In a Bloomberg TV report from Thursday morning, the current food supply and price situation was aptly described as "Kitchen Table Economics." With uncertainty over the direction of food costs, underscored by a recent UN statement showing prices at new highs, where do we go from here?

In any given year, commodity researchers at Weather Trends spend a great deal time analyzing the global weather pattern in the context of a variety of commercial interests which span the agricultural and energy supply chain, from grower, to producer, to investor. While the general relationships between weather and food supply are obvious, our analyses go further than just projecting potential production and yield ranges, by discussing the supply implications in a holistic global macro perspective. This includes viewing global commodity balance sheets for the world’s major raw materials through the lens of anticipated production/consumption/export patterns, foreign exchange, and potential weather risk, while placing geography (and geopolitics) at the center of our discussion.

As the food supply chain has evolved into a truly global interconnected system, disruptions in one origin can trigger effects, both physical and financial, which ripple through the markets in real time. In 2007/08, a fairly rapid price spike caught many off guard, but the market seemingly "corrected" (it actually did not), and many prices were back to their previous range by the end of 2008. In contrast, the recent rise in food prices which commenced around the middle of 2010 is accompanied by a much higher level of uncertainty, as well as the increased risk for civil unrest. To be sure, there were plenty of food-related riots in 2008, however, they were largely short-lived and less violent. However, in recent months, nearly every demonstration from MENA to SE Asia, includes some component frustration and anger over the costs of domestic food staples, and If the recent UN note is a sign of what to expect, things will only get worse in the months to come.

The U.N. Food and Agriculture Organization (FAO) stated that food prices rose 2.2% in January. The FAO food price index is comprised of a basket 55 agricultural commodities, and the January index value demonstrated a gain for the eighth consecutive month, climbing to a value of 236, which is the index record since it was created two decades ago. To add to this, even though crude oil futures are down today after a series of session net-gains, most outlooks are supportive of higher oil prices, which will only add to the uncertainty on the agri side. Index gains were largely attributable to the rising cost of cereals, meat & dairy. They noted that sugar was the only monitored commodity that did not exhibit a monthly rise; however, the world is still suffering from a sugar high. According to FAO economist Abdolreza Abbassian, the chief causes of the price increases are tied to weather impacts and supply disruption. That is not to say that the seemingly insatiable demand for nearly all raw materials and high oil prices do not help support prices at these levels, but the primary causes of the rise are being blamed primarily on the supply side. Abbassian went on to say that the "only commodity" that is keeping the world out of a full blown food crisis is rice.

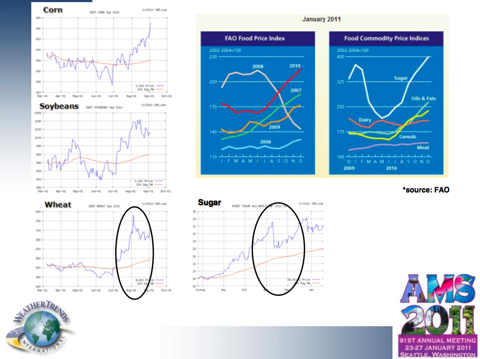

In a talk that I gave at the American Meteorological Society meeting last month, I showed the following slide. The mid year spike in wheat futures was the result of the market absorbing information surrounding the drought/export embargo from Russia. A dry La Nina influenced Argentina limited soybean yields. Lower than expected sugar numbers (India) coupled with flood related losses in Queensland has pushed, and is sustaining, sugar futures above the 30 cent barrier. And there are numerous others. With the well documented cotton shortage, do growers now plant more cotton collecting the cotton premium which is likely to be priced into that market for much of the year, or do they shift acreage to corn where demand from the food and fuel side remain strong. As the 2011 weather/crop relationship takes on heightened importance ahead of the Northern Hemisphere summer planting season, agriculture will likely remain among the largest drivers of global economic activity throughout 2011.

(Click to enlarge)

The market is currently paying close attention to the dry conditions across much of the North China Plain. As noted earlier in the week, the most severely affected regions (Shandong & Henan provinces) have received some rain to alleviate some of the short term worries of growers, but we believe that their winter wheat crop will still be negatively affected by three factors: (1) ongoing dryness and a slow transition to favorable conditions, (2) cold winter temperatures and (3) a lack of winter snow cover; the latter two factors have left the winter crop unprotected during dormancy, and this will likely negatively affect yields.

Turning to sugar, we also discussed earlier that while many analysts have been anticipating a shift to net surplus status regarding the global supply situation, our view is somewhat less optimistic than most consensus estimates. While agreement in the market tends to converge around a number of +1.3 to +1.5 mmt for the 2010/11 (Oct/Sep) year (down from earlier projections in the +2.5 to +3.0 mmt range), the International Sugar Organization recently issued a revision to their supply outlook, adjusting their expectation for the 2010/11 crop to +196,000 mt; this is also down significantly from their 1.3 mmt number from November 2010. Keeping in mind the margin of potential error on these forecasts, 2010/11 could easily remain in deficit for the current marketing year. Further, there is still the potential for poor weather over the next couple of months to negatively impact cane devoted to the next (2011/12) season, so at this stage, we are viewing a potential break-even point in the sugar market to take place in the 2011/12 crop year.

So with speculation surrounding additional outbreaks of food-inflation related demonstrations on the rise, and the prospect for continued strength in the oil sector is coupled with a weak $USD, support for an extended period of higher prices in this sector in the agriculture space is likely.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.