A couple of months ago, investors were eagerly waiting an earnings report from biotech Dendreon (DNDN), which is known for the prostate cancer treatment Provenge. Because the company was in the midst of an executive transition, all we got was a 10-Q filing, which was a major warning to shareholders. The company basically stated that it would not have enough cash to pay back its 2016 notes, something I've been warning investors about for a few years.

As a result, Dendreon shares have continued to hit new lows, breaking below $1.00 last week. We should be hearing from the company in the next couple of weeks, and this update should be rather important for investors. While I still believe this stock could go lower, there are some important items we could learn from Dendreon. Today, I'll recap what needs to be answered.

Provenge into Europe:

One of the big hopes for Dendreon bulls was that the company could get Provenge into Europe. That camp believed the added revenues could get the company closer to a profit and cash flow positive, which would help with the debt situation. Well, Dendreon is expected to get Provenge into Europe late this year, so investors will be looking for details on that. Since I am assuming there will be a conference call with management this quarter, hopefully we'll get more information than just a 10-Q filing.

Getting Provenge into Europe won't help with the debt situation, but it could get the company's revenues headed in the right direction. 2014 was not the year it could have been, which is why the company is in the situation it is in. Looking into 2015, analysts are expecting a decent jump in revenues. Additionally, losses are expected to subside as the company's restructuring plan continues to progress. If Dendreon can get automation going, expenses can be cut further.

Any progress on the capital front?

When it comes to Dendreon, there is a real bull/bear debate over the value of shares. The bear camp believes that shares are headed to zero, as the company may need to declare bankruptcy in the next year or so. With a negative book value that's getting worse by the quarter, this may be true. The bull camp believes that some larger name will come in and buy out Dendreon for some huge premium. Lately, the bear camp has been winning, as you can see from the chart below. Dendreon shares hit another new low on Friday.

(Source: Yahoo! Finance)

Dendreon's market cap has gone from a few billion just a couple of years ago to about $140 million at Friday's close. With more than $600 million of debt due in January 2016, the situation is getting worse and worse. If the company does not declare bankruptcy, investors would be looking at massive dilution, which gets more and more painful as shares continue to go lower. Had the company raised some funds when shares were at $5, this situation might have been a bit different.

An update on short interest:

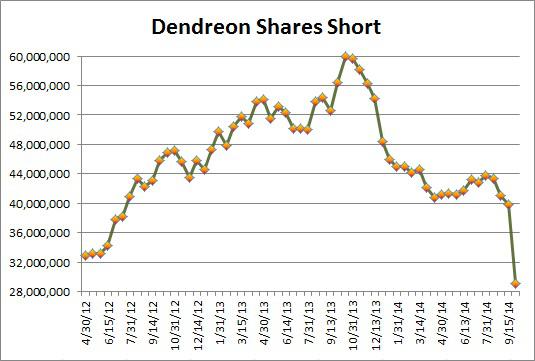

In my most recent article on Dendreon, I detailed how short interest hit a critical point. Not only did short interest cross below the 40 million share mark, but more than one-third of shorts had covered since the peak in October 2013. As you can see from the chart below, the most recent update was even more dramatic.

(Note: last data point on chart is for settlement date of 9/30/14)

In the second half of September, short interest plunged by more than 10.7 million shares. At the end of that month, a little over 29 million shares were short, the lowest number since I started tracking Dendreon's short interest in April 2012. This also seems to explain some of the large volume days we saw in late September, like the nearly 12 million shares we saw traded on the 19th. At this point, more than 51.5% of shorts have covered since the peak. With Dendreon crossing below $1.00, it will be interesting to see if we see more covering at the next update.

Final thoughts:

Dendreon shares have finally crossed below one dollar, and it is time for management to lay out a plan. Provenge may be entering Europe soon, but could it be too little, too late for investors? The company has already warned us about its financial situation, which seems to get worse as shares continue to drop. At this point, investors that can find shares to short may still be able to make large gains if this name does in fact go bankrupt. However, a short position should be accompanied with a hedge just in case some larger name decides to come in and save Dendreon.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.