The price of oil has taken a hit in the past couple of weeks, but oil stocks (especially small cap) have been decimated in many cases with declines of 40% or more. Bespoke recently wrote an article for Seeking Alpha titled "Energy Sector Crashes." As some of us know, crashes are often huge buying opportunities. Chances are good, that this sell-off has gone too far and that means investors should consider wading into this sector now before a potential rebound. Many investors have decided to panic sell or have even been forced to sell due to margin calls. That usually represents a capitulation-like buying opportunity. Let's take a look at a number of reasons why oil and oil stocks could be due for a rebound:

1) The negative sentiment on oil and oil stocks has probably gone too far and the sentiment could quickly turn more positive. For example, On October 6, a CNBC article titled "Oil Steadies Above $92 On Signs Of Global Growth" was published. Just about one week later, the world seemed to be convinced that global growth was a thing of the past and oil prices dropped. However, there are a number of potential upside catalysts that could stabilize oil prices and even create a solid rebound. For example, concerns about excess supply due to a potential global slowdown could subside if China or Europe were to announce new stimulus programs. A geopolitical event could also quickly cause oil to surge.

2) It is not just the oil sector that is oversold, the entire market is oversold now and appears due for a significant rebound. A Seeking Alpha post details how oversold the market is now:

- The S&P 500 (SPY -1.6%) is now lower by 6.8% from last month's record high, says the WSJ's Steven Russolillo, making this current pullback the market's worst in two-and-a-half years.

- Checking in before today's sharp decline, Bespoke noted 63% of stocks in the index were considered to be in oversold territory, with just 10% overbought. It's surely a wider gulf now.

- A bounce is in order.

3) Saudi Arabia recently said it would be comfortable with lower oil prices. However, other countries like Venezuela are pushing for production cuts in order to push prices back to about $100 per barrel. The reality is that many oil producing countries like Russia, Venezuela, Iran and others cannot maintain budgets with oil at current levels. While Saudi Arabia appears to be acting indifferent when it comes to supporting the price of oil, this could be a bluff. By doing so, Saudi Arabia might be able to negotiate production cuts with other OPEC members before the OPEC meeting on November 27. CNBC's Bob Pisani believes Saudi Arabia is bluffing in order to negotiate serious cuts from other members; here is what he says:

"On the supply side, comments out of Saudi Arabia--indicating they are comfortable with oil in the $80-$90 range--is a clear ploy to get everyone on boat with cutting production. Venezuela is already complaining; other OPEC members will undoubtedly start complaining, and we will likely see some kind of production cut in the future."

4) Many analysts see a rebound coming for a number of reasons. For example, some analysts expect OPEC to cut production if Brent crude prices remain below $90 per barrel and many analysts also believe cold weather and increased oil usage will also contribute to a rebound. A recent CNBC article that predicts oil prices to rebound to $100 per barrel states:

"We look for a seasonal pick-up in oil product demand, a cold winter and OPEC production cuts as requirements to prevent a more dramatic slump in the crude oil price," Deutsche Bank (DB) commodity strategists led by Michael Lewis said in a quarterly report on September 30."

Morgan Stanley (MS) is also getting bullish on oil as consumption remains strong, which was detailed in this Seeking Alpha post:

- "While fundamentals have been poor through much of the summer and fall, much of the last leg of downside has simply been a result of financial flows, sentiment and macro fears. Physical markets are strengthening, with more improvement ahead."

- The team says analysts are too concerned with demand for gasoline and heating oil and thus missing the big picture of a strong long-term demand for crude. There's no sign, they say, of a sharp decline in demand outside of Europe,

- Japan, and Mexico (i.e. the U.S. and China are still gobbling it up).

- "From a crude standpoint, OPEC is right to expect a material improvement in demand."

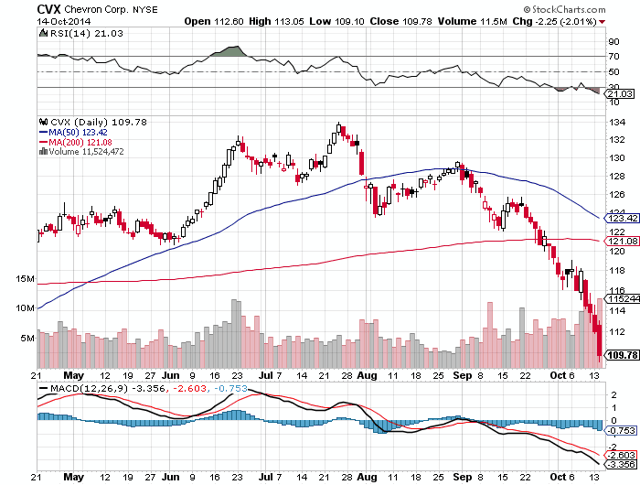

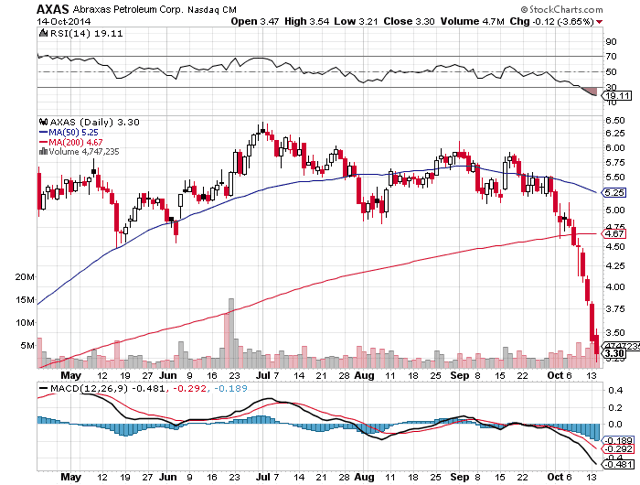

5) Based on the drop in oil prices of just several dollars per barrel and the fact that this is not even yet a sustained price drop, the decline in the major integrated oil stocks like Chevron (CVX) seems overdone. Investors are reacting way too quickly and too negatively to what has not even yet been a sustained decline. The drop in small cap oil stocks has been even more severe and possibly even downright hysterical in nature due to unfounded fears, margin calls, shorts and emotionally based panic selling. Let's take a look at charts of Chevron and a couple of small cap oil stocks to view the carnage:

Chevron shares were trading at $128 just about four weeks ago, but have since plunged to roughly $109. With a Relative Strength Index or "RSI" of 21, this stock is oversold. It also offers a yield of nearly 4%, which will reward investors while waiting for a higher share price.

Abraxas Petroleum (AXAS) shares were trading for about $5.50 per share just a couple of weeks ago but have been decimated and now trade for $3.30. Abraxas is expected to announce earnings around November 6 and the third quarter estimate is for a profit of 16 cents per share. It is worth noting that Abraxas has beat earnings estimates for the past couple of quarters. Furthermore, in mid September, the company announced an increase in production guidance by about 5% and said its lease operating expenses were lower than expected which is just another positive. On Monday, October 13, analysts at Zacks Investment Research gave this stock a strong buy rating. Consensus estimates are at 71 cents per share for 2015. There are not a lot of $3 stocks in this market that have the potential to earn 71 cents. Furthermore, Abraxas has a strong balance sheet with just around $47 million in debt. This financial strength greatly reduces potential downside risks for investors.

Here are a few other points to consider which also make the recent oil sector crash appear to be overdone: The oil price may have overshot to the downside because of traders in the futures market. With oil futures it is possible to control about $85,000 with only around $2,000. That is a huge amount of leverage, which can really accelerate losses when markets plunge. If there has been a significant amount of forced or fear based selling in the oil market, the current price may not last long and rebound soon. Many small oil companies have hedges in place, which means that unless the decline in oil is sustained for many months, the impact from the recent drop could be fairly immaterial. Also, some smaller oil companies are growing so fast that production is increasing at levels that offset any price reductions. Major oil companies can also choose to increase production in order to offset any profit margin loss. Also, consumers are likely to quickly increase oil usage when prices drop and this could end up taking a significant amount of supply off of the market.

For some more small cap oils stock picks, read this article I wrote on McDermott International (MDR), a $4 stock in which hedge fund billionaire David Einhorn has made a major investment in. Or for about $2.50 per share, consider the small oil producer with high potential discussed in this article. Finally, it is important to consider that oil stocks might hit rock-bottom levels even before oil does. That means that even if you believe oil prices could go lower, these stocks may already be at or near the bottom now. All in all, the decline in many oil stocks has been very excessive, especially considering that there has not even yet been a sustained drop in the price of oil. Again, many oil companies have hedges in place and can increase production to keep profits strong. Finally, any number of events could occur fairly soon and put oil right back into the $90 to $100 range which will make investors wonder what they were thinking when they either panicked and sold these stocks or failed to buy this hugely oversold pullback.

Data is sourced from Yahoo Finance. No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.