Imagine you were told the following information:

- A retailer has a SG&A run rate of $197 million

- The retailer's peak "gross profit" in the last five years was $208 million

As you know, SG&A is subtracted from gross profits to equate operating income, assuming no other expenses. The easy math looks like there is a gap of some $11 million between the current SG&A run rate and five-year peak gross profit. That number is, of course, pretax.

We are talking about Bebe (OTCPK:BEBE) the vertically integrated specialty women's retailer. The company sells at about $213 million -- or a 5-year peak earnings yield of 5.4%. And, of course, current earnings are deeply negative, about a negative 32% earnings yield.

Bebe's share price seems to be sustained by its sizable cash hoard and the fact that maybe, just maybe, they can achieve their late housing-bubble profits -- which reached as high as $75 million in 2006.

We believe that Bebe has "value trap" written all over it. It has a large concentration of stores in malls -- a slowly dying breed. Further, being vertically integrated -- except for manufacturing and raw materials -- implies higher fixed costs compared to some other specialty retailers.

Further, retail itself is tough and woman's fashion is especially hard. Fashion trends are constantly changing and further the internet is reworking the entire clothing distribution system. We would avoid Bebe. Let's first examine the "upside" of a turnaround.

Operations

Take a look at revenues, net income and free cash flow:

As one can see, revenues were $650m+ when profits where about $60 million. Seeing as revenues have declined some 35% since then, we would be wise in expecting max possible earnings on $425 million of sales of around $39 million. Let's say that was obtainable in the near term -- then Bebe would be selling at an 18% earnings power. Obviously, only under profitability scenarios like that would Bebe be a worthy commitment today.

Furthermore, the company has a large cash hoard -- some $145 million of cash, cash equivalents, and investments -- which will absolutely help the company in a turnaround.

Take a look at the top of Bebe's cash flow statement (please try our Filings Reader for Android!):

(2013 10-K, F-7; source: Time & Model's Filings Reader)

You can see the last two years of $70m+ losses at the top (orange line). If we try and calculate the current cash burn rate, we would probably do the math like so:

- Negative $30 million in cash from operations (yellow underline)

- $20 million in capital expenditures (purple underline)

- $4.7 million in dividends on the common (forward looking)

Or, in other words, the company has a burn rate of about $54.7 million on a TTM basis. In essence, they could burn through their cash in three years' time, if nothing improves.

For us, these really should suggest that betting on a turnaround at Bebe really isn't going to provide a lot of upside. First things first, the company needs to halt its cash burn rate -- a doable thing but unlikely in the very near term given its current magnitude.

With the 76-year-old founder Manny Mashouf still holding 55% of the stock, there is a lot of incentive for a strong and intelligent managerial response to the continued deterioration of the business. But let's say we get that improvement: the current $213 million in market cap implies profits of around $15 million -- or a huge $85 million more than last year's profits and $69.7 million above last year's cash burn rate.

This gap between current earnings power and "implied" earnings power is quite large when compared with revenues -- 17% to 20% of revenues. In other words, the company has to improve margins by an enormous amount before earnings can even be presumed to support the current share price.

Merchandising

First, the merchandising of Bebe targets the "bebe woman" who is, according to management, describable with the following adjectives: bold, confident, glamorous, feminine, sophisticated, powerful, ageless and, of course, the bebe woman stands out in a crowd.

Nevertheless, the bebe woman hasn't been coming around to the shop as frequently. The new interim CEO Jim Wiggett commented on the company's merchandising and advertising approach on the most recent conference call:

"Our design, merchandising and production process left us with an overly broad and shallow product offering that was not well coordinated or merchandised….the previous 9 PM to 5 AM campaign and imagery was too focused on clubbing and partying message which reinforced very narrow brand positioning."

My! Where have I heard that before -- maybe Citi Trends (CTRN) or Body Central (OTCQB:BODY)?

Retail generally but specialty clothing retail in particular is undergoing a broad fundamental channel adjustment. More goods are being piloted from warehouses directly to the customer -- facilitated by ever expanding internet commerce and the new "omnichannel" approach. The old distribution model, which went from manufacturer, to wholesaler, to retailer, to customer is being shortened in some areas and skipping the operating leases, labor and inventory expenses associated with retailing. You know the old story -- the whole trend will likely be a case study 30 years hence.

Particularly affected, however, appears to be the "clubbing" genre and some areas of woman's clothing. And Bebe is certainly in this category -- as the interim CEO says, "We are pretty defined in the party category." Take a look at some of the retailers in this area:

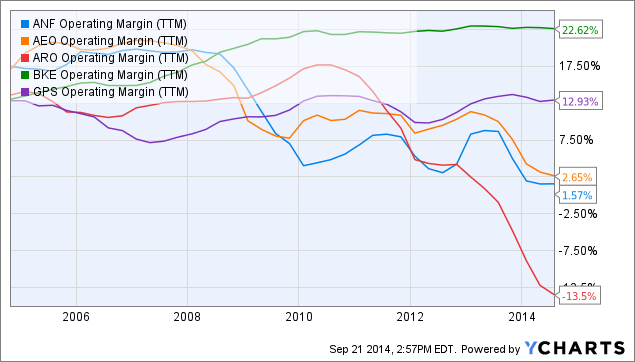

BODY was in default however its lenders entered into an extended forbearance (BODY Q2 2014 10-Q, p. 10). None of these are all that healthy. Most other people would compare Bebe with its fellow mall shops, like Abercrombie & Fitch (ANF), American Eagle (AEO), Aeropostale (ARO), Buckle (BKE) or Gap (GPS). Check out these companies' operating margins:

The tickers, which start with the letter "A," have been doing the worst. Buckle and Gap continue to do fairly well -- but the mall sector is under pressure and Buckle is the only outperformer in this (incomplete) list.

In any case, our real concern is that there is way too much risk, with way too little upside for an investment in Bebe today.

However, we are not condemning it indefinitely since it has the cash assets to make it through a transition -- but we say, "not yet and not at today's prices." We would want to make the venture at a much cheaper price.

Principles of The Turnaround

Turnarounds are provisional and plans are subject to change and adjustment. As the ancient aphorism goes, it is a bad plan, which admits of no modification.

Here is the current plan, as detailed by Jim Wiggett in the last conference call:

"Our first priority is to increase product distinction with the contemporary accessible fashion merchandised offering…We've changed our approach on product and specifically our approach to move away from buying items with extensive SKU counts. The less depth and more breadth strategy in the past year has been stopped…Investments made in certain inventory categories such as day dresses, jumpsuits, knit tops and jackets simply did not pay off, which necessitated extensive mark downs and negatively impacted the merchandise margin…

Our second strategy of focus was to align our marketing campaign from traditional to new media, focused on messaging that speaks to the bebe women. In the past 60 days plus, we've refocused our effort on the bebe brand to align with our defined target customer…

Our online presence is our third strategy and a major part of our upside. Digital is an integral part of a true omnichannel relationship with the market place. This allows us to engage our customer wherever she shops…

Our fourth strategic focus is to close - was to close all 2b stores to focus on the core bebe brand. 2b was not a feeder brand for bebe, and was both a distraction and a financial drain to the company. We will slow [sic] our store growth short-term [i.e., they will decrease their store count] while we reposition our assortments in the lifestyles…

Our fifth strategic focus is our international business…

Our sixth strategic focus is on the ROI based investment for a sustained long-term growth. We are absolutely in cash preservation mode and have been disciplined in managing and planning for investments in SG&A and CapEx.

In addition to the headcount reductions in restructuring in late June and July, we've reduced our marketing by just $20 million for fiscal 2015, trimmed down an additional 10% of all applicable SG&A spending areas and been aggressive in our real estate rationalization efforts to reduce the fundamental cost structure of the company." (Emphasis added)

Basically, it is the plan followed by many troubled retailers: evaluate merchandising strategy and positioning, change composition of marketing spend, push for online sales, close underperforming stores and reduce headcount at corporate.

The company has been taking markdowns on its inventory as it tries to clear its aging inventory. As put on the conference call:

"For the first quarter of fiscal 2015 [July 1 to September 30] we expect comparable stores sales to be in the negative low single-digit to flat range. For the first two months of the quarter we were aggressive with our promotional strategy in order to ensure a clean inventory position heading into the fall. We have completed the clearing process."

As the last sentence indicates, Bebe is trying to position itself for a strong holiday quarter by getting rid of bad merchandise over the last couple of months. While this could provide a pop if they are profitable, we still think the gap between today's cash burn rate and the possibility of profits is much too large to bet on.

If they trim SG&A and trim marketing, they will cut into this burn rate, but they will still likely have at least a $40 million negative earnings gap which needs to be made up for by either (1) gross margin improvements, (2) revenue improvements or (3) more cost cutting. This gap, after assuming success with their current cost cutting process, is still 10% of revenues. It is pretty clear that this gap will be difficult to close within the year.

Leverage

While there is no debt on the balance sheet, it would be imprecise to say that Bebe wasn't leveraged. Like all retailers, Bebe enters into operating leases. These leases, if structured as capital leases, would need to be placed on the balance sheet. I've calculated the PV of future operating leases below:

As one can see, the company actually has an operating lease liability of $150 million -- this makes the balance sheet less attractive.

Conclusion

Bebe is in a tough place -- but it has a base of 207 stores and lots of cash. With the stock having fallen like a brick, the stock seems to be attracting the bottom fishers. In our opinion, this is unwise. Not necessarily because the company cannot turn around -- but because a significant portion of the turnaround is already baked into the shares despite their antecedent decline.

We would be very interested if the price continued to decline further. However, from the standpoint of today, it looks like next year will also be unprofitable. The road ahead for Bebe is a long one -- continued deterioration of the underlying business would continue to hurt the shares despite the company's very liquid position.

We advocate very conservative buying. Bebe is not cheap enough to entice us. We all know the oft repeated phrase, "turnarounds seldom turn" but there is some truth to it -- especially in retailing where customer shopping preferences can simply and capriciously change permanently. Good luck.

Disclaimer: The opinions expressed in this article are those of the author as of the date the article was published. These opinions have not been updated or supplemented and may not reflect the author's views today. The information provided in the article does not provide information reasonably sufficient upon which to base an investment decision and should not be considered a recommendation to purchase or sell any particular stock or other investment.