I have repeatedly come across the same headlines in the media regarding “China’s rate hikes are bearish for gold.” There are several reasons why this couldn’t be further from the truth, two of which I consider to be very obvious and able to be deduced via basic logic, yet overlooked by the mainstream.

The first, which I won’t focus on in this article, is the fact that the real rate of interest is still negative. The second is much more obvious, yet the continuous banter from the masses indicates they have a complete lack of deductive reasoning ability. So the story goes that China’s rate hikes are bearish for gold, as they will prevent inflation. But let’s rationalize these rate hikes and their effects and revisit this statement.

How does a central bank hike rates? It sells bonds (treasuries) to the public, thereby contracting the supply of money (a.k.a. open market operations). But because the yuan still retains a rather hard peg to the USD, central banks are then limited in their ability to hike rates to any meaningful degree. Why is this? Selling a large quantity of bonds on the open market would contract the money supply, thus causing the purchasing power of the yuan to rise if the U.S. did not do the same. In other words, this would cause the yuan to rise against the USD, weakening the peg.

What are the effects of a rising yuan? In our case, because we have abandoned our manufacturing base and have a massive trade deficit -- coupled with the fact we import a significant quantity of lower order goods from China (both input products as well as finished goods) -- our input cost would necessarily have to rise. I know that everywhere I look, I see a tag saying “Made in China” -- but maybe I’m just delusional.

Given the massive increase in the real money supply (that which is immediately available for use in exchange), we have already created an inordinate amount of inflation which has in part been masked by artificially low input costs, as the Chinese have taken inflationary pressures off our hands by accepting a reduction in the purchasing power of the yuan.

So should the yuan begin to de-peg to a meaningful degree, we would see a sharp spike in input costs which would be passed along to the consumer. This would then propel inflation expectations to rise, causing a rise in the demand for an inflation hedge (precious metals). Below is the same argument using purchasing power parity

Purchasing Power Parity and China

1. Equation of Exchange à MV=PQ

a. P is the price level

b. M is the money Supply

c. V is the velocity of money

d. Q is Output

Or àMV = (Ppresent*Qpresent)+[(fe^it)*Qfuture] = PQ

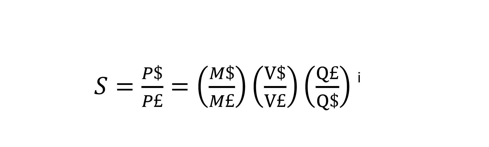

2. Purchasing Power Parity à

a. S is the exchange Ratio

China is currently hiking interest rates. This entails a decrease in M£ and will cause the exchange ratio (S) to increase, but a peg entails holding S constant. One of the other variables must change to offset the decrease in the money. For instance, the peg will be maintained if an increase in Chinese velocity (or fall in U.S. velocity) offsets the decrease in M£.

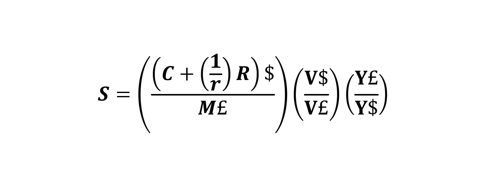

3. Money Supply à M = C + D

4. Demand Deposits à D = (1/r)R

5. Combining Equation 2 and 3, Money Supply à C + (1/r)R

6. Combining Equation 2 and 5 à

[Click to enlarge]

Where: S = Exchange Rate, M = Money Supply, V = Velocity of Money, Y = National Income, C = Currency in Circulation, D = Demand Deposits, r = Reserve Ratio, R = Reserves.

In conclusion, these negligable BOC rate hikes are of little to no significance.

Once again, some asset strategies:

- Physical Gold and Silver, or ETFs such as PSLV or PHYS, whose shares are redeemable for the physical bullion or SLV and GLD.

- Royalty Companies: A leveraged play in the equity arena with greatly reduced mining risk: Royal Gold (RGLD), Silver Wheaton (SLW), Franco-Nevada (FNNVF.PK) and Sandstorm Resources (SNDXF.PK).

- Mining Companies: El-Dorado Gold (EGO), Yamana Gold (AUY), Randgold (GOLD), Alexco (AXU) and Agnico-Eagle (AEM), among many others.

Disclosure: I am long RGLD, FNNVF.PK, SLW, SNDXF.PK, EGO, AXU.