back on duty this week.

Oil continues to be at the whim of global economic growth. Worrisome signals out of China have been evened out by strong results from the US. Even armed conflicts in oil producing countries have not had the effect that forecasted demand have had to the black stuff.

Sugar around the globe continues to fall towards the support line of 0.15 that held at the beginning of the year. High supply has driven prices down. Producers are worried that demand will not catch up with the current supply. The US has increased the duties on Mexican sugar and worries about droughts in Brazil have boosted hopes that sugar can recover from the current slump.

Spot gold has risen on the back of a weak USD and rising uncertainty not only in conflict zones, but in rising political strife in Europe which might trigger further action by the European Central Bank.

US equities continue their rally which should have ended the metal’s hopes of rising, but after confirmation from Russia that it indeed that nation’s soldiers that were captured in Ukraine hopes from a successful negotiation seem unlikely.

Germany has been the engine of European growth, but it seems that even the engine can falter. The German consumer sentiment suffered an expected drop after the Ukraine-Russia conflict continues to threaten European energy supplies.

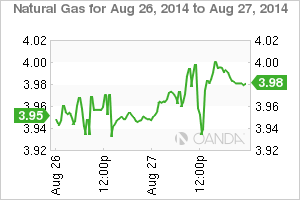

This time Europe has stockpiled enough natural gas to last until fall, but that time is fast approaching and can come before a true agreement is reached between Ukraine and Russia in a conflict that started with the annexation of Crimea.