In today's environment, there is much talk of rising interest rates and how to best benefit from them. Often, one of the 'go-to' solutions to help a portfolio benefit from interest rate changes is through that of insurers. While helpful, this still leaves the question as to what is the best way to own insurance companies. While owning an ETF is usually the simplest way to gain broad exposure, many investors (especially those in Canada) are likely to already hold significant exposure to financial stocks and owning another diversified financial fund may not be the ideal choice. So if we were to own a single insurer, which one should it be? Let's take a look at Manulife Financial (MFC) and Sun Life Financial (SLF).

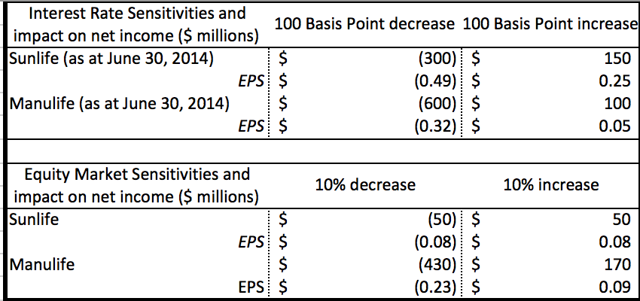

It is interesting that the interest rate debate often occurs in isolation. In reality, with interest rates being a large driver of markets, one should really consider the effect a change in rates will have alongside a change in equity markets. Below we can see the effect that a 100 basis point (1%) change in rates has on net income and EPS as well as a 10% change in equity markets, in isolation.

There are some interesting takeaways from the above table. First, both companies have some fairly high exposure to lower rates. Fortunately, interest rates should not be able to go much lower than they are today. Secondly, Sun Life shows good exposure to a rising rate environment while Manulife appears significantly less 'prepared' to benefit from future rate increases. Lastly, Manulife is fairly sensitive to a decline in equity markets while Sun Life seems to have a strong handle on both the upside and downside of markets. We think, that while using insurance companies to play changes in rates is an interesting idea, not all insurers are created equal and some may even have more risks than investors realize as seen by the downside risk in equity markets for Manulife. However, as mentioned previously, this discussion is not complete without a scenario analysis of the interactions between interest rates and equity markets in the table below.

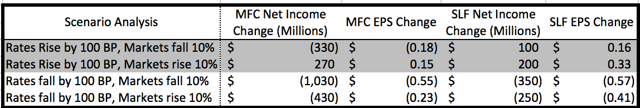

It is interesting that in the four scenarios, Manulife only sees a benefit to net income with both a rise in rates and equity markets, while as long as Sun Life enjoys a 1% rise in rates and the markets stay in a +/-10% range, they should see a positive benefit to the bottom line and to shareholders. We have highlighted the two scenarios that we see as most likely.

Sun Life shows its strong management through the ability to handle equity market risk on both the up and downside while offering investors a chance to benefit in a rising rate environment, regardless of how equity markets react to the change (within reason). This reduced need of trying to guess how interest rates will be increased and what the knock-on effect will be on equity markets helps add to the merits of Sun Life as a hedge in a portfolio against rising rates and this is one of the reasons SLF has earned a solid rating at 5i Research and is also included in both our Model Portfolio and Income Portfolio.