There are many things that people know about oil markets. This is especially true of those who know little about oil. They know that oil prices, for example, are controlled by ExxonMobil (XOM). Or, at the very least, by nefarious speculators in the futures market. They also know that global oil producers don’t use much of their own oil. And, in particular, they know that OPEC has lots of spare capacity. Oil production capacity that can be turned on tomorrow, for example, should world events disrupt supply. Which brings us to current events in Libya.

I note with interest that David Fyfe of IEA Paris on Monday attempted to calm world oil markets, by reminding that in the OECD there are over 1.6 billion barrels of oil in inventory. By marshaling these western supplies of already-pumped, above-ground oil, the world could gain a new source of oil for up to one year, at a rate of 4 mbpd (million barrels per day). There are a few sticky issues surrounding such a claim. Not least of which is that oil markets regard drawdowns of above-ground inventories as a reason to send prices even higher. But that point aside, let’s consider what Fyfe did not claim: the head of IEA’s oil markets division did not claim that Non-OPEC oil producers, which account for nearly 60% of world oil supply, could lift supply to make up for the Libyan disruption. That’s no surprise. Non-OPEC oil production has already peaked, and couldn’t increase supply either tomorrow or next year.

I note with interest that David Fyfe of IEA Paris on Monday attempted to calm world oil markets, by reminding that in the OECD there are over 1.6 billion barrels of oil in inventory. By marshaling these western supplies of already-pumped, above-ground oil, the world could gain a new source of oil for up to one year, at a rate of 4 mbpd (million barrels per day). There are a few sticky issues surrounding such a claim. Not least of which is that oil markets regard drawdowns of above-ground inventories as a reason to send prices even higher. But that point aside, let’s consider what Fyfe did not claim: the head of IEA’s oil markets division did not claim that Non-OPEC oil producers, which account for nearly 60% of world oil supply, could lift supply to make up for the Libyan disruption. That’s no surprise. Non-OPEC oil production has already peaked, and couldn’t increase supply either tomorrow or next year.

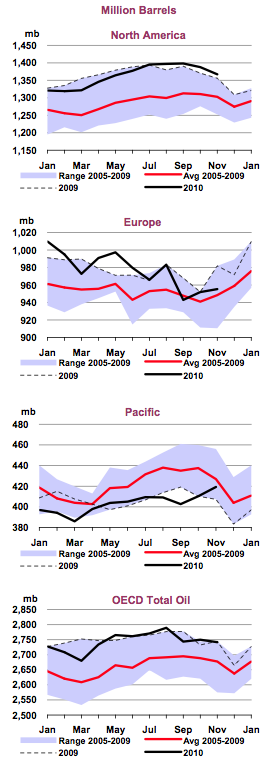

In the graphic to the right () we see the latest publicly available charts for OECD inventories, from the 18 January Oil Market Report from IEA. Note that in the bottom chart what’s being accounted for is not only the 1.6 billion barrels of crude that Fyfe refers to, but another 1 billion barrels of oil products. That said, the scale of these large numbers can be a tad misleading. They represent in part just the normal flows of the global oil market and are a snapshot of oil as it flows from production, to refining, and to distribution. For a different measure, these same levels of inventory represent 57.5 days of supply. Which the IEA itself says are the lowest in the past two years.

In truth, the spare capacity that the world cares about—that the oil futures market cares about—is not the inventory level. But rather, actual production capacity that can be brought on immediately. You can see the problem, from a price standpoint. If the world loses Libya’s 1.5 mbpd production for 90-120 days, and starts drawing down above-ground inventories, this only makes the inventory cushion that much thinner for any new supply disruptions. The question on the mind of the oil market therefore is not Mr. Fyfe’s 1.6 billion barrels of crude, but whether countries like Kuwait, the U.A.E. and especially Saudi Arabia or even Russia can lift supply. Immediately.

Of course, “everyone knows” that OPEC is sitting on lots of oil. However, as has been discussed here, at The Oil Drum, and elsewhere, it remains decidedly unclear whether Saudi Arabia can indeed turn on extra taps at will. But the problems for world supply of oil do not merely end with production capacity. Even if OPEC is indeed sitting on 1-3 mbpd of spare capacity, it’s not clear for how long they can both increase production, and export that production to the world. Not only has Saudi Arabia’s production not increased in the past five years, but, Saudi is increasingly using its own oil for its own population. The result? Flat, to declining exports of oil from Saudi Arabia.

Spare Capacity Theory, therefore, looks a lot like an unproven consensus reality. I’d like to define it as follows:

Spare Capacity Theory: the assumption among western bankers, policy makers, economists, and stock markets that OPEC producers can lift oil production at will, and, export all of that spare production to world consumers.

We shall see how much the oil markets themselves believe in this theory. Monday’s five dollar upward price advance—from already high price levels—suggests the market is justifiably concerned about events in Libya, and the risk of more unrest to come in oil producing regions. Given the potential magnitude of this situation, I actually think it's good that we can still rely on price as a means to ration supply.

Further Reading:

Brown and Foucher: Egypt, a classic case of rapid net-export decline and a look at global net exports