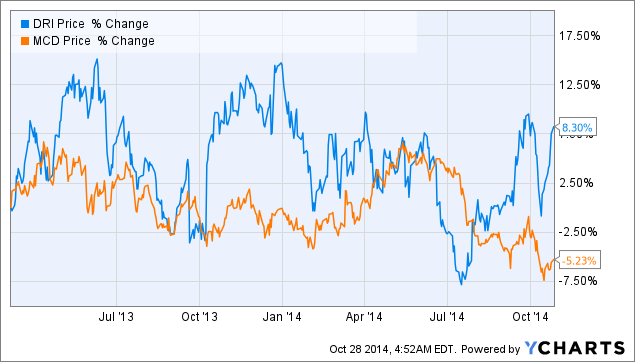

In a piece entitled 3 Reasons Why Darden Is A Better Buy Than McDonald's, published March 7, 2013, I outlined my thesis that Darden (NYSE:DRI) was a better buy than McDonald's (NYSE:MCD). Since publication of my previous piece, as shown by the chart below, DRI shares have moved higher by 8.3% and MCD shares have moved down by 5.23%. Taken together, DRI has outperformed MCD by more than 13%.

Why Has Darden Outperformed?

Darden Positives

I believe DRI has outperfomred for a number of reasons. Perhaps the most important factor in DRI's outperformance has been the company's move to sell its Red Lobster business to Golden Gate Capital for $2.1 billion in cash. DRI has also benefited, to some degree, from an improvement in the U.S. economy. Finally, DRI shares have responded favorably to a change in management after CEO Clarence Otis announced his departure in mid 2014.

McDonald's Negatives

MCD has reported a string of disappointing quarters over the past year. I believe that poor results have been driven to some degree by the stronger economy as consumers have been able to upgrade to more expensive restaurants. In addition to being held back by poor results, MCD shares have also suffered as investors have rotated out of MCD into more aggressive cyclical equities.

Why I Now Prefer McDonald's over Darden

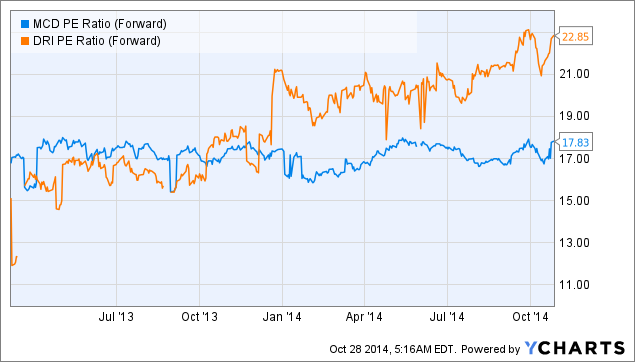

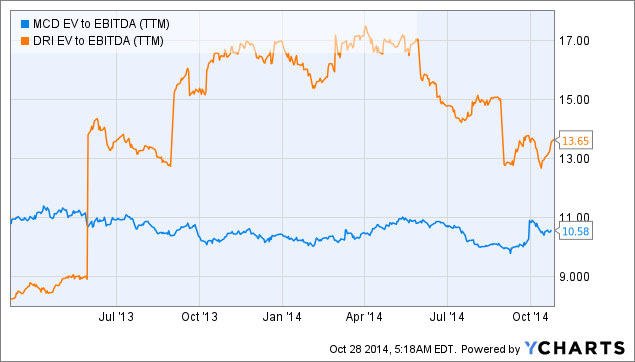

In my previous piece, the primary reason why I preferred DRI relative to MCD was valuation. At the time, MCD was trading at a slightly higher valuation, based on a number of metrics, than DRI. As shown by the charts below, that is no longer the case. DRI now trades at a significantly higher PE ratio and a significantly higher EV to EBITDA ratio.

MCD PE Ratio (Forward) data by YCharts

MCD PE Ratio (Forward) data by YCharts

MCD EV to EBITDA (NYSE:TTM) data by YCharts

MCD EV to EBITDA (NYSE:TTM) data by YCharts

While I did not predict that DRI would move to restructure via selling off its struggling Red Lobster business or that MCD would report a string of poor quarters, I did argue that valuations had made DRI more attractive than MCD based on risk/reward. However, with DRI now trading at a premium valuation to MCD, I no longer believe this is the case. Furthermore, one factor that I did predict in my previous piece was that a stronger economy would benefit DRI and possibly hurt MCD. However, with the economic outlook now looking more uncertain, it is becoming increasingly likely that an economic slowdown could occur. Under this scenario, I believe MCD would be much more well positioned than DRI.

Starboard Transformation

Activist investor Starboard Value LP recently won all of the board seats at DRI. Starboard plans to make significant operational improvements which Starboard believes will boost DRI earnings. While I believe that Starboard has good ideas, the fact that Red Lobster was recently sold, despite the objection of Starboard, leads me to believe that operational improvements will have only a limited impact as Red Lobster was clearly the business that would have benefited most from improvements. While business at Olive Garden may improve over time, DRI's high valuation means that investors have already priced in a positive outcome from Starboard's initiatives. Due to DRI's current valuation, if Starboard's initiatives are successful I believe upside is limited. However, if Starboard's initiatives fail then I believe DRI shares face considerable downside.

McDonald's Now A Potential Activist Target

In addition to being more attractive than DRI based on valuation, another reason why I now believe MCD is a better buy is the potential for activism. Due to MCD string of weak earnings results and falling share price, speculation has emerged that MCD could be an activist target. I believe there is a good chance of an activist getting involved at MCD. Potential activist that could be interested in McDonald's include Nelson Peltz, Carl Icahn, and Bill Ackman. I believe there are a number of moves an activist could push for to help bring out shareholder value. In particular, MCD could consider putting its significant real estate holdings into a REIT, selling some of its company owned locations to franchisees, or expanding its balance sheet to increase the stock buyback plan.

Conclusion

Due to its cheaper valuation, better positioning for a possible economic slowdown, and potential to attract an activist investor I believe MCD now a better buy than DRI. DRI shares have already moved higher based on optimism surrounding plans by activist Starboard. While Starboard has a good plan, I believe the increase in valuation for DRI shares make them less attractive. Comparably, MCD shares would likely see a significant pop if an activist were to get involved.