In the long run, over the course of a company's operational life cycle, fundamentals are what drive share prices either higher or lower. But in the short-run, perceptions of fundamentals are often just as important, if not more so. How investors view a given set of quarterly earnings, or a company's perceived market position can play a huge role in driving a company's stock price higher or lower. But, perceptions of fundamentals do not always align with a company's actual fundamentals, and when these divergences occur, they create entry points for savvy investors to initiate positions ahead of a realignment between the two. And the divergence of the two regarding shares of QLogic (QLGC) has created just such an opportunity.

Since its founding, QLogic has become a leading Fibre Channel player. But, over the past several years, the company's position of strength within the market over archrival Emulex (ELX) has become a liability, as the Fibre channel market began to stagnate and decline under the weight of Ethernet-based alternatives. QLogic's exposure to the market has, for some time, weighed on the company's stock price. But in recent quarters, the company has taken meaningful steps to restructure its business and move itself towards the Ethernet market. While the transition remains ongoing, QLogic is delivering progress, progress that has yet to be fully recognized by the market. Backed by a new CEO and a pristine balance sheet, QLogic is set to accelerate its revenue growth, arrest the decline in its margins, and continue to deliver EPS growth as the various moving parts of the company's transition begin to fall into place. With the potential for further deployments of capital and QLogic's size making it a logical acquisition candidate is combined with the company's organic transition, we see upside of 30% for QLogic as the market begins to value the company in a logical manner. Unless otherwise noted, financial statistics and managerial commentary cited in this article will be sourced from the following: QLogic's Q2 2015 earnings release, its Q2 2015 earnings call, its Q2 2015 earnings presentation, or its fiscal 2014 10-K.

Overview & Market Position

QLogic was founded in 1992, and is based in Aliso Viejo, California, and went public in February 1994 as a spinoff of Emulex. With a market capitalization of less than $1 billion, QLogic is but a niche player in the context of the overall technology sector. But within the Fibre channel (FC) and Ethernet markets, the company is a major player. For those unfamiliar with Fibre channel technology, we will provide a brief overview. In essence, FC is a network technology used to connect computers together, and transfer data between them. The technology is (was) ideally suited to linking servers to shared storage devices at speeds of 2-16 gigabits per second. But, in recent years, the FC market has begun to stagnate, impacted both by volatile enterprise spending and a gradual shift to newer technologies. As Dell'Oro noted, FC switch and adapter revenues declined 10% year-over-year in Q1 2014, and since then, performance has been choppy. This has been evident in QLogic's own results, thereby pushing the company towards the Ethernet market. In February 2014, QLogic made perhaps its boldest move into the market, with the acquisition of certain Ethernet assets from Broadcom (BRCM) for a total of $147 million. The deal gave QLogic control of 10/40/100 GB Ethernet-related assets and licenses to patents on Broadcom's NetExtremeII Ethernet controller product line. As QLogic noted in the press release announcing the acquisition (which has now closed), the deal is immediately accretive to EPS, and has catapulted QLogic into the #2 position within the 10Gb Ethernet port market, with a market share of 21%, second only to Intel's 46%, and ahead of Emulex's 13%.

The decline of the FC market has been slowed by several trends, including both internal enterprise IT politics and continued innovation within the space. We begin with the first. As Forrester Research has noted, FC products have historically been purchased by IT department storage teams, due to their use within a storage setting. However, the move to Ethernet technology would inevitably lead to a shift in IT budgets being allocated to the networking groups, setting up turf battles within IT departments across the United States and other markets. This has delayed the shift to Ethernet-based technologies, as has continued innovation within the FC space. In February 2014, the Fibre Channel Industry Association announced the development of "Gen 6 Fibre Channel," which is set to become the industry's fastest networking technology, enabling channel speeds of up to 32 GB. QLogic is already in the process of developing its own Gen 6 FC product, with broader sampling set to occur in this quarter, and production to begin in 2015. Current "Gen 5" FC products, running at 16GB, make up over 42% of the market, and the rollout of Gen 6 products next year is likely to help stabilize the FC market next year, building on the results that QLogic has seen so far this year. When combined with its emerging position as a leader in 10 GB Ethernet ports, we believe that QLogic is well-positioned to succeed in both the FC and Ethernet markets, and its presence in both will help the company navigate a decline in the FC market better than it otherwise could. While QLogic's long-term transition remains ongoing, progress has been made, and this was apparent in the company's latest quarterly earnings.

Q2 Results: Growing Market Share & Profits

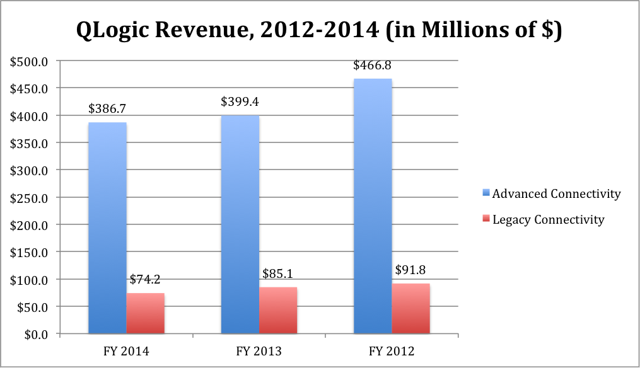

QLogic's results for Q2 2015 (the company's fiscal year ends in March) demonstrated the progress the company has made in navigating the shift to Ethernet. To better understand the transition now underway at QLogic, we believe that context surrounding the company's revenue categories is required. QLogic's revenue is split into 2 broad categories: Advanced Connectivity Platforms (or ACP), and Legacy Connectivity Products, or LCP. The ACP category houses QLogic's adapters and ASIC's for serve and storage connectivity applications, while the LCP category houses the company's FC switches and 1GB iSCSI (Internet Small Computer Interface) products. In June 2013, the company announced that it would cease development of 1GB iSCSI products, as sales of these products continue to decline in the face of newer technologies. The decline of the FC market can be seen in QLogic's historical revenues over the past several years, as shown below.

While part of this decline can be attributed to the sale of its InfiniBand business to Intel (INTC) in January 2012, it is clear that QLogic's revenues have experiences historical declines for other reasons. The continued decline in its FC revenues prompted QLogic to implement a restructuring plan in 2013. In May of that year, CEO Simon Biddiscombe "resigned to pursue other opportunities," with CFO Jean Hu appointed as interim CEO. Then, in June, the company announced that it would begin restructuring its operations to eliminate tens of millions in annual operating expenses, with the goal of reinvesting a portion of the proceeds into its R&D efforts. In December 2013, the company announced that Prasad Rampalli had been appointed as its next permanent CEO, with his tenure to begin in February 2014. Rampalli has spent three decades within the technology sector in senior roles at both Intel and EMC (EMC), and over the past 8 months, he has begun to leave his mark on QLogic. And these efforts are apparent in QLogic's Q2 2015 results, released on October 16, 2014. We present a condensed overview of the company's performance in the table below.

QLogic Q2 2015 Results (in Thousands of $)

Q2 2015 | Q1 2015 | Q2 2014 | Q/Q | Y/Y | H1 2015 | H1 2014 | Y/Y | |

Advanced Connectivity Revenue | $114,877 | $104,701 | $94,011 | 9.72% | 22.20% | $219,578 | $187,201 | 17.30% |

Legacy Connectivity Revenue | $12,626 | $14,748 | $18,611 | -14.39% | -32.16% | $27,374 | $38,537 | -28.97% |

Total Revenue | $127,503 | $119,449 | $112,622 | 6.74% | 13.21% | $246,952 | $225,738 | 9.40% |

Cost of Revenue | $46,758 | $42,481 | $35,830 | 10.07% | 30.50% | $89,239 | $71,622 | 24.60% |

Gross Profit | $80,745 | $76,968 | $76,792 | 4.91% | 5.15% | $157,713 | $154,116 | 2.33% |

Gross Margin | 63.33% | 64.44% | 68.19% | -1.72% | -7.12% | 63.86% | 68.27% | -6.46% |

Engineering & Development | $33,171 | $34,850 | $32,533 | -4.82% | 1.96% | $68,421 | $68,569 | -0.22% |

Sales & Marketing | $14,380 | $15,024 | $15,201 | -4.29% | -5.40% | $29,404 | $32,821 | -10.41% |

General & Administrative | $7,602 | $7,696 | $6,461 | -1.22% | 17.66% | $15,298 | $12,757 | 19.92% |

Total Operating Expenses | $55,153 | $57,570 | $54,195 | -4.20% | 1.77% | $113,123 | $114,147 | -0.90% |

As a % of Sales | 43.26% | 48.20% | 48.12% | -10.25% | -10.11% | 45.81% | 50.57% | -9.41% |

Operating Income | $25,592 | $19,398 | $22,597 | 31.93% | 13.25% | $44,590 | $39,969 | 11.56% |

Operating Margin | 20.07% | 16.24% | 20.06% | 23.60% | 0.04% | 18.06% | 17.71% | 1.98% |

Net Income | $22,015 | $18,486 | $20,042 | 19.09% | 9.84% | $40,501 | $36,458 | 11.09% |

EPS | $0.25 | $0.21 | $0.23 | 19.05% | 8.70% | $0.46 | $0.41 | 12.20% |

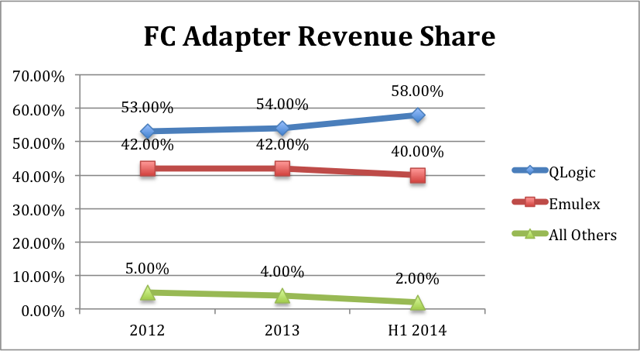

In the first half of fiscal 2015, QLogic has been able to arrest the decline in its overall revenue, as ACP sales grew by over 17%, more than offsetting a 29% decline in LCP sales to bring total sales up to almost $247 million in H1 2015, representing growth of 9.4% in the first half of the year, and beating consensus estimates by $3.06 million (EPS of $0.25, up 8.7% year-over-year also beat consensus by 3 cents). Much of that decline, however, was likely due to a collapse in iSCSI sales. Crucially, management noted on the company's earnings call, FC sales showed sequential growth of 5% in the quarter, and undisclosed year-over-year growth as well, as the FC market shows signs of stabilization. QLogic is benefiting from pockets of strength in the FC market, particularly as it relates to Flash-based storage arrays. These arrays demand higher I/O requirements than traditional storage arrays, thereby providing the FC market with a newfound source of growth, one that QLogic is ideally positioned to capitalize on. Management notes that with the Flash storage array market set to grow at over 50% annually for the next few years, it will be a source of opportunity for QLogic for several years to come. Design wins at multiple customers, including Cisco, EMC, Tegile, and Pure Storage has allowed QLogic to expand its FC market share and build on its lead versus Emulex, as per figures from Dell'Oro, which we present below.

As of the end of June 2014, QLogic holds 58% of the global FC adapter market (as measured by revenue), 18 full percentage points ahead of top competitor Emulex. Management argues that by its measure, the company is capturing 90% win rate for new designs within the flash storage market, which is likely a key part of the company's ability to grow market share in the first half of the year. QLogic has now held the leading position within the FC adapter market for 18 consecutive years, and by all indications, the company will maintain this lead in 2014 and 2015. However, QLogic is not resting on its laurels; as mentioned above, development of its Gen 6 FC adapters is now underway, and we expect more color on the product in 2015, likely when QLogic reports either Q3 2015 or full-year results. However, even as QLogic's FC business is showing signs of stabilization, the company is pushing ahead in Ethernet, intent on expanding its market position and share.

Management has noted that demand for 10GB Ethernet ports remains strong, and the launch of Intel's new Grantley server platform has accelerated deployment of QLogic's products; when combined with the acquisition of certain Broadcom's Ethernet assets, this helped propel a 22% increase in ACP revenues during the quarter relative to a year ago (total ACP revenues grew by 17.3% in H1 2015). But even as QLogic works to build on its newfound position in Ethernet, the company is working to ensure it has a place in the Ethernet market of tomorrow. Earlier this month, the company joined the 25 Gigabit Ethernet Consortium, a trade association of companies pushing for the long-term development and adoption of 25 GB Ethernet. Key members include competitor Mellanox, as well as Google (GOOG), Microsoft (MSFT), and Broadcom. In comparison to 10GB Ethernet, 25GB Ethernet allows for 250% more bandwidth, all while preserving the current level of port density. And 50GB Ethernet, another goal of the consortium, itself offers double the switch port density and 25% more bandwidth in comparison to the 40GB Ethernet, which is essentially created via the combination of four separate 10GB "lanes." The 25GB standard was created to meet the needs of hyper-scale data centers, and is now in the process of being formalized and standardized by IEEE. QLogic is already working to position itself as a leader within this nascent segment of the Ethernet market; just a few days after announcing that it had joined the 25 Gigabit Ethernet Consortium, the company announced that it has begun initial sampling releases of its first 100GB capable network controller, which has been offered to select "Tier-1 server and storage OEMs." The 100GB controller supports dual-port, full line speed 40GB performance, and offers all Ethernet speeds from 10GB to 100GB, depending on each customer's specific needs.

QLogic has parlayed its leading position in the FC market into a strong #2 position within Ethernet, where it now holds 21% of the 10GB port market (as mentioned above). In effect, the company is straddling both sides of the fence (FC and Ethernet), working to nurture the Ethernet market while ensuring it captures as much revenue from the FC market as possible in the interim. However, while the transition that QLogic is undergoing is a necessary one, it has also caused meaningful change to the company's margin structure, which we now turn to.

While it is true that QLogic grew total revenue by double digits in Q2 2015, the same cannot be said of gross profit. Total gross profit grew by less than 6% in the quarter, pushing down QLogic's gross margin by almost 500 basis points to 63.33% relative to 2014, and down over 100 basis points relative to Q1 2015. The company's current decline in gross margin is due to continued growth in Ethernet sales, which carry structurally lower gross margins than FC sales. Management has gone on record in stating that Ethernet gross margins are around 40%, well below the company's historical averages. However, there is more to this than meets the eye. While the ongoing shift to Ethernet sales is putting pressure on the company's gross margins, it is also helping QLogic achieve increasing amounts of operating leverage, thereby countering the decline in its gross margin. In Q2 2015, total operating expenses grew by just 1.77% year-over-year, falling to 43.26% of sales, down sharply from 48.12% a year ago, driven by a 540 basis point fall in sales & marketing expenses. As QLogic noted on its Q4 2014 earnings call earlier this year, the company promptly began consolidating its operations and reducing headcount when it closed on the Broadcom deal. As a result, the company's operating margin rose to 18.06% in the first half of fiscal 2015, up almost 2% from a year ago, as total operating expenses fell 90 basis points. While QLogic is gradually moving to fully absorbing this decline in gross margins, the path ahead of it is not necessarily linear, as evidenced by the company's guidance for Q3 2015, which we present below on both a sequential and year-over-year basis (note: all figures are presented at the midpoint of guidance).

QLogic Q3 2015 Guidance (in Thousands of $)

Q3 2015 | Q2 2015 | Q/Q | Y/Y | ||

Advanced Connectivity Platforms | $125,000 | $114,877 | $98,452 | 8.81% | 26.97% |

Legacy Connectivity Products | $12,000 | $12,626 | $20,997 | -4.96% | -42.85% |

Total Revenue | $137,000 | $127,503 | $119,449 | 7.45% | 14.69% |

Gross Profit | $84,940 | $80,745 | $81,505 | 5.20% | 4.21% |

Gross Margin | 62.00% | 63.33% | 68.23% | -2.10% | -9.14% |

Operating Expenses | $56,000 | $55,153 | $53,955 | 1.54% | 3.79% |

As a % of Sales | 40.88% | 43.26% | 45.17% | -5.50% | -9.51% |

Operating Income | $28,940 | $25,592 | $27,550 | 13.08% | 5.05% |

Operating Margin | 21.12% | 20.07% | 23.06% | 5.24% | -8.41% |

EPS | $0.28 | $0.25 | $0.29 | 12.00% | -3.45% |

Source: company filings

QLogic is forecasting total Q3 revenue of $137 million, representing year-over-year growth of almost 15% (an acceleration from Q2 2015's growth rate), with ACP revenue growing by almost 27%, thereby offsetting a forecasted 43% fall in LCP sales. Of note, however, is the fact that the company is once again forecasting sequential growth in the FC market in Q3, further suggesting that the market has stabilized, at least for the time being. However, continued growth in Ethernet sales continues to pressure gross margins. CFO Jean Hu is forecasting gross margin to fall to 62%, down over 500 basis points from a year ago, and 133 basis points sequentially. But at the same time, total operating expenses are set to fall as well, down to 40.88% of sales, as QLogic continues to restructure and reposition its business in the face of the shift to Ethernet sales. While the company's guidance does imply a fall in operating margins on a year-over-year basis, it does call for a sequential improvement, and the market has not shown signs of displeasure with the QLogic's guidance; shares rose over 12% on October 17, the day after the company released its Q2 2015 results. Management has made clear that fiscal 2015 is a year of transition from a margin perspective, and current consensus estimates call for a return to operating margin expansion in fiscal 2017. However, even at the company's present levels, QLogic's operating margins are already above those of both Emulex and Mellanox. But, despite this, shares trade at a discount to both companies, and as we will show below, that is not the only unwarranted disparity between QLogic and its peers.

Peer Comparison: Little Logic in QLogic's Valuation

As mentioned above, QLogic's closest competitors are Emulex, Mellanox, and Intel, and on multiple metrics, QLogic compares favorably to its competition. We present our peer comparison for QLogic in the table below. But before we do, we wish to highlight a matter of presentation. Because QLogic and Emulex both operate under non-calendar fiscal years, comparing them to Intel and Mellanox (both of which use the calendar year method) is made more difficult than it otherwise would be. To standardize each company's performance and valuations, we utilized a different approach, referring to each company's current or next fiscal year, or "next fiscal year + 1." For QLogic and Emulex, the current fiscal year is 2015, while for Intel and Mellanox it is 2014. Therefore, references to "next fiscal year +1," for example, refer to fiscal 2017 for QLogic and Emulex, and fiscal 2016 for Intel and Mellanox.

Financial figures are derived from relevant company filings and are accurate as of the close of trading on October 20, 2014. Forward estimates are based on Bloomberg consensus figures as of October 20, 2014 and are subject to change (note: fiscal 2017 estimates for Emulex's operating profits are not available)

QLogic Peer Comparison (in Thousands of $)

Company | QLogic | Emulex | Mellanox | Intel | Peer Average |

Ticker | QLGC | ELX | MLNX | INTC | |

Shares Outstanding | 87,914,000 | 70,963,390 | 44,956,215 | 4,951,000,000 | |

Share Price | $11.01 | $5.32 | $44.29 | $31.58 | |

Gross Cash | $276,769 | $158,439 | $340,073 | $24,261,000 | |

Gross Debt | $0 | -$146,478 | $0 | -$13,267,000 | |

Net Cash (Debt) | $276,769 | $11,961 | $340,073 | $10,994,000 | |

Net Cash (Debt) per Share | $3.15 | $0.17 | $7.56 | $2.22 | |

As a % of Market Capitalization | 28.59% | 3.17% | 17.08% | 7.03% | 9.09% |

Adjusted Share Price | $7.86 | $5.15 | $36.73 | $29.36 | |

Non-Controlling Interests | $0 | $0 | $0 | $0 | |

Enterprise Value | $691,164 | $365,564 | $1,651,038 | $145,358,580 | |

Fiscal Year End | March | June | December | December | |

Current Fiscal Year | 2015 | 2015 | 2014 | 2014 | |

Prior FY Sales | $484,538 | $478,567 | $500,799 | $53,341,000 | |

Last FY Sales | $460,907 | $447,333 | $390,859 | $52,708,000 | |

Last FY Sales Growth | -4.88% | -6.53% | -21.95% | -1.19% | |

Current FY Sales | $513,000 | $403,750 | $447,687 | $55,869,000 | |

Next FY Sales | $538,000 | $412,375 | $565,000 | $57,808,000 | |

Next FY +1 Sales | $558,000 | $432,000 | $618,000 | $59,803,000 | |

3-Year Forward Growth | 21.07% | -3.43% | 58.11% | 13.46% | 22.72% |

4-Year Growth | 15.16% | -9.73% | 23.40% | 12.11% | 8.60% |

Prior FY EBIT | $89,186 | $69,494 | $162,604 | $14,946,000 | |

Last FY EBIT | $89,059 | $54,966 | $43,396 | $12,822,000 | |

Current FY EBIT | $98,040 | $40,550 | $47,037 | $15,448,000 | |

Next FY EBIT | $100,200 | $42,350 | $93,864 | $16,130,000 | |

Next FY +1 EBIT | $111,000 | N/A | $83,200 | $17,072,000 | |

3-Year Forward Growth | 24.64% | N/A | 91.72% | 33.15% | 62.43% |

4-Year Growth | 24.46% | N/A | -48.83% | 14.22% | -17.30% |

Prior FY EBIT Margin | 18.41% | 14.52% | 32.47% | 28.02% | |

Last FY EBIT Margin | 19.32% | 12.29% | 11.10% | 24.33% | |

Current FY EBIT Margin | 19.11% | 10.04% | 10.51% | 27.65% | |

Next FY EBIT Margin | 18.62% | 10.27% | 16.61% | 27.90% | |

Next FY +1 EBIT Margin | 19.89% | N/A | 13.46% | 28.55% | |

2-Year Forward Margin Change | -3.61% | -16.42% | 49.63% | 14.70% | 15.97% |

3-Year Forward Margin Change | 2.95% | N/A | 21.26% | 17.35% | 19.30% |

4-Year Margin Change | 8.07% | N/A | -58.54% | 1.88% | -28.33% |

Prior FY EPS | $0.81 | $0.73 | $3.60 | $2.13 | |

Last FY EPS | $0.94 | $0.57 | $0.90 | $1.89 | |

Current FY EPS | $0.97 | $0.49 | $0.92 | $2.28 | |

Next FY EPS | $1.03 | $0.56 | $1.94 | $2.34 | |

Next FY +1 EPS | $1.15 | $0.65 | $1.62 | $2.61 | |

3-Year Forward EPS Growth | 21.99% | 14.04% | 79.44% | 37.83% | 43.77% |

4-Year EPS Growth | 41.57% | -10.96% | -55.14% | 22.30% | -14.60% |

Current FY EV/Sales | 1.35 | 0.91 | 3.69 | 2.60 | 2.40 |

Next FY EV/Sales | 1.28 | 0.89 | 2.92 | 2.51 | 2.11 |

Next FY + 1 EV/Sales | 1.24 | 0.85 | 2.67 | 2.43 | 1.98 |

Current FY EV/EBIT | 7.05 | 9.02 | 35.10 | 9.41 | 17.84 |

Next FY EV/EBIT | 6.90 | 8.63 | 17.59 | 9.01 | 11.74 |

Next FY + 1 EV/EBIT | 6.23 | N/A | 19.84 | 8.51 | 14.18 |

Current FY P/E | 8.14 | 10.56 | 39.76 | 12.88 | 21.07 |

Next FY P/E | 7.60 | 9.22 | 18.98 | 12.54 | 13.58 |

Next FY + 1 P/E | 6.86 | 7.93 | 22.74 | 11.27 | 13.98 |

As the table above shows, QLogic's operating margins are already higher than both Emulex and Mellanox; the implied trend in margins for the group is shown below.

QLogic's operating (EBIT) margins have held up far better than those of either Mellanox or Emulex, and are projected to resume growing in fiscal 2017. Furthermore, we note that QLogic's sales are projected to grow faster than its peer average over a 4-year period. While it is true that Mellanox is set to grow sales by over 58% between now and its fiscal 2016 (described in the chart as "Next FY + 1"), that growth rate is made possible by the ~22% fall in sales that the company posted in 2013. When adjusted for that, Mellanox's 4-year sales growth is set to come in at 23.4%. A similar discrepancy can be seen in EPS growth. Over a 4-year period, QLogic's EPS growth is projected to come in at almost 42%, almost double that of Intel and well ahead of both Emulex and Mellanox. It should be noted that of the four companies listed above, only QLogic is projected to have consistent EPS growth over that 4-year period, with EPS rising from $0.81 in fiscal 2013 to $1.15 in fiscal 2017. However, despite a margin profile superior to both Emulex and Mellanox, and higher EPS growth, shares of QLogic trade at multiples that are not indicative of its fair value. Excluding the company's ample cash balances (more on that later), shares of QLogic trade at just over 8x fiscal 2015 EPS, versus almost 11x for Emulex and 13x for Intel (Mellanox' 2014 P/E multiple is a function of the collapse in EPS that the company saw in fiscal 2013; EPS is not set to partially rebound in 2015). And on an EV/EBIT basis, the multiples are even more modest; shares of QLogic trade at just a fiscal 2015 EV/EBIT multiple of just over 7x, versus multiples above 9x for both Emulex and Intel. In light of the QLogic's superior sales and normalized EPS growth, we see no reason for the company's shares to trade at their current multiples. In our view, shares of QLogic deserve to trade at a premium to Emulex and Intel; for the sake of conservatism, we will estimates such a premium at 10%. Taking the average of Emulex and Intel's current year EV/EBIT multiples and applying a 10% premium leads to a target EV/EBIT multiple of 10.14x, which we discount back to 10x. Applying a 10x multiple to QLogic's projected EBIT of $98.04 million for fiscal 2015 implies a value of $14.30 for the company's shares, representing upside of 29.88% from QLogic's October 20, 2014 closing price of $11.01. We use EV/EBIT, rather than P/E because that method removes the effect of QLogic's share repurchases on its EPS, which form a key component of the company's capital return strategy, and a meaningful catalyst for its shares.

As the table above shows, QLogic's balance sheet is pristine. The company holds almost $280 million in cash & investments, and no debt; this is equivalent to $3.15 per share in cash, representing almost 30% of the company's total market capitalization. And QLogic has moved aggressively to return this capital to shareholders. In conjunction with its Q2 2015 earnings, the company announced a new $100 million share buyback, to be completed over the next 18 months. At QLogic's current share price, that is equivalent to over 10% of the company's current shares outstanding, At the same time, CFO Jean Hu left the door open for other, more strategic uses of cash; she stated on QLogic's Q2 earnings call that the company remains open to bolt-on acquisitions. Conceptually, this is the only remaining avenue for QLogic to deploy cash, at least in the context of its existing markets. The company is already the leading player within the FC market, and together with Emulex, the two companies hold 98% of the FC adapter market by revenue. There is little that can be acquired within that market, given that an acquisition of Emulex would not pass anti-trust scrutiny. And within Ethernet, the story is fairly similar. With 21% of the market, QLogic is sandwiched between Intel and Emulex, thereby closing off the opportunity for sizeable acquisitions in that market as well. Therefore, that leaves QLogic the option of either bolt-on Ethernet acquisitions, or acquisitions within entirely new markets, something that management have not indicated the company is planning to do. That being said, QLogic's current financial position gives the company flexibility to act upon strategic opportunities as they arise.

Catalysts

The catalysts that could spark a rise in shares of QLogic come in several forms. First is commencement of QLogic's own share repurchase program. The current $100 million buyback program could repurchase over 10% of shares outstanding at current levels, and depending on how aggressive the company is in the timing of repurchases, the program could have a meaningful impact on QLogic's stock in short order. Second, the potential for acquisitions should not be discounted. While there are no reports to suggest an acquisition is currently in the works, QLogic's management has left the door open for bolt-on acquisitions. Should the company announce such a deal, there is potential for a favorable market reaction, depending on the terms and nature of the acquired company. But it is the third catalyst that is most immediate. QLogic and archrival Emulex often trade in tandem with one another in the short to medium-term, given the overlap in their businesses. Emulex is set to reports its own Q1 2015 earnings on October 30, and positive commentary about the markets from Emulex executives would likely lift shares of QLogic alongside those of Emulex. While a good deal of the positive surprises possible on the call were released on October 15 when Emulex pre-announced that Q1 revenue would be above its guidance range, Emulex has yet to give forward guidance or elaborate in more detail on the state of its markets; both have the potential to move shares of Emulex and QLogic.

Finally, the possibility of an acquisition cannot be discounted. With an enterprise value of less than $700 million, QLogic is easily digestible by a larger technology company. In the past, QLogic has been cited as a takeover target for EMC, as well as other firms. While our thesis for QLogic is based on its standalone prospects, and a belief that the company will remain a standalone entity, the possibility exists that once QLogic puts its affairs fully in order, the company could catch the eye of a larger technology company.

Conclusions

We do not believe that QLogic's current share price accurately reflects the company's fair value. QLogic has expanded its lead within the Fibre Channel market over Emulex, and is building on the Broadcom Ethernet deal to further expand its position in the growing Ethernet market. With multiple initiatives underway to maintain and grow market share in both markets, QLogic is well positioned to capitalize on the continued growth of the Ethernet market, as well as any further stabilization in the FC market. While the company's gross margins do remain under pressure, tight cost controls have allowed QLogic to dramatically mitigate the impact to its profits. However, despite favorable growth prospects and higher margins than both Emulex and Mellanox, shares of QLogic trade at multiples that do not reflect the company's solid market position and growth potential. We believe that as QLogic continues to execute and deploy capital, either via share repurchases or selected acquisitions, investors will come to appreciate the changes that have taken place at QLogic, and that the company's share price will rise to a level that fairly values the changes that have taken place at QLogic, and the potential that lies ahead.