HAL Trust, HAL Holding, HAL Investments

HAL Holding N.V is a Curaçao based international investment company led by the Van der Vorm family, with HAL Investments B.V. as its European investment subsidiary and based in Rotterdam. All shares of HAL Holding are held by HAL Trust and form the Trust's entire assets. The shares of the Trust are admitted to the official listing of Euronext Amsterdam N.V. (XAMS-HAL) and OTC traded on U.S. markets under symbol HALFF (OTCPK:HALFF)

The history of HAL dates back to April 18, 1873, when the Nederlandsch-Amerikaansche Stoomvaart-Maatschappij (N.A.S.M.) was founded in Rotterdam, the Netherlands. The company continued its activities under various names and is now operating as HAL Holding N.V.

HAL's strategy is focused on acquiring significant shareholdings in companies, with the objective of increasing long-term shareholder value. When selecting investment candidates HAL emphasizes, in addition to investment and return criteria, the potential of playing an active role as a shareholder and/or board member. HAL does not confine itself to particular industries. Given the emphasis on the longer term, HAL does not have a pre-determined investment horizon.

NAV Third Quarter trading update

The net asset value based on the market value of the quoted associates and the liquid portfolio and on the book value of the unquoted companies, increased by $365 million (€304, EUR/USD exchange rate 1.2) during the first nine months of 2014. Taking into account the cash portion of the 2013 dividend ($22 million) and the net purchase of treasury shares ($11 million), the net asset value increased from $8.791 million ($122.86 per share) on December 31, 2013 to $9,124 million ($123.29 per share) on September 30, 2014.

The net asset value does not include the positive difference between estimated value and book value of the unquoted companies. This difference is calculated annually and, based on the principles and assumptions set out in the 2013 annual report, amounted to $844 million ($11.78 per share) on December 31, 2013.

During the period from September 30, 2014 through November 14, 2014, the value of the ownership interests in quoted associates and the liquid portfolio decreased by € 264 million ($3.56 per share).

H1 2014

Net income of HAL Holding N.V., attributable to the shareholders, for the first six months of 2014 amounted to $334 million ($4.64 per share) compared to $271 million ($3.78 per share) for the same period last year, representing an increase of $63 million ($0.86 per share). This increase was primarily due to higher results from the optical retail and other unquoted companies. The comparative figures for 2013 were restated due to the application of IFRS 10.

During the period from June 30, 2014 through August 22, 2014, the value of the ownership interests in quoted companies and the liquid portfolio increased by $144 million ($1.94 per share).

Liquid portfolio and net debt

The corporate liquid portfolio at the end of June 2014 amounted to $504 million (December 31, 2013: $361 million). The consolidated pro forma net debt (excluding the net debt of Koninklijke Vopak N.V. and Safilo Group S.p.A.) as of June 30, 2014 as per the pro forma consolidated balance sheet on page 28 (defined as short-term and long-term bank debt less cash and cash equivalents and marketable securities) amounted to $674 million (December 31, 2013: $784 million). The decrease in consolidated net debt is primarily due to dividends received, the sale of real estate and cash flow from the optical retail activities.

As of June 30, 2014, the corporate liquid portfolio consisted for 79 % of cash balances amounting to $398 million (December 31, 2013: $263 million) and for 21% of equities for an amount of $106 million (December 31, 2013: $98 million). The corporate liquid portfolio provided a total return of 1.6% during the first half of 2014 compared to 8.6% for the same period last year.

Composition Executive and Supervisory Board

On August 6, 2014 proposed changes in the composition of the Executive and Supervisory Board were announced. Mr. van der Vorm decided to step down as Chairman of the Executive Board effective September 30, 2014 and was succeeded by Mr. Groot, member of the Executive Board. Mr. Van der Vorm was appointed as member of the Supervisory Board effective October 1, 2014.

Quoted companies

At the end of September, the stock market value of HAL's interests in quoted companies Koninklijke Vopak N.V. (OTCPK:VOPKF), Koninklijke Boskalis Westminster N.V. (KKWFF), Safilo Group S.p.A. (OTCPK:SAFLF) and SBM Offshore N.V. (OTCPK:SBFFF) amounted to $6.24 billion compared with $6.12 billion at the end of 2013. This increase is primarily the net result of a higher share price of Boskalis and a lower share price of Safilo.

The ownership interest in SBM Offshore N.V. has since increased to 15.01%. At the end of June 2014 this ownership interest amounted to 13.43%. The ownership interest in Koninklijke Vopak N.V. recently increased to 48.15%, reported January 7, 2015. Ownership interest in Koninklijke Boskalis Westminster N.V. is 34.28% and ownership interest in Safilo Group S.p.A. stands at 41.68%.

Prospects

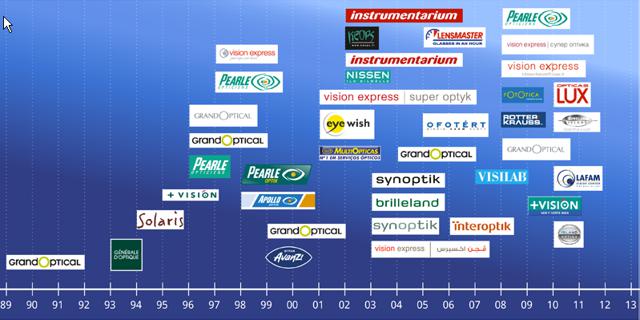

In August the announcement was made that HAL was preparing an initial public offering (IPO) and listing of GrandVision shares on Euronext Amsterdam and that this IPO might take place, at the earliest, by the end of November 2014. The preparation phase for the IPO has been substantially completed and it's now expected that the IPO will take place in 2015. The intended IPO will consist of a secondary offering of 20-25% of the GrandVision shares.

In view of the fact that a significant part of the Company's net income is determined by the results of the quoted associates and the timing of potential investments and divestitures, no expectation as to the net income for 2014 was expressed.

Acquisitions optical retail and other unquoted companies, real estate divestiture

During the first half year of 2014 GrandVision acquired three optical retail chains in Colombia, the United Kingdom and Germany. The chains operated a total of 156 stores and had, in aggregate, 2013 revenues of $39.6 million. In July, Grandvision signed an agreement to acquire 62% of the shares including an option for the remaining 38% of the Peruvian optical retail chain Topsa. The company has approximately 1,030 employees and reported 2013 net sales of $32.4 million.

In April, HAL acquired full ownership of Gispen Group B.V. Before the transaction HAL had a 49% ownership interest. Gispen, based in Culemborg (the Netherlands), produces and sells office furniture. Revenues for 2013 amounted to $68.4 million.

In June, HAL participated for $15.4 million in a share issue by PontMeyer N.V. HAL's ownership interest in PontMeyer N.V. increased from 68% to 80%.

In April, HAL sold an office building in Seattle for $60 million (€ 50 million), realizing an after tax capital gain of $7.2 million.

On December 10, 2014 GrandVision reached an agreement to acquire 100% of the shares in Angelo Randazzo S.r.l. Randazzo operates 101 optical retail stores in Italy under the brand name "Optissimo" and 89 points of sale in supermarkets. Randazzo reported 2013 revenues of € 105 million and has approximately 1,000 employees. GrandVision already operates 183 optical retail stores in Italy under the brand name "Avanzi", and 30 sunglass stores under the brand name "Solaris".

Optical retail

Revenues from the optical retail companies for the first nine months of 2014 amounted to $2,568 million (2013, restated: € 2,419 million) representing an increase of $149 million (6.2%). Excluding the effect of acquisitions ($45.6 million) and currency exchange differences (negative $33.6 million), revenues increased by $136.8 million (5.7%). Revenues for the third quarter amounted to $881 million (2013, restated: $815 million).

The same store sales increased by 4.0% during the first nine months compared with the same period last year (2013 restated: 1.9 %). Same store sales for the third quarter increased by 4.2% (2013 restated 2.9%). The operating income of the optical retail companies (earnings before interest, exceptional and non recurring items, taxes and amortization of intangible assets but including amortization of software) for the first nine months amounted to € 318 million (2013, restated: € 268 million). The operating income for the third quarter amounted to $114 million (2013, restated: $104 million).

Revenues and operating income for 2013 of the optical retail companies were restated, due to the application of IFRS 10. The positive effect of the restatement on revenues for the first nine months 2013 was € 128 million and on operating income $18 million.

Other unquoted companies

Revenues from the other unquoted subsidiaries for the first nine months amounted to $1,470 million (2013, restated: $1,387 million), representing an increase of $83 million (6.0%). Excluding the effect of acquisitions and divestitures ($26.4 million) and currency exchange differences (negative $4.8 million), revenues from the other unquoted subsidiaries increased by $61.2 million (4.4%). This increase is primarily due to higher sales at AudioNova International B.V. and PontMeyer N.V. Revenues for the third quarter amounted to € 496 million (2013, restated: € 458 million).

Revenues for 2013 of the other unquoted companies were restated due to the application of IFRS 10. The negative effect of the restatement on revenues for the first nine months 2013 was $6 million. There was no effect on operating income.

Financial calendar 2015

Publication of preliminary net asset value January 22, 2015

Publication of 2014 annual results March 31, 2015

Shareholders meeting HAL Trust and interim statement May 18, 2015

Publication of 2015 half year results August 27, 2015

Interim statement November 18, 2015

Stock performance

Dividend

On May 16, 2014 the proposal to distribute a yearly dividend of $4.92 (€ 4.10) (2013: $4.68, € 3.90) per HAL share was approved. In case of payment in shares, shareholders received one new Trust share per 26.7 dividend rights of shares. Both the cash and stock dividend were payable June 19, 2014. Shareholders representing 6% of the outstanding HAL Trust shares elected for payment of the 2013 dividend in cash. Current dividend yield stands at 3.3%, based on a share price of $150 (€125)

Value proposition

U.S. and international admirers of brilliant investment strategists might do well to look across the pond on this occasion, as HAL Trust led by the Van der Vorm family has been outperforming Buffett's investment vehicle Berkshire Hathaway (BRK.A) (BRK.B) for the past quarter century.

Since Nico van der Vorm sold the cruise activities of the Holland America Line (CCL) in the late eighties for $840 million and used the proceeds to start a listed investment company, HAL has realized an average annual return (including dividends) of 17.8%. Investors in Berkshire Hathaway had to 'make do' with an increase of 13.7% during the same period.

HAL has shown almost flawless execution in its investment strategy all these years. A share of HAL Trust currently costs approximately € 125, giving the company a market value of $11.4 billion, and HAL has shown itself to be conservative in the valuation of its interests in unquoted companies.

Hal Trust and Berkshire Hathaway show more similarities. Both companies invest only for the very long term, often decades, and always choose so-called value plays. Acquiring companies that generate a lot of free cash flow with proven business models, often when priced at crisis lows relative to underlying assets.

The approximately $1 billion that HAL will net in 2015 from GrandVision, on the books for less than $2.4 billion, when it will IPO a quarter of its optical retailer will surely be put to good use in the usual aggressive and opportunistic manner that we have come to know from HAL.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.