Harvest Natural Resources (HNR)

Image: Tortue Marin Prospect

Uncertainty related to the Venezuela Share Purchase Agreement signed with Petroandina.

HNR owned 32% interest in Petrodelta (HNR energia, Venezuela) which is a joint venture or JV, forced by the Venezuelan Government in 2007. The majority owner is PDVSA, the Venezuelan state-owned oil and natural gas company, which exercises most of the control over Petrodelta's operations. PDVSA has been managing very poorly the JV, providing insufficient monetary support in capital expenditures and falling behind in payments to contractors providing services to Petrodelta (HNR is considered a contractor.)

HNR is still waiting on a $13.91 million that was declared in November 2010, and is uncertain on when or whether this or any future dividends will be paid. This is due to Petrodelta's liquidity constraints from PDVSA's lack of monetary support. Since then, no other dividends have been declared despite the fact that PDVSA declared a constant profit from 2007 to 2014. HNR also advanced cash to HNR energia and is still waiting to be reimbursed by Petrodelta. This money is indicated in the balance sheet as "long-term receivable."

In early January 2014, HNR "sold" its 32% interest in the JV to Petroandina (Pluspetrol), an Argentinean company, due to be concluded in 2 separate closing transactions.

The first part, has been concluded for an amount of $125 million, however, to be definitive, it is subject to a second closing deal for an amount of $275 millions, that should have occurred no later than June 30, 2014.

Assuming that the two deals are effectively concluded, HNR will receive net after tax respectively, $122 million and $208 million.

Here is an excerpt of the 8k filing regarding the sales.

Upon execution of the Share Purchase Agreement, HNR Energia and Buyer effected the First Closing for a cash purchase price of $125 million. The Second Closing, for a cash purchase price of $275 million, will be subject to, among other things, approval by the holders of a majority of the Company's common stock and approval by the Ministerio del Poder Popular de Petroleo y Mineria representing the Government of Venezuela (which indirectly owns the other 60% interest in Petrodelta.)

The filing 8K 12/20/2013, is subject to a lot of interpretation, and if the second closing deal cannot be done by June 30, 2014 or Venezuela approval is not given by the end of 2014, then the whole financial scheme may fall apart including the first deal. For the ones who want to study in-depth this subject, here is the deal (SEC 2.1.)

An extra 6 months can be given under certain conditions and by the buyer, which he exercised already two times.

The Share Purchase Agreement may be terminated by either HNR Energia or Buyer if the Second Closing has not occurred on or before the later of June 30, 2014 or the date that is four months after the date of the special meeting of the Company's stockholders. However, if certain conditions have not been satisfied, including obtaining approval for the sale of the Venezuelan interests from the Government of Venezuela, Buyer may extend the termination date for up to six one-month periods, but in no event will the closing date or the termination date be after December 31, 2014...

On May 7, 2014, Harvest's stockholders voted to authorize the sale of the remaining interests in Harvest Holding. Once the Harvest's stockholders authorized the sale, the Share Purchase Agreement allowed 120 days, for consummation, extension or annulation of the sale.

The last day was on September 7, 2014. Petroandina extended this final date to now December 7; however, it cannot be extended after December 31, 2014, which gives another five weeks in total for the closing of the sale or its final termination?

HNR in exchange for this right to extension was entitled to get a loan of $2 million per extended month, however not exceeding a total of $7.6 million. If the sale is terminated by either party, any outstanding loans will become due, one year from the date of the termination, at 11%.

HNR and Petroandina have already extended two times the final date, in August 28, September 29; as the result of this extension the final date is now reported in December 7, 2014. It can be pushed into another time until December 31, 2014, if needed.

HNR received $4 million from Petroandina. We will need to get confirmation of the second payment so.

It is hard to conclude anything, right now, however, these "extensions" are not considered as a good omen, in my opinion, and judging by the stock trading since June 30, it is obvious that many investors are thinking that the deal will be cancelled with dire financial consequences to Harvest. The recent 30% collapse of the oil price is not helping either.

On second thought, who can seriously think that Petroandina is willing to pay HNR twice the HNR TOTAL market cap including Gabon Dussafu, for a non-majority stake in the Venezuela JV controlled by the government, who has not paid any dividend since 2010, despite its legal obligation?

Time will tell...

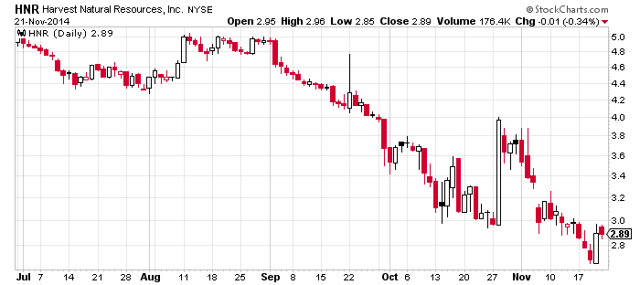

HNR Graph since June 30, 2014:

It is not clear how Harvest Natural Resources will be able to financially survive in 2015, if the deal with Petroandina is cancelled? Which is highly probable now, the first transaction will be reversed.

HNR will have to get back its 32% of the JV with Petrodelta from Petroandina, and uses the equity financing to get the cash needed to survive, which means to purchase back somehow the $125 million received for the first closing?

HNR already set up an "ATM shares" agreement of up to $75 million on September 4, 2014. HNR sold 334,563 shares for a net proceed of $1.4 million ($4.45 a share,) for the period ending on September 30, 2014. More cash will be needed during the fourth-quarter.

In the last 10Q, HNR is stating that it will need $14 million for the remainder of 2014.

It is quite possible that if the deal is cancelled, the stock price will be trading well below $2, because no one will assume any value left in the Venezuela asset after Petermina and Petroandina failures.

It is obvious that the Venezuela assets will be considered as totally worthless, and have been de facto nationalized by the Venezuelan government, since 2010. This is probably the main reason why Venezuela is not giving its consent for the deal, right now. Why changing the situation or even negotiating?

The question is now, what is a realistic HNR valuation per share, assuming a negative ending for the Venezuela SPA? Which is still on hold, as we speak, and can be concluded, of course. I did not want to add an even darker color on an already dramatic setting.

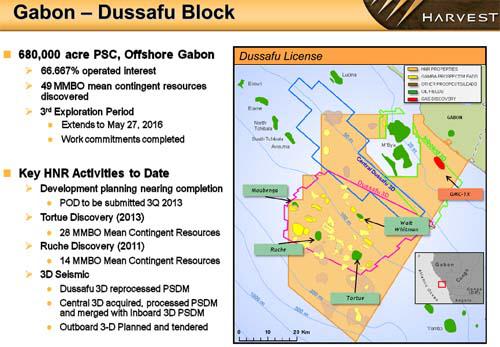

Besides, Venezuela "so called assets," the only asset left in HNR's book, worth something, is their prospect in the Dussafu Gabon.

The Indonesia Budong Budong prospect, has been totally impaired and subsequently relinquished.

Harvest advised the Indonesian government of this decision on June 4, 2014, and is now in the process of finalizing the relinquishment of the interest. As a result of these decisions, Harvest accrued a $3.2 million liability as of June 30, 2014 related to the December 5, 2012 farm-out agreement discussed above, thereby creating a total impairment expense of $7.6 million recorded in the nine months ended September 30, 2014. Harvest paid this $3.2 million liability in October 2014.

China prospect is also gone.

Harvest Natural Resources and the Gabon prospects.

The Gabon prospect is an offshore deep-water drilling exploration.

In September of 2013, HNR entered into negotiations with Vitol S.A. to sell HNR's 66.67% interest in Gabon for $137 million in cash. The net proceeds were expected to be $121.8 million after transaction costs and taxes; however HNR and Vitol S.A. were unable to reach a deal and this sale has been cancelled.

On July 21, 2014, HNR announces Declaration Of Commerciality And Exclusive Exploitation Authorization For The Dussafu Block Offshore Gabon.

Because the prospect has not any real reserve the whole presentation resumed to "potential reserves" called Contingent resources. HNR has indicated that the Dussafu prospect has 1C, 2C and 3C contingent resources.

| Class | Contingent Resources In MMBO gross | |

| Dussafu Prospect Gabon | 1C | 17.0 |

| 2C | 36.3 | |

| 3C | 70.6 |

The project has been well presented by HNR in at Enercom Oil & Gas conference on August 18, 2014; however, we are now at the end of November and no initial Tortue wells have been drilled yet.

The valuation of this prospect is very controversial, because it is hard to quantify "potential" in the oil industry, and despite some good elements the Dussafu prospect is not presenting any concrete evidence to conclude a sustaining production that can be transported and sold. Contingent resources are considered sub-commercial, however presenting a value.

HNR will need to contract a semi-submersible or a jackup for a few months at a day-rate close to $350k probably or an expense around $25 million. The development of Dussafu can be done only if Petroandina decides to go ahead with the second closing, before the end of December at the latest.

So far, we have an excellent price comparison with what has been decided between Vitol S.A and HNR in September 2013. Dussafu prospect was estimated at $137 million for a contingent resource 2C at 36.3 Mmbo gross, which means $3.8 million per Mmbo gross. Unfortunately, the price of oil went from $115 to now $80 or a discount of 30% and the same valuation today would represent around $96 million or basically around $1.95/share assuming a total share outstanding roughly around 49 million (with warrant and options.)

To illustrate how tough the market for prospects like Gabon are, at the moment; I show below an excerpt of the Vaalco Energy (EGY), last conference call. The CEO, Steve Guidry, indicated that EGY was interested in acquiring new oil prospects, however, the oil price is a big negative.

Lastly, in regards to new opportunities in West Africa. I can report that we continue to advance our analysis and understanding of a number of discovered resource acquisitions, but in light of the recent downturn in oil prices and the prospect for a longer term period of lower prices. We are being even more selective in our search to for the right opportunity.

Conclusion:

It is very hard to give any straight valuation for HNR at the moment. Depending on the completion or the termination of the Venezuela second closing sale, which is still pending, the stock price can fluctuate very widely between perhaps $6 to as low as $1.25.

I am still thinking that a deal can be agreed for the Dussafu with Vaalco Energy because of the evident synergy that the Etame Marin prospect and the Dussafu prospect will represent. The recent problem with the Ebouri field can illustrate plainly what I meant about the real reserves P1, P2 and P3 versus the "contingent resources."

Considering the high risk attached to Venezuela, I am recommending now a HOLD rating with a target price at $1.50, based solely on the Gabon Dussafu valuation.

Of course, if HNR and Petroandina can close the second deal before the end of December, then the rating will change dramatically.