Introduction

Google Finance describes this little bank as follows:

"CMS Bancorp, Inc. (CMSB) is a unitary savings and loan holding company. Community Mutual's principal business is accepting deposits from the general public and using those deposits to make residential loans, as well as commercial real estate loans and consumer loans to individuals and small businesses primarily in Westchester County and the neighboring areas in New York State"

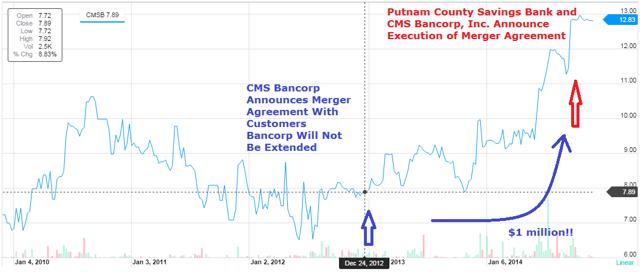

The bank became famous in SA because of an interesting article about the one million dollars the company was said to receive and that was not still in the balance sheet. (Some other websites cited the case too). The origin of this money was the termination fee that Customers Bancorp (CUBI) had to pay to CMS for the delay of regulatory approvals in their merger. One million dollars for a company which has $24 million market cap is really a big sum of money. The articles explained that the valuation of the company in case of earning the litigation could go to $15 per share.

Well, watch out! The situation has now changed - there is a new merger, and that can make you lose that million...

New Merger Agreement

On September 25, 2014, CMS signed a new merger agreement with Putnam County Savings Bank, under which the shareholders of CMS receive the right to receive a payment of $13.25 per share in cash.

In this new case, we can read the following in the agreement:

"CMS Bancorp shall pay to Putnam a termination fee of One Million Dollars ($1.0 million) (the "CMS Bancorp Termination Fee ") in the manner set forth below only if:

1. this Agreement is terminated by (A) Putnam pursuant to Sections 11.1.2 or 11.1.3, or (B) by either Putnam or CMS Bancorp pursuant to Section 11.1.5, ..."

And Section 11.1.5 reads:

"11.1.5 By either Putnam or CMS Bancorp if the shareholders of CMS Bancorp shall have voted at the CMS Bancorp Shareholders Meeting on this Agreement, the Merger and the transactions contemplated by this Agreement and such vote shall not have been sufficient to approve the Agreement, the Merger and the transactions contemplated by this Agreement;"

In conclusion, there is a termination fee of 4% the size of the bank that can make the stock price of CMS lose a lot of its value. In the following picture, we see the reaction of the stock. It has never been higher, and I cannot explain the last movement of 2014, since the company has not released financial information about this year.

Source: Yahoo Finance

If the merger does not work out, the stock price can go to $8 per share, which is a 38% loss!

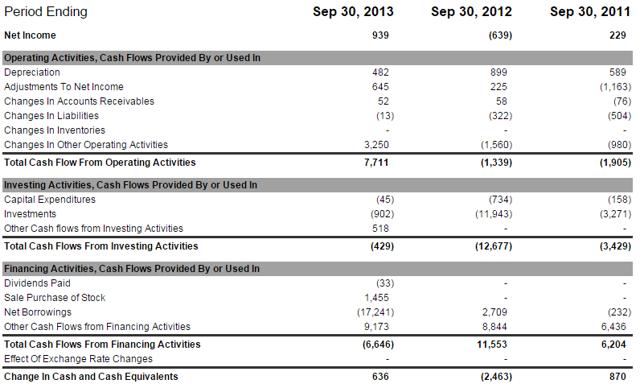

The financial results released on September 30, 2013 were actually very good, but I do not think that they can explain this last rally of the price:

Source: Yahoo Finance

In addition, under the merger agreement, the company cannot contact third-parties. I imagine that after the last merger, in the new process, the target has been offered to everyone (the company has not released the background). Therefore, I do not expect a third player.

Symmetry of the merger

The stock price discounts the time of termination (first half of 2015), the antitrust conditions, and this last rally. The spread is 3%, which I think is little if we take into account the risk involved.

Investment recommendation and conclusion

The article is mainly a warning for those who bought when the company stopped the first merger and wanted to profit that sweet million. In my opinion, it is time to sell. You have profited almost 40%, and you are taking a huge risk for only a 3% profit.

For those like me who are outside, I dislike this merger - first because of the high fee, and second because of the way that the last attempt ended. CMS changed the terms of the merger, including that $1 million termination fee, and later, stopped the transaction. That's not a nice way of doing business. Though, I do not think shorting the stock is a good idea, so if you do, watch out too! (You can lose 3% and earn 40% return)

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.