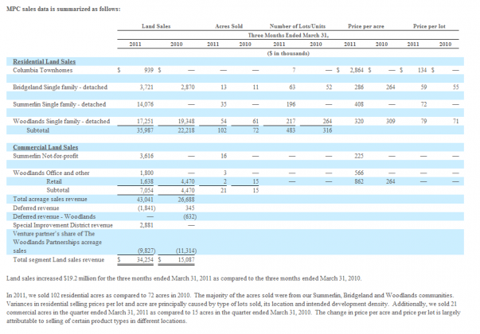

The Howard Hughes Corp. (HHC) earnings release is listed below. My guess is people are looking at the headline number and not the operating results. The BIG point here: We are seeing a significant uptick in activity at Summerlin in Las Vegas, which goes to bolster our MGM thesis as well. Lots there are selling for $408k an acre. 196 lots sold vs none in 2010. Both Bridgeland and Woodland in Houston, saw increasing prices per acre and per lot over Q1 2010. Details below - click charts to enlarge:

Here are the MPC results in detail:

Let's just take Summerlin here (below is a description of it).

Spanning the western rim of the Las Vegas Valley and located approximately nine miles from downtown Las Vegas, our 22,500-acre Summerlin master planned community is comprised of planned and developed villages and offers suburban living with accessibility to the Las Vegas Strip. For the last decade, Summerlin has consistently ranked in the Robert Charles Lesser annual poll of Top Ten Master Planned Communities in the nation. With 25 public and private schools, five institutions of higher learning, nine golf courses, and cultural facilities, Summerlin is a fully integrated community. The first residents moved into their homes in 1991. As of December 31, 2010, there were approximately 40,000 homes occupied by approximately 100,000 residents.

Summerlin is comprised of hundreds of neighborhoods located in 19 developed villages with nearly 150 neighborhood and village parks, all connected by a 150-mile long trail system. Summerlin is located adjacent to Red Rock Canyon National Conservation Area, a landmark in southern Nevada, which has become a world-class hiking and rock climbing destination and is in close proximity to our Shops at Summerlin Centre development site. Summerlin contains approximately 1.7 million square feet of developed retail space, 3.2 million square feet of developed office space, three hotel properties containing approximately 1,400 hotel rooms, as well as health and medical centers, including Summerlin Hospital and the Nevada Cancer Institute.

In [[HHC]]’s 10K Summerlin had 5995 acres of saleable land. That is defined as:

Includes standard, custom and high density residential land parcels. Standard residential lots are designed for detached and attached single- and multi-family homes, of a broad range, from entry-level to luxury homes. At Summerlin, we have designated certain residential parcels as custom lots as their premium price reflects their larger size and other distinguishing features – such as being within a gated community, having golf course access, or being located at higher elevations. High density residential includes townhomes, apartments and condominiums.

If we take out the 35 acres just sold, we have 5960 left. We will not assume the $400k an acre they just sold for. Lets go with $200k. That gives us a valuation of that remaining land of $1.2B or ~50% of HHC’s current market cap. If we go to a more realistic $300k (this is some of the most valuable real estate in Las Vegas) then we can get to $1.8B just for Summerlin. This means that the remaining MPC in Houston and Maryland, 60 coastal acres of some of the most valuable real estate in Hawaii, the South Street Seaport in NYC and the other operating assets of HHC are worth a paltry $700M.

I would argue the Hawaii land is the most valuable HHC has and the $390M HHC carries it at is a small fraction of its eventual worth. It will be very interesting to see what new hire David Striph does there.

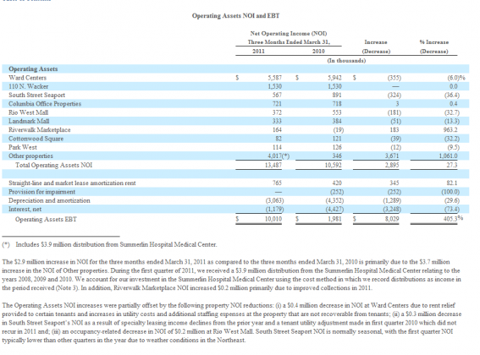

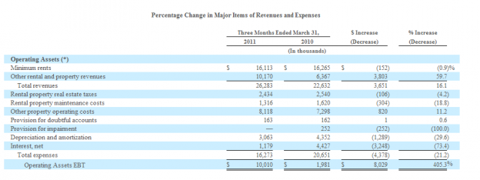

Operating assets had some declines in NOI due to seasonal items and adjustments. I can’t get worried about these as the leases are going to be reworked going forward as they expire. Many of these leases were annual in nature and signed at below market rates when HHC was in Chapter 11 with GGP. As they expire, we can expect to see rental rates increase and NOI increase also. This will unfold as the year progresses.

Further, as some of these properties are developed, we may see significant NOI declines at some of them as construction disrupts current operations. Again, I can’t get bothered by that as something that dramatically increases future NOI and property value in the long run is worth a temporary issue…right?

Press Release

DALLAS, May 10, 2011 (BUSINESS WIRE) –

The Howard Hughes Corporation (NYSE: HHC) today announced its results for the first quarter 2011.

First quarter 2011 net income was $11.5 million, excluding the $126.0 million non-cash charge relating to an increase in estimated value of the Company’s warrants, compared to net loss of $(20.5) million for the same period in the prior year. First quarter 2011 net loss was $(114.5) million inclusive of the non-cash warrant expense.

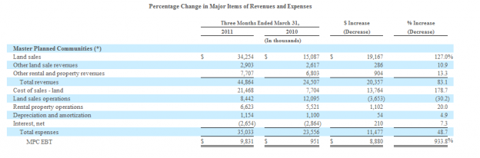

Master Planned Community land sales, including our share of the sales at The Woodlands joint venture, were $34.3 million for first quarter 2011, compared to $15.1 million for first quarter 2010.

Net operating income for our Operating Assets was $13.5 million for first quarter 2011, compared to $10.6 million for first quarter 2010.

Howard Hughes announces hiring of General Counsel, Senior Vice President to lead Maryland, Virginia and New Jersey Developments and Senior Vice President to lead Hawaii.

Net loss attributable to common stockholders was $(114.5) million, or $(3.02) per share, for the three months ended March 31, 2011 compared with $(20.5) million, or $(0.54) per share, for the three months ended March 31, 2010. Net loss attributable to common stockholders for the first quarter 2011 includes a $126.0 million, or $(3.33) per share, non-cash charge relating to the increase in estimated value of outstanding warrants. Excluding the non-cash warrant charge, net income attributable to common stockholders would have been $11.5 million, or $0.30 per share.

Master Planned Community (MPC) land sales, including our 52.5% proportionate share of The Woodlands land sales, were $34.3 million for the first quarter 2011, a $19.2 million increase over $15.1 million of land sales for the first quarter 2010. Summerlin MPC’s $14.1 million of residential and $3.6 million of commercial lot sales in the first quarter 2011 were responsible for a majority of the increase over 2010. Summerlin had no land sale revenue in the first quarter 2010 due to the weaker Las Vegas real estate market in the prior year.

Howard Hughes’ thirteen Operating Assets generated $13.5 million of net operating income (NOI) for the three months ended March 31, 2011, a $2.9 million increase over the first quarter 2010. First quarter 2011 NOI includes a $3.9 million cash distribution from the Summerlin Hospital Medical Center, a real estate affiliate accounted for using the cost method, representing our share of its profits from 2008 through 2010.

For a reconciliation of Operating Assets NOI to Operating Assets earnings before taxes (EBT,) Operating Assets EBT to GAAP-basis loss from continuing operations, and segment-basis MPC land sales revenue to GAAP-basis land sales revenue, please refer to the Supplemental Information contained in this earnings release.

During the first four months of 2011, Howard Hughes continued to build its senior management team. The Company hired Peter Riley as its General Counsel, John E. DeWolf as its Senior Vice President and head of the Maryland, New Jersey and Virginia Developments, and David Striph as its Senior Vice President and head of Hawaii. Prior to joining The Howard Hughes Corporation, these executives had years of success in their respective fields of expertise. Peter Riley is based in the Dallas, Texas headquarters, John DeWolf is based in Columbia, Maryland and David Striph is based in Honolulu, Hawaii.

David R. Weinreb, CEO of The Howard Hughes Corporation, stated, “We continue to be patient and selective in filling our senior management ranks, and are pleased to have Peter, John and David join Howard Hughes. As we move forward in developing our assets, the Company will benefit from their talent and experience.”

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.