There is a growing number of commentators who are suggesting on no uncertain terms that the U.S. and world economy is contracting at a significant pace and that the next big move for the S&P500 is to the downside. I disagree with the assertion that the world economy is slowing down materially because economically sensitive markets which usually lead downturns remain robust. These economically sensitive markets are:

- credit markets

- emerging market small cap equities

- industrial metals

I will discuss each of these in turn.

Credit markets remain in a healthy state indicating that there is no contraction in liquidity. If we look at various spreads, from 2yr swaps, to the TED, spread, and yields of emerging market bonds relative to investment grade in the U.S., there is certainly no out of character behavior, certainly nothing that is suggestive of increasing financial stress. The graph below is the TRACE Distressed Issuers Traded Index. It is an index of the number of companies who have bonds trading in a "distressed" state (more than 1000 bpts above yields on U.S. treasuries).

If credit conditions were deteriorating then the index above should be trading at a multi-week high by now.

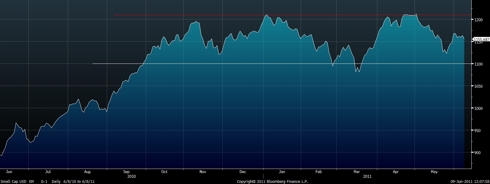

Emerging market small cap equities are perhaps the most sensitive equities to changes in world growth. Having traded equities in a number of emerging markets over the last 15 years I know it is no fun trying to get out of small cap issues when economic growth is contracting. This is why emerging markets tend to sell-off well before the press start talking about economic growth contracting. Yet emerging market small caps remain well above levels they were trading at a few weeks ago let alone the lows of the Fukushima crisis.

MSCI Emerging Markets Small Cap Index

Now forgive me if I am missing something but if the term "slow-down" is on everyone's minds right now then surely if there really was a significant slowdown then we would expect to see economic growth sensitive industrial metals clearly trading at multi-week lows. But this is not the case. The Journal of Commerce Industrial Metals Index (all six base metals plus steel) is actually trading higher than where it was a few weeks ago and is essentially unchanged over the last couple of months:

JOC Industrial Metals Index

There are simply too many inconsistencies to the argument that the world or U.S. economy is slowing down to any significant degree. I think that the contraction we have seen in a number of economic stats over the last few weeks (ISM Manufacturing, Jobs etc) is due to one off events like the Fukushima crisis (where Japan essentially closed down for about 10 days). Accordingly we will see surprises to the upside over the coming weeks. I think any weakness in equities will short lived and that one should see it as a buying opportunity.

Disclosure: I am long DIA.