I introduced the "Conservative Total Return" or CTR portfolio in August. The general philosophy of this method has allowed me to cumulatively beat, since 1999, the S&P 500 by a wide margin.

Following the introduction of the CTR, I received positive feedback as well as good suggestions. I encourage recommendations and feedback, as they make me (and all of us) better investors. While I neglected to update in October, I wanted to continue to share my thoughts on the portfolio.

The Conservative Total Return Philosophy

The essence of the CTR method is to combine a strong value bias with flexibility, opportunism, and an ability to assimilate and respond to new information. Over time, as well as during periods of high valuations, dividends have become increasingly important. I believe in PEG (PE/Growth). I appreciate a broad industry thesis, and occasionally will "hedge my bets" by selecting multiple positions within an industry. I don't love labels, but in the parlance of the investor, my philosophy is generally consistent with growth-at-a-reasonable price (GARP).

I dislike rigid formulas. Stocks, like people, are unique and need to be evaluated as such (given the time and inclination). Therefore, I don't have minimum yield thresholds or put much significance in the number of consecutive years dividends have been paid (or for how may consecutive years they have been increased). A trend of a couple of years is relevant to me, what a company was doing 20 (or 30) years ago is not (to me). I respect every investor's personal strategy, and do not mean to be dismissive.

Always important to me are catalysts for appreciation, a strong sense of the stability or risk of the business (and cash flows), competitors, external influencers (weather, government, currency, etc.). My goals are to outperform the market on a risk-adjusted basis. In other words, the same things that are important to you (except my bias is total return and yours might be income).

Personal Background

Writing this article is part of the investment journey I am on, which has been enhanced since I began documenting my research and opinions through these articles. Though my writing has firms in diverse industries, they generally have shared a fondness for companies with strong value attributes, robust upside potential and an attractive-to-robust dividend.

I am several years away from retirement. Like most of us, I'd prefer more over less. That being said, I am not willing to take (what I view as) an imprudent amount of risk to get "more". Unfortunately, I am still learning about risk - and making mistakes! I am more comfortable "dating" my stocks than "marrying" them. As of this writing, for me, all of the positions listed are worth owning. Some of the speculative positions should be considered as such, and while they offer high potential returns, they also assume a good amount of risk.

The Individual Stocks

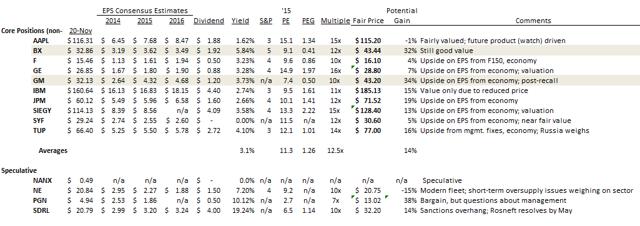

The core stocks I hold are (alphabetically): Blackstone (BX), Ford (F), General Electric (GE), General Motors (GM), International Business Machines (IBM), JPMorgan (JPM), Siemens (OTCPK:SIEGY), Synchrony Financial (SYF) and Tupperware (TUP). I added a speculative holding in Paragon Offshore (PGN).

As the above chart confirms, my positions have a strong bias toward dividends, reasonable valuation and a moderate (in most cases) PEG. Below, I will provide (very) brief comments (in the interest of space; if interested, many of the stocks have separate articles). Obviously, the qualitative statements are my opinion, not fact.

Holdings

Apple (AAPL) - AAPL had a successful launch of its new iPhone and is largely fully valued. However, there is a bias toward multiple expansion. Beyond Q1 2015, price appreciation will be largely dependent on the company's ability successfully introduce new product types (e.g. watch).

Blackstone - 5-star rated by S&P, BX is beginning to exit some successful positions, such as commercial real estate, and make new value investments. I continue to believe BX is the best and most clever private equity firm. Strong income from assets under management and a significant amount of unrealized gains. Dry powder, great leadership and a healthy (though variable) dividend.

Ford - Part of an American auto industry investment (with GM). F jumped (after it fell) recently; the launch of the new F150 seems to be going well and lower gas prices generally are more positive for US automakers. Core US market continues to expand with generous credit availability. Valuation is close to full.

General Electric - GE continues to do what it says it is going to do - focus on once again being the pre-eminent industrial conglomerate (75% of revenues by 2016). GE is beginning to get some respect. Quasi-oligopoly; benefits from a growing world economy that has seen under-investment for close to a decade. GE also boasts a nice dividend that should be materially increased later this year.

General Motors - Recall issues continue to grab headlines, but are less impactful. Products, valuation and PEG are highly compelling in 2015 and beyond. Fully/over-reserved on recall issues. Strong dividend. Lower gas prices are generally positive for US automakers.

International Business Machines - Investment thesis changed as company backed off $20/share EPS in 2015. Unfortunately, the price fell and now is cheap relative to the new earnings target. Positives of smart management, key relationships with governments and major corporations globally, and significant technology are still present. Upside if any new initiatives, such as its recent deal with Apple, "click".

JPMorgan - Banks are receiving recognition for being post-litigation and having earnings power in an increasing interest rate environment. Second best bank, behind Wells Fargo (WFC), but the best combination of value and potential. No home runs here, but should be a lower risk and consistent provider of value during economic growth. Dividend has room to grow.

Siemens - A German GE (and a European dividend aristocrat), with somewhat reduced upside due to a weaker European economy. The company should benefit from the overall growth in the global economy, and the (longer-term) recovery in Europe. Impact of Russian sanctions has been factored into the price.

Synchrony Financial - This spin-out from GE, which still holds over 80% of SYF's shares, has performed well. "Buy" ratings of $30 from almost all analysts. A focused company that will benefit from capital investment and has ability to "shine". Also, should benefit from more US consumer spending as economy improves and gas price reduction "tax cut" takes hold.

Tupperware - The company is recovering from tough third-quarter results; however, 2015 looks strong. A truly global company, with developing country expansion opportunities. TUP trades at a discount to consumer products companies. TUP has a strong, sustainable dividend which eases investor pain while waiting for management fixes to take hold.

Position Summary

All of the discussed positions share, in my opinion, the potential for price appreciation at reasonable/minimal risk. Dividends supplement the investment thesis. None of the positions can be considered "expensive" under traditional PE or PEG ratios (I use other metrics, but those two are "universal"). CTR companies generally have one or more of the following attributes: 1) an upcoming introduction and sale of a superior product, 2) an expanding or changing economy, 3) positive multiple expansion prospects or 4) just too cheap.

I appreciate any feedback on individual securities and recommendations on equities to add to the CTR.

Disclaimer: This article reflects the personal opinions of the author and should not be relied upon or used as a basis in making an investment decision. Investors should always do their own due diligence prior to making an investment decision.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.