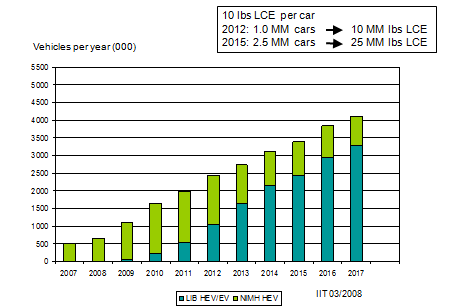

All indications are that by 2020 auto companies will be manufacturing more EVs and hybrid electric vehicles than gas powered cars. Certainly that is the case for China, India and Europe. America will trail this world-changing development, but will eventually be brought into the lithium economy kicking and screaming.

All indications are that by 2020 auto companies will be manufacturing more EVs and hybrid electric vehicles than gas powered cars. Certainly that is the case for China, India and Europe. America will trail this world-changing development, but will eventually be brought into the lithium economy kicking and screaming.

Rather than placing bets on which of the hundreds of labs around the world will develop the best battery, best technology or the most stable catalyst in its uses, I have been placing my money on the producers of lithium - specifically the small- and mid-tier group that for the past two years have staked the best lithium properties around the world.

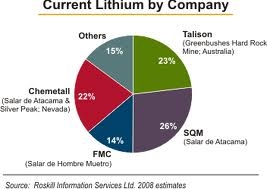

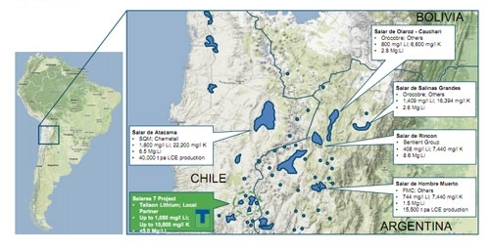

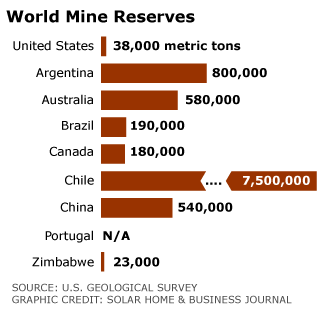

Larger producers such as SQM of Chile produce lithium only as a by-product of its massive potash operations, and refuse to sign agreements with auto companies, preferring instead to have buyers purchase supply from the spot market (there is no futures market in lithium). This is a no-no for auto companies due to assembly-line production needs for an uninterrupted supply. SQM, along with FMC and Chematall, three of the big-four, are already priced fairly, because of their exposure to large investors, whose analysts project them as the only opportunities in the sector. The illustration here is over a year old. Talison has now become the front runner in lithium production, with almost a third of worldwide production.

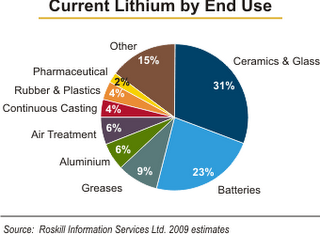

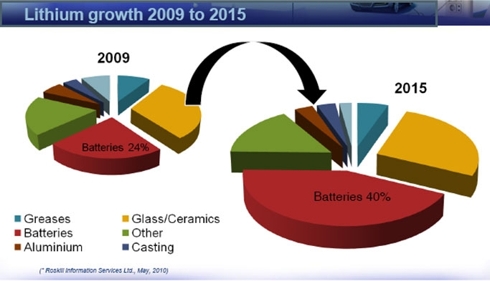

The potential for lithium production to satisfy the auto industry of the next decade is indeed, massive, as is shown in the chart above, but investors should not forget the many, varied uses for this 21st-century resource.

The Talison website lists these Chemical uses for lithium:

Batteries

The two main lithium battery types are:

- Primary (non-rechargeable): including coin or cylindrical batteries used in calculators and digital cameras. The lithium battery has a higher energy density compared to alkaline batteries as well as a low weight and long shelf and operating life.

- Secondary (rechargeable): the main applications are powering cell phones, laptops and other hand held electronic equipment. As with the primary battery, the lithium secondary battery has a higher energy density and lighter weight compared to NiCd and NiMH batteries.

Lubricants

Lithium is used as a thickener in grease, ensuring lubrication properties are maintained over a broad range of temperatures.

Aluminum Smelting

The addition of lithium during aluminum smelting reduces the bath temperature which reduces power consumption, increases the bath electrical conductivity and reduces fluorine emissions.

Air Treatment

A number of lithium-based chemicals are used in air treatment. This includes lithium bromide as an absorption medium for industrial refrigeration systems and lithium chloride for humidity control and drying systems.

Pharmaceuticals

Lithium is used in the treatment for bi-polar disorder as well as in other pharmaceutical products.

Other Chemical Applications

Lithium chemical compounds are also used in a range of other applications including:

- butyl lithium as a catalyst for polymerization of synthetic rubbers

- aluminum-lithium alloys

- lithium niobate and tantalate in electronics

- concrete additive

- water treatment

- specialty inorganics

As billions of smart phone devices are being manufactured this year and beyond, what material do you think is being put into them for rechargeable energy storage? What material do you think is going into the massive Chinese electric bike market (75 million and climbing rapidly at this writing)?

This chart from 2009 gives a comparative for current uses. However, it is changing constantly as batteries have become the largest piece of the pie at this writing.

Technical applications for lithium include

Glass and Ceramics

There are three distinct markets for lithium in glass and ceramics:

- Glass: including container glass, flat glass, pharmaceutical glass, specialty glass and fiberglass. These glass products may be designed for durability or corrosion resistance or for use at high temperatures where thermal shock resistance is important. The addition of lithium increases the glass melt rate, lowers the viscosity and the melt temperature providing higher output, energy savings and molding benefits. Major producers of technical glass products are located in Germany, France, Japan and the United States of America.

- Ceramics: including ceramic bodies, frits, glazes and heatproof ceramic cookware. Lithium lowers firing temperatures and thermal expansion and increases the strength of ceramic bodies. The addition of lithium to glazes improves viscosity for coating, as well as improving the glaze's colour and luster. The major ceramic production centres include China, Italy, Spain and Mexico.

- Specialty Applications: including induction cook-tops and cookware. Lithium's extremely low co-efficient of thermal expansion makes these products resistant to thermal shock and imparts mechanical strength.

Metallurgical

Lithium is used in mould fluxes for steel casting. The addition of lithium to continuous casting mould fluxes assists in providing thermal insulation and lubricates the surface of the steel in the continuous casting process. Lithium is also used in the production of iron castings, such as engine blocks, where it reduces the effect of veining, thereby reducing the number of defective casts. Producers of continuous casting steel are located around the world, including in the U.S., China and Europe.

Another use for lithium may be apparent in aerospace as an addition of 1% of lithium to aluminium results in a 3% reduction in weight and a 5% increase in stiffness. This offers quite an advantage in aerospace manufacturing.

Electricity production for national grids (or international grids as the case may be in Europe) will require massive storage facilities in the coming years. This is especially true for wind and solar or any other intermittant energy production source such as tidal generators. Lithium, in its various forms, utilizing various catalysts, is the material that will store it.

Electricity production for national grids (or international grids as the case may be in Europe) will require massive storage facilities in the coming years. This is especially true for wind and solar or any other intermittant energy production source such as tidal generators. Lithium, in its various forms, utilizing various catalysts, is the material that will store it.

Merger activity has already begun, with the takeover of Canadian junior Salares Lithium last summer by Talison Lithium of Australia, which has been in the business for over 25 years producing lithium from its massive hard rock (spodomen) deposits at Greenbushes Australia. Talison thereby acquired the large Salares 7 brine project in Chile.

This takeover by Talison was, I believe, a very smart move on their part, as it moves to consolidate even more of the lithium pie in the future. Unlike others, Talison will have both spoodomen and brine producing properties, and their own processing plants. Both types of production have their advantages.

A front-running producer of lithium from spodomen, taking over a junior with a huge lithium brine resource in South America, is, in my opinion, the canary in the coal mine of future merger activity in the sector. Lithium from spodomen is usually more expensive to produce than it is from brine deposits,unless, of course, you have the richest spodomen deposit on the planet like Talison does at Greenbushes. However, spodomen mining has one big advantage over brine - a continuous, healthy supply line to customers that can be guaranteed and uninterrupted. The auto industry needs uninterrupted supplies for its assemply lines.

A syndicate of underwriters led by Cormark Securities Ltd. and including Scotia Capital Inc., Haywood Securities Inc. and Byron Securities Ltd. are, at this writing, concluding a bought deal in Talison for over 10.7m shares that will put $80 million cash into Talison's hands for the 100% increase in their Greenbushes operation and the development of their Salares 7 operation.

The Atacama desert on the Puna Plateau (Chile and Argentina) is the driest place on the planet, and has some of the richest brine deposits, with the least amounts of contaminants such as magnesium. The combination of dry weather, sun and rich deposits of lithium (with a byproduct of potash) is what makes this place unique on the planet.

There are also huge lithium deposits in Bolivia, China, and Afghanistan, however Bolivia has a backward, leftist government that wants to develop its deposits without outside help from western companies, and it has a huge problem with high concentrations of magnesium (a pollutant in lithium deposits) which makes production much more expensive. It will be decades before they might be considered a player, if at all. Ditto for Afghanistan (do I have to explain why?).

Talison (TLTHF.PK), as you may have already deduced, is my top pick in the sector. It currently has almost 75% of the Chinese market and is ramping up its production in 2011 by 100% at its Greenbushes operation to keep up with a huge increase in demand. It has over 300 customers worldwide and 25 years of experience in the production of lithium. And lithium is Talison's only business, unlike SQM, FMC or Chematall. However, like the other three, they now have a large brine resource in Chile as is shown here.

Talison investors include: Resource Capital Fund LP, Goldman Sachs Group Inc. (GS) and Fortis Investments. These three majors bought in when Talison was still a private company.

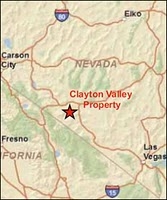

There are some promising juniors with large lithium brine projects in various stages of discovery or development. Western Lithium (WLCDF.PK) is one of those promising juniors with a large lithium property in Clayton Valley Nevada.

TNR Gold will spin off International Lithium Corp. this spring according to company spokesman, Jerry Huang. In that situation, the lithium properties in South America will be spun off with International Lithium, while the gold, silver and copper properties will stay with TNR. Holders of TNR stock will receive 1 share and one warrant in ILC for each 4 shares held in TNR, thereby allowing shareholders to immediately own ILC shares.

Rodinia Lithium (RDNAF.PK) is another. It also has a large deposit in Clayton Valley along with three very promising brine properties in South America. Its second largest property, Salar De Diabillos, in Salta, Argentina, on the Puna plateau, is the most promising. Last week, Rodinia announced it is moving forcefully to develop Diabillos as it just concluded a deal with a Chinese battery company, and is now flush with cash for development.

Rodinia Lithium (RDNAF.PK) is another. It also has a large deposit in Clayton Valley along with three very promising brine properties in South America. Its second largest property, Salar De Diabillos, in Salta, Argentina, on the Puna plateau, is the most promising. Last week, Rodinia announced it is moving forcefully to develop Diabillos as it just concluded a deal with a Chinese battery company, and is now flush with cash for development.

These juniors could be prime takeover targets as other larger fish move to consolidate this industry. They also could be affected by mergers or more investment from the battery or auto industry.

Auto companies, auto-parts companies and battery companies, have bought into promising juniors. Examples include Magna international (MGA) buying into Lithium Americas Corp, BYD (of China) buying into a Tibetin LIthium Mine, Toyota (TM) investing in a Canadian junior etc. Recently, Hong Kong's Shanshan Resources Co. purchased the entire bought deal from Rodinia Lithium at a price above the asking price, and it is that cash that Rodinia is now plowing into its Diabillos project. Unknown on this side of the pond, Sanshan is a rising producer of lithium-ion batteries for the Chinese market.

Dr. Jon Hykaway of Byron Capital Markets, has developed much expertise in lithium production and developments; you should put him on your reading list. He was instrumental in developing Byrons lithium index.

Another expert in the field, Mr. R. Keith Evans, should also be on your reading list if you are an investor in this booming market.

In the 1800s it was railroads. In the early 1900s it was automobiles and airplanes, (steel, rubber etc.). In the 50s plastic. In the 70s computers. In the 90s the internet. And today, folks, the game changer is electrification and lithium.

Disclosure: I am long RDNAF.PK, TLTHF.PK

Additional disclosure: Author is considering WLC in near term