Economic data from Japan this week was much worse than expected. Japanese GDP decreased by an annualized 1.6 percent in the third quarter, despite forecasts that it would rebound by 2.2 percent. In Germany, the economy only narrowly avoided falling into a technical recession in the third quarter, expanding at 0.1 percent, a figure that will do little to alleviate concerns surrounding the euro zone's main growth engine. Economic weakness around the world is being directly translated into the price of oil.

The short-term trajectory of oil prices will depend on a number of factors, including the growth outlook for Europe and Asia, as well as the global supply/demand dynamic. Despite the recent decline in market prices, producers in the Middle East have not yet cut back on production. With fracking having fundamentally increased output in the United States, I suspect that oil is at least ten dollars a barrel away from any kind of price support.

While gas prices at the pump have been heading lower recently, U.S. equities have been moving in the opposite direction. In this regard, the domestic economy will likely benefit from both the wealth effect of rising equity prices, as well as the consumer spending power released by the decline in gasoline prices. Lower gasoline prices act like a tax cut, leaving more money for American consumers to spend on other goods, which is likely to provide the U.S. economy with a boost as we head toward the all-important holiday shopping season.

Despite the positive backdrop for the nation's economy, the current rally in U.S. equities has still not been confirmed in the NYSE Cumulative Advance/Decline Line and investors would be well advised to monitor this closely. Historically, a persistent divergence between the Dow Jones Industrial Average and the Advance/Decline Line usually leads to a correction in equities. Whether or not the Advance/Decline Line can catch up with the increase in equity prices over the next few weeks will determine whether the current rally is sustainable.

Cheaper Gas Should Boost Holiday Spending

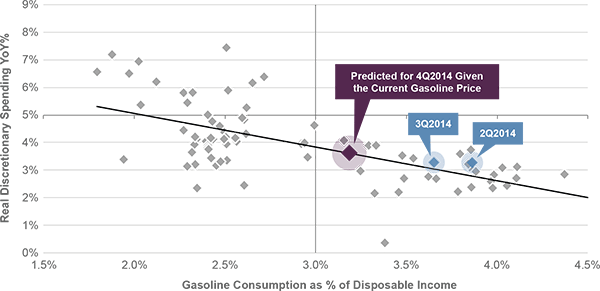

Due to plummeting oil prices, the cost of gasoline in the United States is now at the lowest level since 2010. Gasoline consumption as a share of total spending should fall in the fourth quarter due to lower prices, freeing up income for spending in other areas. Even if gasoline prices remain unchanged for the rest of the year, we project real discretionary consumption should rise by the most since the beginning of 2011, helping to spur GDP growth.

GASOLINE CONSUMPTION AND REAL DISCRETIONARY SPENDING GROWTH*

Source: Bloomberg, Haver, Guggenheim Investments. Data as of 11/17/2014. *Note: Data excludes recession periods. Discretionary spending is defined as personal consumption expenditures less food, energy, housing, and clothing expenditures.

This material is distributed for informational purposes only and should not be considered as investing advice or a recommendation of any particular security, strategy or investment product. This article contains opinions of the author but not necessarily those of Guggenheim Partners or its subsidiaries. The author's opinions are subject to change without notice. Forward looking statements, estimates, and certain information contained herein are based upon proprietary and non-proprietary research and other sources. Information contained herein has been obtained from sources believed to be reliable, but are not assured as to accuracy. No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Guggenheim Partners, LLC. ©2014, Guggenheim Partners. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information. Past performance is not indicative of future results. There is neither representation nor warranty as to the current accuracy of, nor liability for, decisions based on such information.