An often very profitable investment strategy is spotting depressed small cap stocks trading at irrationally low levels due to temporary headwinds, but actually present all the good reasons to bounce, and bounce hard. With some clever timing, gains over 100% become realistic. I believe I spotted such a stock in Image Sensing Systems (ISNS). This company is with a low $10 million market cap trading in a 'forgotten corner' on the NASDAQ exchange, and due to a myriad of reasons, the stock shed 80% of its value in the past few years. But there is for a large part an irrational side to the story, having resulted in an oversold low share price savvy investors should be more than interested in. On top of that, it is probable a major short squeeze will amplify the share price appreciation. This article lays out the bull case.

About Image Sensing Systems

The company offers intelligent hardware and software products for the transportation industry, ranging from video detection to radar products. The business segments are transportation (improve traffic flow, etc), crime (reading plates, etc), parking (car park counting, etc) and security (video capture, etc). Their so-called Autoscope line-up is sold worldwide; Image Sensing Systems has offices and distributors in Canada, Europe, Asia and the Unites States. Read a Top Idea article Seeking Alpha published back in March for more insight in the company's workings.

The role of IT in traffic is growing. Ever heard of automatic lighting embedded in high ways? It's a wide open space for innovation to thrive, and most of it will be software-based. The industry in which Image Sensing Systems operates is big, global and growing. MarketsandMarkets, a leading market research and consultancy company, has estimated the total market opportunity is nearing $15 billion in size, with an annual growth of 12%.

Why is the share price so low?

At first glance, a look at the chart may signal not much appears to be up with this company. The stock traded at $15 in 2011, dropped to $5 last year, and in the last 4 months, hit new lows, after a short-lived superspike to $9. What happened? Here's an explanation:

Reason 1: Investigation

The primary reason for the poor performance is an investigation (FCPA probe) initiated in February 2013. It cost millions of dollars, which the company could have spent on core business related purposes otherwise. The costs are non-recurring though, and the good news is that the investigation has been finalized last month without any further penalties for Image Sensing Systems.

Reason 2: Fear of dilution

The investigation doubled the cash burn, and shareholders feared dilution was imminent. The high cash burn turned out to be incidental, as evidenced by the latest Q2 earnings. But the fear of dilution did, in our opinion, play a role in the stock's poor performance, as shareholders wanted to get out of their positions because of it. With the cleaned up financials, dilution is in fact an improbable event.

Reason 3: Increase in R&D expenses

Another factor for the temporary increase in cash burn are the elevated expenses related to R&D. While short-term traders regard all expenses simply as costs, I consider R&D as an investment, that should unlock value later on, but it does make the income statement look bleaker in the short run.

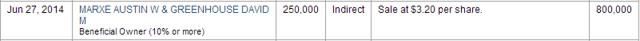

Reason 4: An institutional investor sold out

This year, an institutional investor dumped 750k shares on the open market.

source: NASDAQ.com

This is huge for a $10 million market cap stock. The share price took, obviously, a big hit. But I think the dump had nothing to with the underlying business. Why? Check out this link. It shows the seller is for 95% of the times reducing and liquidating all its stakes in a whole range of stocks for months now. This is actually good news, because this reduces the risk of a large shareholder selling its stake, because it just took place (similar to buying an index after a crash).

Reason 5: Irrational selling in an empty book

Till a month ago, Image Sensing Systems was a thinly traded stock, and because of the share price continuously heading south, individual investors are feeling the heat (margin calls, stop-losses, etc) and are stopped out. Even a small block of shares can have a fairly significant impact on the share price when the trading book is empty. It's a vicious downwards cycle of continuous selling pressure, and only a clear technical bottom would indicate the cycle is over, which occurred a month ago, and now again. The rise in trading volume of the past few weeks has pretty much eliminated the trading risk.

Turn-around in progress

Due to the reasons described above, Image Sensing Systems is currently trading at fire sale prices. But I believe the temporary headwinds are over, and the next factors indicate a successful turn-around is underway as we speak:

Number 1: Financials back on track

The Q2 earnings call presented what I was hoping for: improved financials. The most important aspect is the significant reduction in cash burn, from $3.23 million previous quarter to $0.35 million now. Revenue grew from $4.32 million to $5.94 million. Gross margin stands at a healthy 37%, and management believes margins can be ramped up to the company's historical rate of 60%. The current assets outweigh the current liabilities by a factor of 2.5. Overall, the financials appear to be back on track, and I believe profitability is within reach if management keeps executing.

Number 2: Renewed product line-up offers big upside

Image Sensing Systems has recently decided to enter the promising area of cloud solutions. The focus is on the expansion of the cloud offerings through their first software-only product, CitySync, Recognition as a Service (RaaS). CitySync RaaS is an annual service that provides organizations with automated license plate recognition they can use and access from anywhere. This is a stand-alone solution that can be implemented by any organisation without the need for purchasing expensive software. Tests showed this license plate recognition technique resulted in a capture rate of 98.74% and a correct read rate of 99.61%. These are truly phenomenal results, unrivalled in the area of intelligent traffic solutions. Management is very upbeat as they stated CitySync RaaS could be an industry game-changer because it significantly enhances the security and infrastructures that have been deployed by cities and businesses. They also state that the market opportunity represents hundreds of millions of dollars; huge for a $10 million market cap company. CitySync is the main reason the company deployed more resources to R&D.

Number 3: Amended agreement with Ecolite

Image Sensing Systems has a long standing agreement with Ecolite (a bigger peer company), per which Image Sensing Systems is entitled to a 50% royalty rate on Econolite's gross margin on sale of 2 products: Autoscope Video products and Autoscope Remote Traffic Microwave Sensor or RMTS. The derived revenue stream equated to approximately $10 million per year, depending on how Econolite performed. But per July 14th, the agreement got amended. The Autoscope RMTS will be fully transitioned to Image Sensing Systems.

Is this a good or bad thing? The market reacted in a neutral manner, but I think it will work out for the better. In this way, Image Sensing Systems will regain total control. In effect, the royalty stream will be reduced by 80%, but Image Sensing Systems now has the opportunity to take matters into own hands, and grow this business. The Autoscope RTMS is a market leader in vehicle detection radars, and the launch of the new Sx-300 model should appeal to a lot of organizations worldwide.

Number 4: International expansion

You can imagine the congestion and parking problems countries face worldwide. Take China for example. Traffic is completely clogged, and good luck finding a decent parking spot. The best solutions are to be found in innovation. Image Sensing Systems stepped up the plate by supplying and installing 360 units of Autoscope video detection equipment for integration with traffic signal controllers in Jinxing, a 8 million populated city in China. There are more Chinese cities evaluating such solutions, creating opportunity for massive revenue growth for Image Sensing Systems. Most organizations should prefer the superior and non-intrusive solutions offered by Image Sensing Systems, whereas the industry standard is plainly intrusive.

Number 5: Partnership with NuPark

Last month, Image Sensing Systems announced it struck a deal with NuPark. According to the press release, the partnership will leverage Image Sensing Systems' license plate recognition technology.

The CEO commented:

We are excited about this partnership with NuPark. We work diligently to identify technology partners that can leverage our technologies and experience in the parking industry. We believe that NuPark's parking management platform coupled with our LPR platform is an unprecedented combination for parking customers.

Number 6: Technical bottom at $2

The share price is currently at $2, which is a strong technical bottom, as the next chart shows.

source: Morningstar

Buying stocks at strong technical bottoms often makes for a great trade.

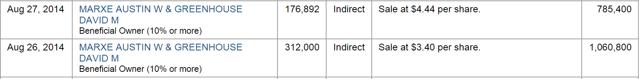

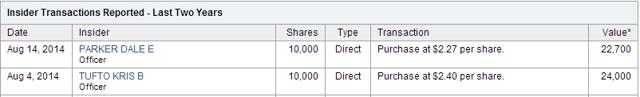

Smart money is picking up shares

The ideal combination I'd like to see is high insider ownership and insiders adding shares, preferably with direct purchases in the open market. This is exactly the case here with high insider ownership:

and the CEO and CFO buying shares:

source: NASDAQ

These are next to an automatic purchase program that the company has already put in place. Click here for a complete overview. At first glance, you may not be impressed with the numbers, but since the company's market cap is only $10 million, I argue the numbers are significant.

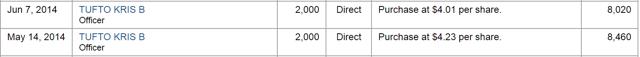

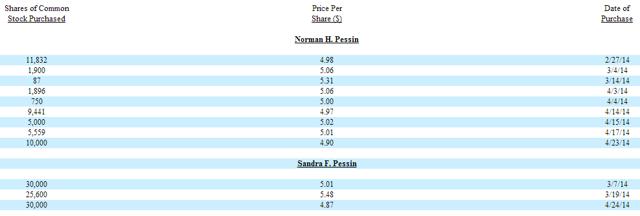

Also, a widely respected wealthy individual investor named Norman Pessin (and his wife) gobbled up quite some shares as well:

source: SEC filing

Big upside potential

Let's dig in the upside part of the story.

Image Sensing Systems is currently trading at a sales multiple of 0.43. A direct competitor Iteris (ITI) is valued at 0.77x sales. A bigger competitor is Flir Systems (FLIR), valued at 2.72x. Iteris had its problems too, and I think it's fair to state that Image Sensing Systems should be valued at least at an equal multiple, implying fair value is 75% higher than today's share price. There should be some discount to Flir Systems; this company has a far bigger moat and is more diversified. But I don't think the current 85% discount is justified. Even if Image Sensing Systems would be valued say 100% higher, the discount to Flir would still be more than 50%.

Also, the industry average sales multiple for scientific & technical instruments is 1.60, and for application software around 4, much higher. At the moment, Image Sensing Systems is a mix of both (hardware and software), but is leaning towards, and will continue to lean, becoming a niche software-only company. If management executes well, a valuation based on a blended sales multiple of 2 should be more than reasonable to assume in the mid term, equating to a 400% upside. Image Sensing Systems valuation should gradually approach industry standards with the transitions the company is going through.

The very low price/book multiple of 0.77 confirms the undervaluation compared to peers.

In short, I believe when Wall Street recognizes the bull case and the company is building more moat, a 100% return before year end is feasible, and for next year, the return could be far greater. Weighing the odds, I think a 12-month 150% return is very realistic in this case. Image Sensing Systems has been trading a far higher prices before based on the same financials, so historically, a 150% return could even turn out to be conservative.

Keep in mind that Image Sensing Systems already has a steady income stream, and if their new and promising (cloud software) products will be successful, or even disruptive, the impact on share price could be huge, given how low the company's market cap is today.

Lastly, considering how cheap Image Sensing Systems is today, and considering the market dynamics and potential of the intelligent traffic industry, it would not surprise a buy-out would take place. I would not place my bets based on such a speculative scenario alone, but it does add weight to the bull case.

Short squeeze could amplify share price appreciation

Image Sensing Systems has a high level of short interest, but I believe short interest is good once the trades have taken place. I actually see more risk when a company has low short interest because once investors begin initiating short positions - that's what hurts the share price. At present, the short percentage is about 15%, which is remarkably high for such a small NASDAQ stock. Take note that this company is not a binary bet, like IP or many biotech stocks are. The shorts have to cover their positions eventually, and if they do, the share price could shoot up fast, especially given the low float. The flimsiest positive press release, or this article, could spark some serious short covering.

Risks down the road

The flipside of the coin is downside risk. There are a few company-specific risks investors should bear in mind:

First, management is very upbeat, and has presented quite ambitious plans for the days, weeks and months ahead. They also assumed full responsibility for the Autoscope RMTS from Ecolite. Now perhaps more than ever, management has to deliver.

Second, the company is operating at a loss. I can't tell when exactly the income statement will turn green. Again, it depends on how management will execute, but small niche companies operating at a loss certainly have a higher risk profile than profitable companies.

Conclusion

Image Sensing Systems could turn out to be a very rewarding contrarian play. Wall Street currently values this company far below fair valuation for a myriad of reasons outlined in this article, but I believe several factors indicate the worst days are over, and the best days are yet to come. Innovation in the traffic industry is thriving, and Image Sensing Systems now has a renewed product line-up and the capabilities to capture sizeable market share. This stock is one of today's most compelling risk vs. reward opportunities in the small cap space and if management executes well, gains up to 150% become realistic in a matter of months.

Click here for full disclosure and disclaimer information.

Click here to join my free stock pick alert service.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.