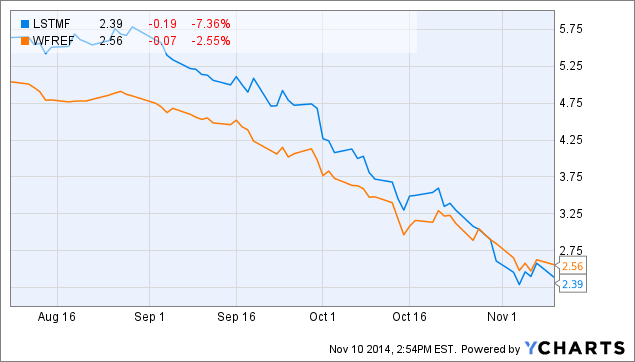

You'd have to be living under a rock not to know that the entire oil and gas exploration and production industry has taken a beating over the past 3 months. The fast fall in crude oil has sent lots of solid companies shares plummeting. Some see this as a terrible sign, and ultimately lots have dumped their energy names. For some though, especially those who can afford a little more risk, this is clearly an opportunity. In the past I have highlighted both Long Run Exploration (OTCPK:WFREF) and Lightstream Resources (OTCPK:LSTMF) and in recent months I believed both companies presented a very enticing risk vs. reward scenario. With both of the companies shares down over 50% in the last 3 months it could be an opportune time to pick some up, especially with their extremely high yields.

LSTMF data by YCharts

Long Run Exploration

I originally highlighted Long Run in August and I believed that the company had a promising future. At present I still believe that and looking in the long term the company is a very compelling investment. On November 5th the company reported once again good results. Looking at the financial results net earnings were up 327% versus last year and funds flow from operations was up 29%. EPS results blew past analyst estimates beating by 12 CAD cents. Operationally though the company did have minor complications due to outages and third party issues, decreasing production by 1,600 boe/d for the quarter. It did revise guidance slightly down for Q4 and FY 14, but it isn't anything extremely significant. Production still averaged 34,795 boe/d, an increase of 38% since last year. Something to point out about Long Run is the fact that 54% of production currently is comprised of natural gas. Natural gas production was also up 54% Y/Y and is yet another reason the shares should not be punished as much as they are.

In the outlook section of the results the company touched on the current oil environment and included the fact that 65% of its liquids production is hedged through year end. Other hedges in place include 50% of natural gas production for Q4 and 35% of it for 2015. In mid-December the company is due to release an updated 2015 outlook with a more detailed outline of its strategy and estimates. Looking into the future the company has a reserve life index of 13 years with a net acreage land position of over 2.3 million acres.

Lightstream Resources

A little over a month ago I wrote about how I thought shares of Lightstream might be too cheap to ignore. Since June the shares have been crushed, dropping about 70%. Just since I wrote that piece a month ago the shares are alone down a ridiculous 45%. Lightstream also just reported Q3 results and again the results didn't look terrible. For starters, for the longest time, the main concern with the company was its high debt. This year so far it has decreased it debt by $716 million, a 31% decrease since year end 2013. Since the beginning of the year the company has disposed of $729 million worth of assets, destroying its 2014 goal of $600 million. Through these dispositions the company lost about 16% of its production and about 11% of its 2P reserves. Something to think about would be what that makes up and how much it was valued at. Obviously, land and operations vary by location and potential, but if those assets are worth $729 million alone, can the market really justify a current market cap under $500 million? I certainly don't think so.

Operationally production decreased but this again was mainly attributed to the company's divestiture program. Lightstream, unlike Long Run, is heavily weighted toward liquids, ergo it does have a lot more exposure to the falling crude price. The company has accounted for the oil environment though, reducing its WTI pricing assumption for Q4 by $15. Looking ahead long term the company still has lots of potential. Its current drilling inventory is over 10 years and it has 635,000 acres of undeveloped land. The current focus for new growth is the company's land in northern Alberta at its Swan Hill position. Earlier this year the company reported relatively poor results from the area but completed a technical review of the area and finished it during Q3. The Q3 results said the findings of the technical review were that it still remains confident that the area will deliver future growth with large oil in place.

Conclusion

With both companies shares down over 50% in the last 3 months they are both definitely worth a deeper look. Shares of both also have a current yield of over 15%, which makes them all the more compelling. The falling crude prices have created what is probably an overreaction in these names, and if a rebound in crude occurs I would expect these to follow as well. Looking at Long Run specifically there is less of a concern because it's production is comprised by more than half of natural gas. Compared with crude prices, natural gas is actually up nicely over the past 3 months. While both of these companies remain risky while crude prices are low, it could be a very good time to pick some shares up for the long term.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.