Two stocks which are active Nasdaq movers and shakers are Apple (AAPL) and Netflix (NFLX). Because the stocks are so volatile and highly active in the pre-market, market day, and after hour markets, the option trader can benefit on the implied volatility in the option markets. The option trader can sell covered calls for option income.

Apple Inc.

Business Model - Apple offers customers the ability to download apps, download iTunes, purchase iPads, purchase iTouches, and purchase Mac Notebooks. The ecosystem is incredible and growing quarter-by-quarter.

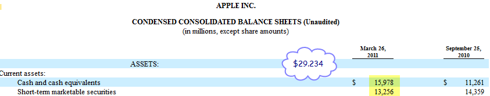

Balance Sheet - The company has zero debt, and approximately $31 dollars in net cash per share.

Click to enlarge

Valuation - The company is trading at a 14x P/E multiple once the $31-per share cash is backed out. This is a reasonable valuation.

Competitors - Google (GOOG), HP (HPQ), Motorola (MMI), Microsoft (MSFT) and Nokia (NOK) all want access to the space. It's profitable pure and simple. Apple has first mover advantage and has an ecosystem that continues to develop.

Option Trades - My strategy is to sell fairly short-in-duration out-of-the-money (OTM) calls. This provides immediate time decay on the calls. In addition, the OTM covered call sales provide a lower cost basis if the stock does take a nose dive. I prefer to set a 7-10% stop loss on the equity trade, and buy back the covered call for a slight profit.

There is a strong neutral sentiment, albeit a tight watch on the 200-day moving average, on Apple equity's valuation. The stock continues to hold its own. I am trading on the presumption AAPL stays in a reasonable trading range and I can make money on option income. I want to be on the opposite site of any such 200-day moving average break sentiment as possible. Apple represents the market leadership.

My proposed Apple trade is the following:

- Buy 100-Apple shares at $331.23.

- Sell the Aug 2011 $350 Covered Call, symbol AAPL110820C00350000 for $6.15 or $615.

- My cost outlay is ($33,123 - $615 = $32,508).

- My cut loss on AAPL is 9% of $33,123, or $30,142. I will close the position and also buy back the Aug 2011 $350 Covered Call if this $30,142 is breached. I will make a slight profit on the AAPL covered call closure.

- My cost break-even is ($33,123 - $615 = $32,508). As long as I can remain in this tight range by the Aug 2011 covered call expiration, then I will sell another covered call - ideally at a higher strike price - to reduce my net cost basis between AAPL common and covered call gains.

Netflix, Inc.

Business Model - Netflix offers 23 million subscribers the ability to watch movies in various electronic formats. Customers can subscribe to download a movie or to receive movies on DVD in the mail. The business model is a reoccurring one where customers pay between $5 to $60 per month for their choice of movie options.

Balance Sheet - Netflix has $200 million in long-term debt, and $342-million in cash holdings.

Valuation - Netflix is anticipated to earn $4.40 per share for calendar year 2011. Netflix's earnings-per-share are expected to grow to $5.50 in 2012. Presently Netlfix is trading at a 58-P/E multiple.

The EPS growing between 2011 and 2012 is an estimated 25%. The stock trades at $255.The market cap is approximately $12.50-billion.

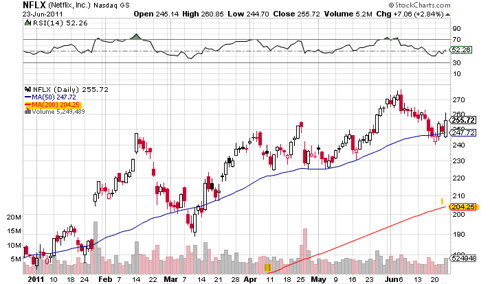

I am watching the 50-day moving average at $247.72 and 200-day moving average at $204.25. I attempt to set mental stop-loss gaps based upon my own risk tolerance, but I do track the 50/200 days moving averages as everyone else does.

Click to enlarge

Competitors - The business model is a very desirable one in which customers are opting to stay in and watch entertainment. In a difficult economy, staying in and watching movies is a cheaper substitute than other forms of entertainment.

Amazon (AMZN) has entered the space with "Amazon Instant Video." DISH Network (DISH) and Blockbuster have teamed up to provide three free months of DVD rentals. Netflix, despite intense competition, remains the industry's leader in simplicity and providing customers what they demand.

Option Trades - My strategy is to sell fairly short-in-duration out-of-the-money (OTM) calls. This provides immediate time decay on the calls. In addition, the OTM covered call sales provide a lower cost basis if the stock does take a nose dive. I prefer to set a 7-10% stop loss on the equity trade, and buy back the covered call for a slight profit.

There is a strong neutral sentiment, albeit a tight watch on the 200-day moving average, on Netflix's valuation. The stock continues to hold its own. I am trading on the presumption Netflix stays in a reasonable trading range and I can make money on option income. I want to be on the opposite site of any such 200-day moving average break sentiment as possible.

My proposed Netlfix trade is the following:

- Buy 100-Netflix shares at $25,500.

- Sell the Aug 2011 $275 Covered Call, symbol NFLX110820C00275000 for $10.30 or $1,030.

- My cost outlay is ($25,500 - $1,030 = $24,470).

- My cut loss on NFLX is 9% of $25,500, or $22,505. I will close the position and also buy back the Aug 2011 $275 Covered Call if this $225.05 is breached.

- My cost break-even is ($25,500 - $1,030 = $24,470). As long as I can remain in this tight range by the Aug 2011 covered call expiration, then I will sell another covered call - ideally at a higher strike price - to reduce my net cost basis between NFLX common and covered call gains.

Disclosure: I am long AAPL.