(Editors' Note: Noah Holdings reported Q3 earnings yesterday after the market close. See here for details).

We feel that Noah Holdings Ltd (NYSE:NOAH) is a substantially undervalued Chinese wealth management services provider with a set of strong catalysts that will push its price well above the current valuation. Noah has achieved an impressive organic growth; its 2013 revenue was 173 million, more than 10 times its 2009 revenue of 15 million. Moreover, it is strategically located in 57 cities in China, primarily among the Yangtze River Delta, the Pearl River Delta, and the Bohai Rim, where most of the Chinese high net worth population resides.

China's fast-growing market for private wealth management

The macro environment of private wealth management is favorable for wealth managers like Noah. Chinese economy has doubled in size in the past six years, and a tremendous amount of high net worth population (individual who owns investable assets valued above 10 million CNY) has emerged during this process. As a result, the demand for high-end private wealth management reaches all-time high in a market yet to be exploited.

According to the 2013 Chinese Private Wealth Report published by Bain & Company and China Merchants Bank, at the end of 2012, the number of households with investable assets valued above 10 million CNY (1.6 million USD) in China has reached 700,000. The value of total investable assets is estimated at 22 trillion CNY, and would reach 36 trillion CNY by the end of 2015 according to forecast. With an estimated compound annual growth rate of 15%, the number could reach 73 trillion by the end of 2020. In BCG's 2014 Global Wealth Report, China ranked #2 in total private wealth, only behind the USA. Based on our estimations, the size of the high-end wealth management market in China is estimated at 135 billion CNY by 2015, and would reach more than 500 billion CNY in 2020.

Currently in China, major wealth management services providers are banks (including state-owned banks, private joint-equity banks and foreign banks), trusts, funds, and third-party wealth management firms. Noah falls under the last category and provides its services to a more defined group of clients, specifically large corporate clients and high net worth individuals with more than 6 million CNY in investable financial assets. Noah provides a wide variety of wealth management products that tailor to different clients' need and its products include cash management, fixed income securities, high-end structured investment product, high-end insurance, PE funds and P2P products. By the end of Q2 2014, Noah has registered 60,801 clients, a 32.6% increase compared to 2013. Noah currently has branches in 56 cities with a total of 690 relationship managers, with 1.7 billion CNY AUM (Assets Under Management) and 47.3 billion CNY managed by Gopher Asset- Noah's fully owned subsidiary.

Investment Thesis

a) Transformed business model positioned for more growth

Noah's transition from third-party wealth management to active wealth management is positioned for higher growth, profit margin and reputation. Before 2010, Noah relied fully on third-party wealth management agencies in products sales but such a business model became inefficient as the number of competing agencies reached 3000-5000 in China. Meanwhile, insufficient regulations on third-party wealth managers also created regulatory problems, especially in P2P products that most third-party managers sold.

In 2012, Noah established its fully-owned subsidiary Gopher Asset, which integrates Noah's sales channels, therefore increases its product designing and client servicing ability. In 2013, the company generated 51% of its revenue from Gopher Asset's management fee but only 12% from third-parties. In addition, Noah has the ability to develop and provide international wealth management products such as foreign ABS and dollar-linked PEs, through its off-shore operation in Hong Kong. Noah has become fully independent wealth management services provider, fulfilling high net worth clients' needs for a complete range of products. Noah's transformed business model is a strong catalyst for its share price to soar in the near future.

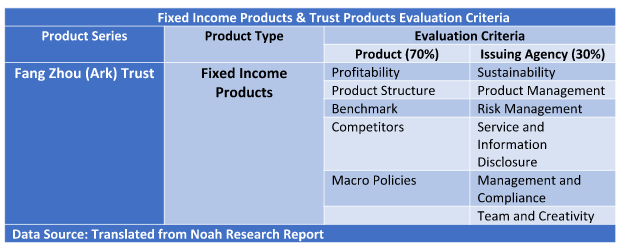

b) Comprehensive product lines and thorough risk management system to manage huge client assets

Noah has a vastly diversified pool of financial products for high net worth individuals and business to choose from. It includes fixed income products, private equity fund products, security investment fund, and investment related insurance product. The main product of Noah is mortgage-backed fixed income product or private equity product issued by trust companies. Noah makes no contact with customer's capital, issues no financial products, and collects no management fees; thus its independence provides its customers with a sense of trust. Noah also provides independent, objective investment advice base on its customers' financial status, financial needs, and risk tolerance. In addition, Noah is actively participating in the design and development of front end products, as well as evaluating the risk of these products. In doing so, Noah not only guarantees the quality of its product, but also controls the potential risk. Furthermore, based on the special needs of some customers, Noah customizes its product to meet the needs of these customers. Customization is also one of Noah's core competitive strengths.

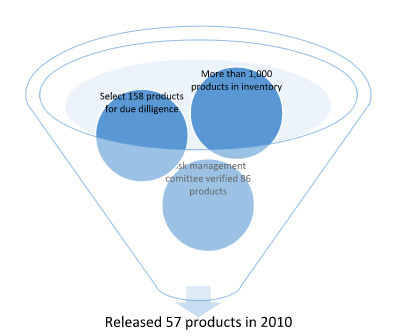

Noah has a complete product management process which consists of a financial product research platform, board of investing strategy, product developments, risk management, product approval, product evaluation, product revision and modification. Most of the members in the financial product research platform have experience in product development. Their main tasks consist of understanding the investment thesis behind the product supplier and to filter a similar product. After which, every product has to go through the board of investing strategy, product approval, and risk management. In board of investing strategy, every three month, the strategist will forecast the market for the next three month, thus further filter out target products. After that, the product managers will closely examine the products and give approvals, only then will each department evaluate the product. Lastly, the product has to pass the risk evaluation process of the risk management team in order to come online. After step-by-step filtering, the rate at which the products come online is really low. In 2011, Noah had followed around 1500 product, yet only 5% came online at last.

The interdependency of each department in the filtering process enhances the objectivity of the product. On the other hand, Noah has different rating indexes and systems for different financial products, which makes the whole filtering system more convincing and maneuverable.

In the case of those products that the customers had already purchased, Noah will follow these products, update customers on newest information, and help on possible adjustment. The whole process will last until the products mature.

c) Outstanding Management Team

Below is Noah's management team according to the latest SEC 20F file:

Directors and Executive Officers | Age | Position/Title |

Jingbo Wang | 42 | Co-founder, chairman and chief executive officer |

Zhe Yin | 40 | Co-founder, director and vice president |

Boquan He | 54 | Co-founder and director |

Chia-Yue Chang | 54 | Director |

Steve Yue Ji | 42 | Director |

May Yihong Wu | 47 | Independent director |

Shuang Chen | 47 | Independent director |

Shusong Ba | 45 | Independent director |

Zhiwu Chen | 52 | Independent director |

Theresa Teng | 45 | Chief financial officer |

Harry B. Tsai | 52 | Chief operating officer |

Jingbo Wang

As the captain of this ship, Ms. Wang graduated from Sichuan University with an economics major and attended China Euro international business school. She has spent at least ten years in this industry. She was awarded the 2011 Best EY Enterprise Award, 2012 Creative Leader Award by the Securities Times and Global Entrepreneur, 2013 New Leader by 21 Century Business Herald. After watching some interviews and articles of Ms Wang, she is actually very different from typical female CEO's image. No Prada outfit, no aggression, all she has is grace, sentiments and idealism. Those characteristics are really suitable to Noah's business. Compared with investment bank and hedge fund industry, Noah's team does have that much GPA 4.0s or crazy engineers. Most members of its management team did not study abroad, or former of world-famous investment banks. From above table, Noah's team is even very different from this industry which is getting younger and younger. Most of them have more than 10 years of experience in Chinese mainland wealth management industry.

Other than many private wealth management companies, trying to offer the clients the sense of superiority, like sending private jets to pick up the clients or furnished the office to be very luxurious, Noah never spent money on that. Because the management team believed that these money would ultimately come from the clients. These are just two different styles which are hard to judge right or wrong. However, companies like Noah can settle down and think from customer's perspective and use revenue generation as a direct measure was rare in the industry. This kind of spirit helped Noah to be more sustainable and would definitely attract more investors in this multi-billion market.

Also, some other big shareholders need to be mentioned. Sequoia capital is one of the biggest venture capital supported and fostered the growth of many Chinese companies. Many Chinese companies received funds from Sequoia Capital, which managed by Nanpeng Shen. For example, the most welcomed stock this year on wall street like Vipshops and Qihoo received Sequoia's investments. As for Noah's investors, having a such big investor like Sequoia means that the company has passed a strict evaluation by the company. Also, Sequoia was famous for investing in tech companies, but investing in an off-line company like Noah seems rare in its history, yet Nanpeng didn't hesitate in the decision making process. In March 2008, CEO Jingbo Wang and Nanpeng Shen met for ten minutes and set the framework for cooperation. As Nanpeng said, this team has "enthusiasm, dedication and honesty." Sequoia Capital, after 2 month of their meeting, invested 5 million dollars in Noah for 20% of its shares, and brought in a mature operation model.

Another co-founder worth to mention is Boquan He, a renowned entrepreneur and investor, who was famous for his long-term perspective. His story was selected as one of the Harvard Business School case study.

d) Significantly Undervalued Stock Price

One of the most important reasons for choosing NOAH is due to its considerably lower valuation compared to its intrinsic value. We used four different valuation models: DCF, Residual Earning Model, Abnormal Earning Growth Model, and comparable to assess its value. By our current estimations, we determined that NOAH is undervalued by more than 50%.

Discounting Cash Flow Model (DCF)

The crucial variables for DCF are the following:

Sales growth rate

Target operating margin

Reinvestment rate

Discount rate

Sales Growth Rate

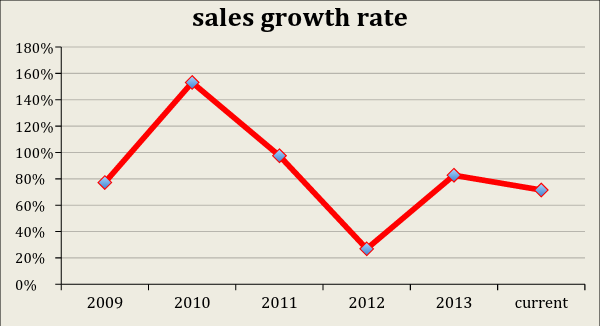

Since 2009, NOAH has maintained a relatively high sales growth rate. Ranging from 153.1% (2010) to 26.9% (2012), NOAH has always kept its growth rate above 20%. Furthermore, data from the most recent four quarters showed a growth rate of 71.5% compared to the trailing four quarters a year ago.

Furthermore, based on Bain & Company's 2013 report on the private wealth level of China, the company predicted that the number of high net worth individuals in China would grow at an annual rate of 14%-16% between 2015 and 2020. We also took into consideration the fact that Third-Party Wealth Managements in Western countries hold more than half the share of investible assets whereas in China, only less than 10% is held by these firms. As a result, the potential market for NOAH and other Third-party Wealth Management Institutions is enormous.

All in all, we determined that an annual sales growth rate of 20% in the first five years is reasonable and relatively conservative. After year 5, the growth rate will approach the GDP growth rate of China.

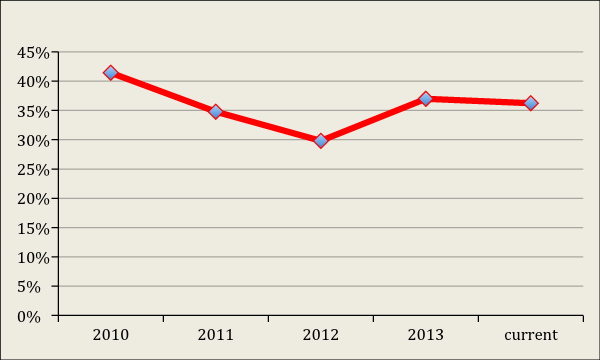

Target Operating Margin

Historically NOAH has been keeping its operating margin around 35%, which is very similar to those of some U.S wealth management industry leaders such as Blackrock and Franklin Templeton. Since NOAH is also the industry leader in China, it is reasonable for the operating margin to remain at current levels. However, due to increased competition in this industry, we think that a 30% target-operating margin is a good assumption.

Reinvestment Rate

Excluding cash, NOAH's return on invested capital (ROIC) has reached 51% for the trailing four quarters. Before 2011, NOAH spent a significant amount of cash in expanding geographically, yet since NOAH, its geographic expansion has been slowing down. The number of offices reported in recent financials has remained constant between 57 and 59. Given its relatively stagnant expansion pace yet high sales and income growth rate in recent years, we are confident of NOAH's ability to generate income.

Based on our analysis of its past spending on reinvestment and our future expectations, we assumed a sales/capital ratio of 2.

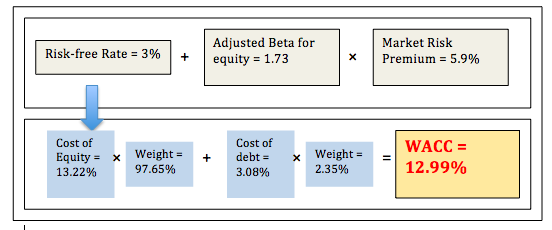

Discount Rate

DCF results

Our DCF model gives an equity value of $30.61/share.

Residual Earning and Abnormal Earning Growth Model

Since both models are based on analyst's forecast of earning and growth, they give more authentic values.

The variables of both models are:

Discount rate

Short-term EPS growth rate

Dividend growth rate

Terminal EPS growth rate

Discount Rate

It is calculated to be 12.99% as above

Short-term EPS Growth Rate

We used data from Bloomberg. The analysts gave a 24.9% EPS growth rate for the next five years.

Dividend Growth Rate

The analysts did not give a dividend growth rate. However, based on the 2014 estimation of $0.15/share and $0.18/share in 2015, we get a dividend growth rate of about 10%.

Terminal Growth Rate

We decided to use China's long term GDP growth of about 5.5%.

Results

The average of both models gave a value of $26.88/share, which is very close to the number we got from DCF.

Comparable

NOAH reported its trailing four quarters EBITDA to be 76.65 million, EBIT to be 69.37 million. Times the corresponding industry multiple of 14.4 and 15.9, we got the value of $25.87/share.

Conclusion

We used different models to valuate NOAH. Our results ranged from $30.61/share to $25.09/share. Given the closing price of $16.77 on Nov 10, 2014, there is still 58% to 94% upside potential. Moreover, since our estimations of model variables are relatively conservative, the equity value of NOAH could be higher.

e) Active response to the new financial market in China

1. Noah's off-shore subsidiaries fulfill clients' need for international wealth management solutions

China's booming high net worth population vastly increases the demand for tailored wealth management services that traditional commercial banks and financial institutions are unable to fulfill. In 2012, McKinsey & Co and Minsheng Bank Corp jointly published a survey showing that a great portion of Chinese high net worth individuals want and need "better banking":

"…about 40% of customers are dissatisfied with what their current private bank provides for them. Around 30% of HNW individuals' assets are currently allocated to real estate. Of the remaining 70% percent, basic investment products such as mutual funds and savings deposits represent more than half of their holdings. While offshore investments are becoming more common, they represent only about 10% of total HNW individuals' assets. All main investment activity is still onshore in China."

As the leading wealth management services provider exclusively for HNW clients, Noah has successfully expanded their operations off-shore, founding its first subsidiary in Hong Kong in 2012; and it is now operating three subsidiaries in Hong Kong, which according to CEO Jingbo Wang, has significantly increased Noah's ability to market new products, thus fulfilling Chinese HNW clients' need for international asset management solutions. In additional to its signature products (fixed income products, private equity fund, securities investment funds, and investment-linked insurance policies) originated within mainland China, Noah has added a wide range of global wealth management products to its portfolio.

One of Noah's Hong Kong subsidiaries, Fang Zhou (ARK) Trust, offers full-range family trust services that was previously not available, despite in high demand, for HNW clients. Fang Zhou Trust HK functions as the trustee, and is responsible for clients' asset allocation, wealth planning, trust fund management and the handling of law administrative issues under Hong Kong regulations. It cooperates closely with Noah's global network of well-established, highly-acclaimed trust and wealth management firms, therefore is capable of providing tailored family trust services to Chinese HNW clients. As China enters to the fast-track of financial market reform which allows much wider cooperation between Chinese and foreign financial institutions, Noah would very likely achieve faster organic growth thanks to its well-established offshore arms.

2. Noah's march into internet finance

In 2013, internet finance became one of the hottest topic in Chinese financial industry. While most of Chinese population still holds its money in traditional depository institutions offering low interest rate that barely matches inflation, internet financial products provide the idea alternatives that combine both higher return and greater flexibility. The financial market reform from top-down triggers the explosion of internet finance market. It's estimated that China's internet finance market has reached 1 trillion dollar in size in 2013, and is growing 30% per year.

Chinese e-commerce and SNS giants are the major driving forces of the internet finance boom. Take Alibaba as an example, this largest e-commerce company in China launched Yu'E Bao, a money market fund that grants investors high interest rate and easy transfers of funds from Alibaba's payment system Alipay, in June 2013. In only 6 months, Yu'E Bao has become China's largest fund holding assets of over 250 billion RMB in January 2014.

While China's internet titans advance into internet finance market fairly smoothly with their well-established user database, social network platforms and payment systems, Noah has also ventured into this booming market. In April 2014, Noah partnered with Sequoia Capital, invested in PPDai, a P2P (Peer-to-Peer) online lending company. Later in 2014, Noah launched YuanGongBao, an online financial services platform that designed specifically for white collar individuals. While most of Noah's HNW clients are late-middle age, successful multi-millionaires and billionaires, YuanGongBao approaches to a slightly different demography, which contains mostly young white collars, who are not ultra-rich yet, but have among the highest income in their class. YuanGongBao, as Noah's most important play in the internet finance field, follows Noah's philosophy, and will certainly become another one of Noah's key growth driver as China's internet finance market continues to boom.

US Investors are too sensitive to the Chinese Macro Environment

Starting from the beginning of 2014, international investment banks have lowered expectations of China's future economic growth. For international investors, their worries about China's economic trends and some of the macroeconomic policies changes are reflected in the share prices of Chinese companies listed on the US stock market. Many investors are worried about the slowing of the Chinese economy, transparency of Chinese companies and a possible real estate housing bubble. However, the economic downturn would not impact Noah significantly since Noah has been making adjustments to the dynamic environment by adopting flexible investment strategies

a) Will the hard landing for the Chinese economy have an impact Noah's business?

China is now the second-largest economy in the world. Since the reform and the opening up of its economy, China has been developing rapidly for the past 30 years. However, the rapid development has also caused extreme imbalance in China's economic structure, forcing China to start making adjustments to its economy. China's new Prime Minister Keqiang Li was a strong reformist; he does not advocate stimulating the economy in the short-run. He realized that there is a tradeoff between fast growing economy and economic sustainability. He would rather stimulate urbanization and industrialization, which he believes will finally lead to sustainable economic development. From the current Chinese economic data, it can be seen that his policies are indeed guiding the development of the Chinese economy in a more sustainable fashion. China's 2014 GDP in the first three quarters of 2014 kept a growth rate of more than 7%, and PMI has been keeping larger than 50 in 2H of 2014. Li Keqiang's strategy led to the steady growth of the economy and the number of skeptics critical about China's economy has been decreasing.

Even if the Chinese economy faces a potential hard landing, investors do not have to worry too much about the resulting impact on Noah. The concept of "save a little more" is deep-rooted in Chinese people. Currently, most individuals, businesses, and governments' 50% wealth is accumulated in the form of savings in bank and most of the investment funds were in the real estate market. Therefore, under the macro environment that the penetration rate of wealth management is relatively low. As the demand for professional wealth management and a wide range of investment from individuals and business, wealth management companies like Noah has a great market potential even if the economy is facing downward pressure.

b) Can Noah be trusted?

Another worry that Investors have is Noah's large risk of running as a third-party financial business, which refers to the business model that sells products from other companies instead of developing products from the business itself. This business model, compared to traditional banking services, still lacks regulation from the government. Investors were even more concerned about the stability of this business model after China's largest P2P Credit Company, CreditEase, which suffered a crisis of confidence. The situation even deteriorated when news reported that some small-scale P2P companies in Zhejiang defaulted.

However, compared to other P2P companies, instead of focusing on particular investment assets, Noah is proactive in diversifying client's portfolios, thus avoiding systematic risks. First of all, due to the high quality of Noah's partners, Noah was not involved in this crisis. Also, the P2P credit in Noah's portfolio accounts for only a small portion of its third-party financial businesses. Secondly, as one of the first Chinese's third-party financial companies that received the license for selling third-party funds, Noah was able to minimize the impact by adjusting to the uncertainty of the government policy. For example, on May 13, the CBRC and the Banking Bureau issued Document No. 99, announcing a ban on third-party finance companies to make recommendations and to sell trust plans. However, Noah had already prepared to adjust its portfolio before the document came out. Compared to most of the third-party financial companies in China that have more than 50% of their businesses in trust plans, the income trust products only accounted for only 7.3 percent of Noah's revenue when its first quarter earnings came out, less than 5% of its total business. Moreover, the asset management company Gopher Asset that is under Noah's assets is expanding rapidly and now accounts for 51% of Noah's total revenue.

c) Will Noah be affected by the downturn of China's real estate market and the macro-economic policies?

Investors are concerned about the downturn of the Chinese real estate market and the impact of macroeconomic tightening policy will have on Noah. There are some areas in China with extremely high housing prices, but the government has taken actions and made policies to curb the excessive heat of rising real estate prices. China's housing prices has been skyrocketing for the past few years. But it does not necessarily mean that the real estate market in China is on the edge of collapse. Investors' main concern was that if the real estate market collapses, Noah would lose everything.

First, the readjustment of housing price to the new policy will make the real estate market become more structured, resulting in increase of prices among regions. With the accelerating urbanization process in China today, many cities' demand for houses is far from being filled. The housing prices of a lot of second and third tier cities were pulled too high from the past few years, leading to an oversupplied market. Even with the new macro-economic policy, the housing price is still rising although with a reduced rate. We can still find many second-tier cities with firm housing prices. China's current urbanization rate is less than 54%, which means that it is too early to talk about a dangerous housing market. In addition, Premier Li thinks urbanization plays an important role in China's economic reform, and it will be one of the keynotes for China over the next few years. Thus, people can infer that one of the objectives of Premier Li will be maintaining the stability of the housing price, so it is unlikely that house market will collapse. This wave that caused decreasing housing prices due to the callback policy can make Chinese housing market structure become more reasonable, and thus paves the way for a long-term development in real estate market.

Noah's percentage of investment in real estate market of total portfolio was particularly high before 2014, which even reached 75.3% in 2013. However, in 2014, Noah suggested reducing the proportion of real estate product in its total assets in its investment strategy proposal for the first half of 2014, and it did. Besides that, the companies that Noah selected for real estate investments are all top 100 companies within the industry, and most of those companies' operations are concentrated in the first and second-tier cities where prices are still steadily climbing. Therefore, investors do not need to worry about the real estate market downturn that would impact Noah because Noah can adjust the macro environment by fine-tuning its asset allocation ratio and by working with reliable real estate partners, thereby reducing systemic risk.

d) Did Noah's choose its investment strategy wisely?

Noah knows how to adjust the portfolio accordingly under different economic cycle and allocate their assets wisely from their track record. For example, after China's stock market peaked in 2007, it has experienced the doldrums. The public started to doubt the profitability of investment in the stock market, and they were reluctant to invest money into it. As most of the stocks are closely related to the cyclical industry and the macro-economy, it is hard to breakthrough in the current downtrend. This made the choice even harder for Chinese investors who already had negative attitudes toward the stock market to invest into it. Therefore, in the downward economic cycle, the typical mentality of the public generally was to prevent their asset value from going down and from the inflation. Meanwhile, the doldrums in stock market made Chinese investors more resistant to risk that they became more inclined to choose those investment with steady growth. Noah spotted and grasped this opportunity in the conversion of investment preferences, and the proportion of Noah's fixed-income services is has experienced explosive growth from 20% of total business volume in 2007 to 80% in 2013.

In addition, Noah's strong risk management ability is reflected in its strategy in 2014. Real estate investments were crossed out from its favorite list. Although the real estate bubble burst was merely true, people can see the slowdown of housing prices. Noah made structural adjustments for this change. Noah's founder and CEO Jingbo Wang said at the beginning, of 2014 that Noah will continuously invest in real estate products, but it will no longer be the primary choice. In 2014, Noah is optimistic about the stock and PE markets. Indeed, the new leadership in China is leading a large-scale of reforms, and many new policies will make China's financial system closer to that of the developed countries. Premier Li said: "We will accelerate the economic structural reforms. We will expand market access and guide private investment growth in the areas of finance, oil, electricity, railways, telecommunications, resource development, public utilities, and services, and provide more space for development for all types of private enterprises." Therefore, it is reasonable to believe that China's stock market is preparing for a new wave of bull market. We believe Chinese stock market has broken out of its resistance level and begun a new bull market. The shanghai stock index has raised from 2000 to more than 2400 in just 5 months, which is more than 20% gain. From Noah's performance these years, we can find the company was wise in allocating its assets and helped the clients to avoid the risks.

Risk Factors:

The laws and the regulations about the Chinese wealth management industry are still developing and subject to further changes that will create uncertainty.

If the wealth management products Noah sell involves risks and might not be able to appreciate that would adversely affect client relationships.

Any harm to the reputation or brand of Noah would adversely affect the business

Conducts and images of relationship managers are crucial for Noah to continuously win business from corporations or wealth individuals. Any misconduct by relationship managers might affect Noah's growth.

Conclusion:

As the leading company in Chinese wealth management industry, Noah is destined to capture the rapid growth of demands from wealthy individual and corporations. Investing in Noah now is the best way to share the cakes of such big industry in China.