Disposable personal income and personal consumption spending rose last month, the U.S. Bureau of Economic Analysis reports. But after adjusting for inflation, the nominal rise fades to zero for income and posts only the smallest of increases for consumption. As such, today’s income and spending report is likely to give bears and bulls something to chew on.

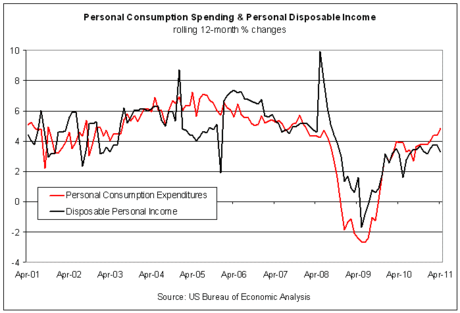

One trend that bears watching is the growing gap between spending and income when measured on a rolling 12-month percentage-change basis, as the chart below shows. This can’t last, and so it implies that either spending must slow or income must rise, or perhaps a bit of both.

Private-sector wages are, in fact, continuing to rise at a fairly strong pace in nominal terms, advancing by 0.5% last month--the fastest rate since last August. On an annual basis, private-sector wages are higher by 4.1%. That’s down slightly from the annual pace of February and March, but it’s hardly indicative of a hefty downshift.

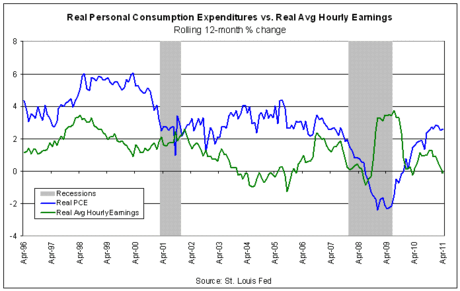

But that doesn’t let us off the hook just yet. Another way to look at income and consumption is on an inflation-adjusted (real) basis for rolling 12-month periods, which has a fairly good history of dropping clues about major turning points in the economic cycle. Unfortunately, there’s some reason for anxiety in looking at these numbers, as the second chart below indicates. In particular, note that real average hourly earnings are now slipping, if only slightly, on a year-over-year basis. The last time that happened was March 2010, just before the economy hit a rough patch. In other words, the divergence between income and spending is far more pronounced on a real basis than it is in nominal terms. Quite simply, that's not encouraging. The question is whether the trend in real wages will continue falling?

“The recovery still lacks vigor,” Aaron Smith, a senior economist at Moody’s Analytics, tells Bloomberg.“Incomes have struggled to keep pace with inflation recently.”