By Larry D. Spears

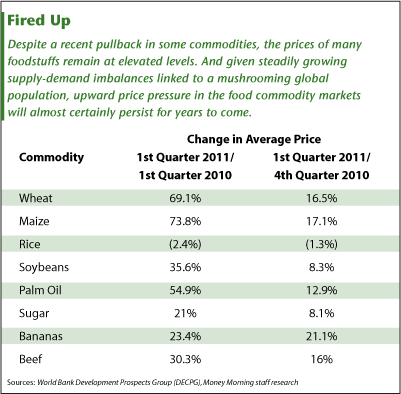

And, given steadily growing supply-demand imbalances linked to a mushrooming global population, upward price pressure in agricultural commodities markets will almost certainly persist for years to come -- meaning repeated profit opportunities for investors savvy enough to ride the trends.

That's when Starbucks Corp. (Nasdaq:SBUX) informed its legions of coffee addicts its prices would be raised because the company could no longer absorb the added cost of the bulk Arabica coffee beans it brews. At the time, Intercontinental Exchange Inc. (NYSE:ICE) futures for July delivery of those beans were trading at $3.025 a pound - more than double their price in May 2010. By last week (May 3), July coffee futures had climbed to $3.089 a pound, a 35-year-high, before retreating late-week in trading.

Starbucks reported a 20% increase in first-quarter profit, but the company was quick to justify retail price increases by adding that it expected input costs to trim its full-year 2011 earnings by at least 22 cents a share.

Of course, of all the leading food commodities, coffee is the least essential to the average U.S. or global consumer, so the decision to pay those higher prices - at Starbucks, the grocery store or elsewhere - is largely discretionary. However, that's not the case with most other food commodity products - and the coffee concerns were amplified when the U.S. Department of Labor's Bureau of Labor Statistics issued its report on the March Consumer Price Index (CPI).

That report noted that prices for all consumer items rose just 0.1% in March, but prices for all food items jumped 0.8%, and prices for groceries (classed as "food at home") were up a full 1.1% - bringing the year-over-year increase to 3.6%. More alarming was the fact that the March food-price hikes came on top of respective increases of 0.5% and 0.6% in January and February.

Globally, The World Bank's Food Price Index remains near its all-time high, set in early 2008. The March numbers indicated food-price increases were running about 5% higher in poor and developing nations than in the developed countries. Regardless of the region, however, every key global food commodity was significantly higher than a year ago save for rice, prices for which were described as "stable."

The World Bank also definitively linked the rising cost of energy to price hikes for food, saying that every 10% increase in the price of crude oil resulted in a 2.7% jump in the overall cost of food.

Obviously, you hate to see the impact of such numbers on your grocery bill - but they certainly offer substantial incentive from an investment perspective.

You simply cannot ignore the potential to capture single-contract gains ranging from $9,300 to as much as $65,025 for your futures portfolio. Even if the entry and exit timing was off by 20%, or even 30% - missing both lows and highs - nearly every food commodity produced upper triple-digit gains on the typical futures margin deposit for 2010-2011.

And, as noted earlier, prospects appear ripe for similar moves in the future - on both a short-term and a long-term basis.

A Short-Term Bounce in Agricultural Commodities

Short-term, food commodities have pulled back from last month's highs - largely due to profit-taking and sympathy selling in response to the downturn in the metals and oil prices. Even coffee, which didn't peak until May 3, retreated more than 20 cents a pound to close at 287.77 on Friday, May 6.

Most analysts view these pullbacks as temporary , since there's been no real change in the fundamentals that supported the earlier price increases. That makes the current pullback a good buying opportunity.

In the corn market, for example, U.S. plantings for the week of May 2-6 came in at just 13%, the third slowest pace since 1986 and well below the 10-year average of 43%. Ohio, Indiana and Iowa reported respective plantings to date of just 1%, 2% and 8% of expected seasonal totals. The odds that farmers will close the planting gap are getting slimmer by the day, since large sections of prime U.S. corn-growing land are currently suffering either flooding or severe drought. That signals another weak yearly corn harvest, adding to last year's poor average yield of just 152.8 bushels per acre.

Conditions are also bullish near-term in the cattle market, with many herds being pulled off drought-withered or fire-ravaged pasture land in Texas, New Mexico and Oklahoma and placed on feed, which will raise costs - and consumer prices. The arrival of the summer barbeque season and a forecast drop in gas prices could also conspire to increase consumer demand, sparking a general beef price rebound.

According to Inside Futures, a leading commodity analytical service, pork fundamentals also remain unchanged from when prices soared to record highs last fall and again this spring.

And the coffee market continues to face the same fundamental support it did before its recent pullback - tight supplies due to poor harvests in several prime growing regions, coupled with rising demand in both developing and developed countries. As an example of continued growing demand, India saw its export orders climb 46.4% between January and April of this year, with most of its crop going to Italy, Russia and Germany.

In short, the recent pullback in the food commodities should be viewed as a healthy retracement and a new near-term buying opportunity, not a major trend reversal.

A Long-Term Look at Agricultural Commodities

Longer-term, the outlook for food commodities is even stronger. The

United Nations Food and Agriculture Organization (FAO) projects of an increase of 2.3 billion in the world population by 2050 - to more than 9 billion. Nearly all of that growth is expected to come from developing countries. This population growth will require a 70% increase in global food production, with needs in developing nations nearly doubling.Given the dwindling availability of arable land on the planet, meeting this exploding food demand will require new farming techniques, new crop technologies, new types of seeds and fertilizers, a whole new approach to agriculture - if it's even possible.

The FAO report estimates private investment of $209 billion a year will be needed just to keep the percentage of the world population that goes hungry at current levels. If world hunger is to be significantly reduced, that investment number must skyrocket to $359 billion a year.

This huge spurt of population growth will affect future food commodity prices in a number of ways. We'll face not just shrinking supply and steadily growing demand, but also, in terms of politics, territorial conflicts and control of distribution systems.

Just this past weekend, U.S. Secretary of State Hillary Rodham Clinton addressed a meeting of the FAO at its headquarters in Rome, warning that global food shortages and spiraling prices could lead to widespread social unrest and political and economic destabilization. She urged immediate action to develop new policies aimed at preventing a repeat of 2007-2008 food riots that hit dozens of developing countries around the globe.

Clinton also urged a united worldwide effort to hold down food commodity costs and boost agricultural production. However, she admitted food prices will continue to rise for the foreseeable future, citing the World Bank's report that its Food Price Index climbed 15% between October 2010 and January 201 alone.

So given the huge projected increase in world population and the bullish price implications of steadily increasing demand for food commodities, how can you best take advantage of the investment potential the sector offers?

Investing in Agricultural Commodities Markets

Basically, there are three ways to invest in agricultural commodities markets.

First, if you have sufficient capital and a large tolerance for risk and volatility, you can invest directly in the futures markets, examining the fundamentals and technical outlook in greater detail and opting for the food commodities you believe hold the greatest potential.

Secondly, you can focus on the individual stocks of companies that either harvest or distribute basic foods and will benefit from rising demand, or companies that develop the new agricultural technologies and equipment needed to meet those demands.

Three potential investment options include:

BRF-Brasil Foods S.A. (NYSE ADR: BRFS):

One of the 50 fastest-growing international companies listed on U.S. exchanges, BRFS focuses on the production and sale of poultry, pork, beef, milk, dairy products and processed food. The company and its subsidiaries supply markets in Brazil and 140 other countries, including many developing nations. BRFS has reported steadily increasing quarterly profits since 2009, with earnings totaling 57 cents a share over the past 12 months. The stock, which pays a modest dividend giving a current yield of 1.29%, hit a high of $20.79 in late April, nearly double its May 2010 low of $11.35.

Deere & Company (NYSE: DE):

If global farmers are to meet rising demand from developing nations, they won't do it with teams of oxen and wooden plows. Deere is the world's largest manufacturer of agricultural equipment - from plows and planters to tractors and harvesters. As such, it will get a big chunk of that projected $209 billion to $359 billion in required annual spending, adding to profits that already totaled $4.98 a share over the past 12 months. With the investment, you'll get a dividend of $1.40 a share (1.49%) and the wisdom of lots of analysts for institutions, which hold 73% of the stock.

Monsanto Company (NYSE: MON), recent price $65.27- Just as Deere will benefit from rising global agricultural-equipment sales, Monsanto will profit from the need for new crop technologies. As one of the world's top developers and suppliers of seeds and herbicides, as well as research into agricultural biotechnology and hybridization (known as "genomics"), MON has a leading role in increasing global crop yields and improving farmland arability. The company's most recent 12-month earnings came in at $2.32 a share and its $1.12 dividend provides a yield of 1.6%.

Finally, perhaps the easiest way to gain access to a broad spectrum of higher food prices is through shares in one or more of the exchange-traded funds and exchange-traded notes that target agricultural commodities markets. Two of the top funds, plus one newcomer, include:

Market Vectors Agribusiness Fund (NYSE: MOO):

This fund attempts to track the price and yield performance of the DAXglobal Agribusiness Index (DXAG), which is calculated by Germany's Deutsche Boerse AG, based on prices for the stocks of agribusiness companies whose shares trade on major international exchanges. Fund investments focus on five different sub-sectors, including agri-product and livestock operations, agricultural chemicals, equipment and ethanol/biodiesel. The fund, with a market capitalization of $3.75 billion, has a below-industry-average expense ratio of 0.55%.

E-TRACS UBS Bloomberg CMCI Food ETN (NYSE: FUD):

FUD tracks the 13 agricultural food and livestock futures contracts included in the UBS Bloomberg CMCI Food Total Return index. While the fund focuses on near-term contracts, it smooths out short-term price volatility by investing in three different maturities for each individual commodity. The expense ratio is 0.65%, below the industry average, and the fund has $42.9 million in net assets.

Global X Food ETF (NYSE: EATX):

The newest entry in the food ETF market (and on the ETF roster in general), EATX shares just began trading the first week in May. Geared solely around the consumption of food - including commercial fishing and fish farming - the fund attempts to mirror the performance of the Solactive Global Food Index, which tracks the 50 largest international firms with primary operations in production, development or distribution of food or food ingredients. Unlike the index, however, the fund will limit the holdings in any single company to 4.75% of assets, rebalancing every six months, and will also emphasize investments in firms serving the developing countries. Holdings include such giants as General Mills Inc. (NYSE:GIS), Kraft Foods Inc. (NYSE:KFT) and HJ Heinz Co. (NYSE:HNZ), but smaller companies from 17 countries round out the fund's portfolio. Initial capitalization was not announced, but the operators anticipate having an expense ratio of 0.65%. And, for those who like to mix social activism with their investing, Global X has promised that all profits from the fund will go to fight global hunger.

Obviously, solutions to world hunger remain far in the future - but, if you put your money behind any of these food commodity-related investments, it's unlikely you'll wind up hungry for profits.

Disclosure: None