If you want to increase your portfolio’s exposure to high growth stocks while decreasing its market risk, then this may be interesting starting point for your own analysis.

To construct this list we looked for stocks with the following characteristics:

- Beta between 0 and 1

- 5-year EPS growth rate > 25%

- Experienced mutual fund buying over the last two quarters

Interactive Chart: Press Play to compare changes in analyst ratings over the last two years for the top six stocks mentioned below. Analyst ratings sourced from Zacks Investment Research.

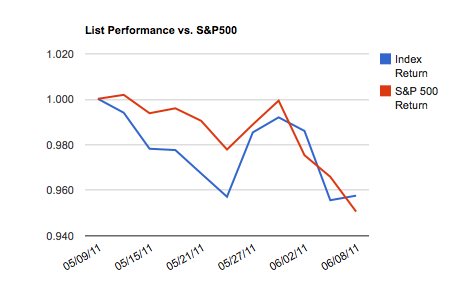

We also created a price-weighted index of the stocks mentioned below, and monitored the performance of the list relative to the S&P 500 index over the last month. To access a complete analysis of this list's recent performance, click here.

Which of these names do you find to be a better fit for your portfolio?

1. Alaska Communications Systems Group Inc. (ALSK): Telecom Services Industry. Market cap of $393.88M. Beta at 0.76. 5-yr expected growth rate at 31.9%. On a net basis, mutual funds bought 701.3K over the current quarter and 450.4K shares during the previous quarter. The stock is a short squeeze candidate, with a short float at 16.77% (equivalent to 11.85 days of average volume). The stock has gained 15.34% over the last year.

2. AeroVironment, Inc. (AVAV): Aerospace/Defense Products & Services Industry. Market cap of $640.79M. Beta at 0.24. 5-yr expected growth rate at 38.13%. On a net basis, mutual funds bought 212.5K over the current quarter and 246.4K shares during the previous quarter. The stock is a short squeeze candidate, with a short float at 8.93% (equivalent to 5.75 days of average volume). The stock has gained 18.37% over the last year.

3. Companhia Brasileira de Distribuicao (CBD): Grocery Stores Industry. Market cap of $11.03B. Beta at 0.73. 5-yr expected growth rate at 29.77%. On a net basis, mutual funds bought 5.6M over the current quarter and 3.7M shares during the previous quarter. The stock has gained 39.54% over the last year.

4. CEVA Inc. (CEVA): Semiconductor Industry. Market cap of $720.69M. Beta at 0.93. 5-yr expected growth rate at 30.57%. On a net basis, mutual funds bought 429.8K over the current quarter and 396.1K shares during the previous quarter. It's been a rough couple of days for the stock, losing 8.88% over the last week.

5. Corcept Therapeutics Inc. (CORT): Biotechnology Industry. Market cap of $369.47M. Beta at 0.8. 5-yr expected growth rate at 30.0%. On a net basis, mutual funds bought 1.9M over the current quarter and 338.5K shares during the previous quarter. It's been a rough couple of days for the stock, losing 10.93% over the last week.

6. CARBO Ceramics Inc. (CRR): Oil & Gas Equipment & Services Industry. Market cap of $3.36B. Beta at 0.56. 5-yr expected growth rate at 29.1%. On a net basis, mutual funds bought 79.5K over the current quarter and 858.4K shares during the previous quarter. The stock has gained 112.01% over the last year.

7. EOG Resources, Inc. (EOG): Independent Oil & Gas Industry. Market cap of $29.0B. Beta at 0.87. 5-yr expected growth rate at 40.24%. On a net basis, mutual funds bought 6.4M over the current quarter and 2.5M shares during the previous quarter. The stock has gained 3.18% over the last year.

8. Franklin Electric Co. Inc. (FELE): Industrial Electrical Equipment Industry. Market cap of $990.64M. Beta at 0.87. 5-yr expected growth rate at 40.0%. On a net basis, mutual funds bought 306.4K over the current quarter and 595.3K shares during the previous quarter. The stock has gained 56.81% over the last year.

9. Frontier Oil Corp. (FTO): Oil & Gas Refining & Marketing Industry. Market cap of $3.01B. Beta at 0.95. 5-yr expected growth rate at 31.4%. On a net basis, mutual funds bought 2.4M over the current quarter and 5.1M shares during the previous quarter. After a solid performance over the last year, FTO has pulled back during recent sessions. The stock has gained 116.93% over the last year.

10. Harmony Gold Mining Co. Ltd. (HMY): Gold Industry. Market cap of $5.84B. Beta at 0.22. 5-yr expected growth rate at 76.1%. On a net basis, mutual funds bought 2.8M over the current quarter and 3.9M shares during the previous quarter. The stock has gained 39.75% over the last year.

11. Heartware International Inc. (HTWR): Medical Instruments & Supplies Industry. Market cap of $944.89M. Beta at 0.91. 5-yr expected growth rate at 64.5%. On a net basis, mutual funds bought 532.6K over the current quarter and 583.9K shares during the previous quarter. The stock is a short squeeze candidate, with a short float at 10.56% (equivalent to 8.71 days of average volume). It's been a rough couple of days for the stock, losing 6.82% over the last week.

12. KIT digital, Inc. (KITD): Entertainment Industry. Market cap of $468.50M. Beta at 0.93. 5-yr expected growth rate at 31.13%. On a net basis, mutual funds bought 1.6M over the current quarter and 1.8M shares during the previous quarter. The stock is a short squeeze candidate, with a short float at 19.24% (equivalent to 16.95 days of average volume). The stock has gained 27.5% over the last year.

13. Pacific Capital Bancorp (PCBC): Regional Banks Industry. Market cap of $999.83M. Beta at 0.92. 5-yr expected growth rate at 46.5%. On a net basis, mutual funds bought 298.8K over the current quarter and 81.8K shares during the previous quarter. The stock is a short squeeze candidate, with a short float at 7.86% (equivalent to 7.31 days of average volume). The stock has lost 76.62% over the last year.

14. MetroPCS Communications, Inc. (PCS): Wireless Communications Industry. Market cap of $6.07B. Beta at 0.7. 5-yr expected growth rate at 26.39%. On a net basis, mutual funds bought 23.3M over the current quarter and 1.9M shares during the previous quarter. The stock has gained 104.1% over the last year.

15. Resolute Energy Corporation (REN): Independent Oil & Gas Industry. Market cap of $989.54M. Beta at 0.33. 5-yr expected growth rate at 43.0%. On a net basis, mutual funds bought 6.0M over the current quarter and 2.2M shares during the previous quarter. The stock is a short squeeze candidate, with a short float at 11.16% (equivalent to 15.38 days of average volume). It's been a rough couple of days for the stock, losing 6.02% over the last week.

16. Salix Pharmaceuticals Ltd. (SLXP): Drugs Industry. Market cap of $2.19B. Beta at 0.7. 5-yr expected growth rate at 28.3%. On a net basis, mutual funds bought 888.5K over the current quarter and 1.3M shares during the previous quarter. The stock is a short squeeze candidate, with a short float at 10.04% (equivalent to 6.1 days of average volume). It's been a rough couple of days for the stock, losing 6.37% over the last week.

17. Sequenom Inc. (SQNM): Biotechnology Industry. Market cap of $825.17M. Beta at 0.29. 5-yr expected growth rate at 30.0%. On a net basis, mutual funds bought 1.7M over the current quarter and 2.0M shares during the previous quarter. The stock is a short squeeze candidate, with a short float at 18.63% (equivalent to 8.3 days of average volume). The stock has had a couple of great days, gaining 5.04% over the last week.

18. Seaspan Corp. (SSW): Shipping Industry. Market cap of $1.08B. Beta at 0.97. 5-yr expected growth rate at 29.5%. On a net basis, mutual funds bought 95.0K over the current quarter and 254.5K shares during the previous quarter. It's been a rough couple of days for the stock, losing 9.04% over the last week.

19. SXC Health Solutions, Corp. (SXCI): Application Software Industry. Market cap of $3.52B. Beta at 0.8. 5-yr expected growth rate at 27.96%. On a net basis, mutual funds bought 1.4M over the current quarter and 1.5M shares during the previous quarter. The stock has gained 57.49% over the last year.

20. Toyota Motor Corp. (TM): Auto Manufacturers Industry. Market cap of $140.63B. Beta at 0.69. 5-yr expected growth rate at 38.6%. On a net basis, mutual funds bought 592.7K over the current quarter and 286.7K shares during the previous quarter. The stock has gained 15.9% over the last year.

21. TIM Participacoes S.A. (TSU): Wireless Communications Industry. Market cap of $12.36B. Beta at 0.95. 5-yr expected growth rate at 30.37%. On a net basis, mutual funds bought 2.6M over the current quarter and 1.7M shares during the previous quarter. The stock has gained 94.7% over the last year.

22. Zep, Inc. (ZEP): Cleaning Products Industry. Market cap of $383.51M. Beta at 0.95. 5-yr expected growth rate at 29.8%. On a net basis, mutual funds bought 307.0K over the current quarter and 931.0K shares during the previous quarter. It's been a rough couple of days for the stock, losing 6.17% over the last week.

*Data sourced from Fidelity and Finviz.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.