While the financial market party has been gaining momentum in the U.S., Europe has been busy attending an economic funeral. Mario Draghi, the European Central Bank President is trying to reverse the somber deflationary mood, and therefore has sent out 1.1 trillion euros worth of quantitative easing (QE) invitations to investors with the hope of getting the eurozone party started.

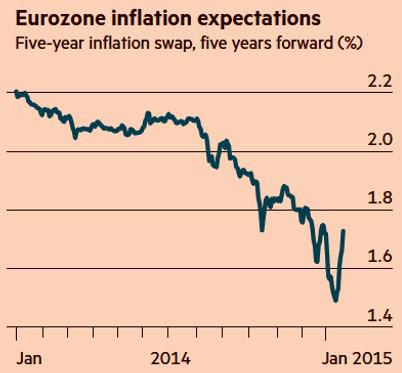

Draghi and the stubborn party-poopers sitting on the sidelines have continually been skeptical of the creative monetary punch-spiking policies initially implemented by U.S. Federal Reserve Chairman Ben Bernanke (and continued by his fellow dovish successor Janet Yellen). With the sluggish deflationary European pity party (see FT chart below) persisting for the last six years, investors are in dire need for a new tool to lighten up the dead party and Draghi has obliged with the solution… "QE beer goggles." For those not familiar with the term "beer goggles," these are the vision devices that people put on to make a party more enjoyable with the help of excessive consumption of beer, alcohol, or in this case, QE.

Source: The Financial Times

Although here in the U.S. "QE beer goggles" have been removed via QE expiration last year, nevertheless the party has endured for six consecutive years. Even an economy posting such figures as an 11-year high in GDP growth (+5.0%); declining unemployment (5.6% from a cycle peak of 10.0%); and stimulative effects from declining oil/commodity prices have not resulted in the cops coming to break up the party. It's difficult for a U.S. investor to admit an accelerating economy, improving job additions, recovering housing market, with stronger consumer balance sheet would cause U.S. 10-Year Treasury Note yields to plummet from 3.04% at the beginning of 2014 to 1.82% today. But in reality, this is exactly what happened.

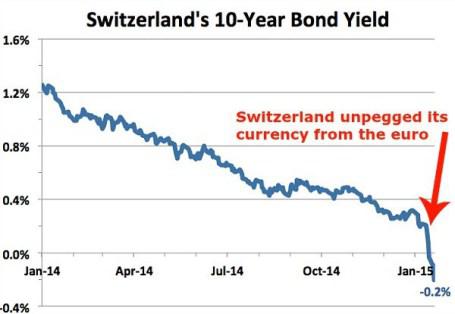

To confound views on traditional modern economics, we are seeing negative 10-year rates on Swiss Treasury Bonds (see chart below). In other words, investors are paying -1% to the Swiss government to park their money. A similar strategy could be replicated with $100 by simply burning a $1 bill and putting the remaining $99 under a mattress. Better yet, why not just pay me to hold your money, I will place your money under my guarded mattress and only charge you half price!

Does QE Work?

Debate will likely persist forever as it relates to the effectiveness of QE in the U.S. On the half glass empty side of the ledger, GDP growth has only averaged 2-3% during the recovery; the improvement in the jobs upturn is arguably the slowest since World War II; and real wages have declined significantly. On the half glass full side, however, the economy has improved substantially (e.g., GDP, unemployment, consumer balance sheets, housing, etc.), and stocks have more than doubled in value since the start of QE1 at the end of 2008. Is it possible that the series of QE policies added no value, or we could have had a stronger recovery without QE? Sure, anyone can make that case, but the fact remains, the QE training wheels have officially come off the economy and Armageddon has still yet to materialize.

I expect the same results from the implementation of QE in Europe. QE is by no means an elixir or panacea. I anticipate minimal direct and tangible economic benefits from Draghi's 1+ trillion euro QE bazooka; however, the psychological confidence building impacts and currency depreciating effects are likely to have a modest indirect value to the eurozone and global financial markets overall. The downside for these unsustainable ultra-low rates is potential excessive leverage from easy credit, asset bubbles, and long-term inflation. Certainly, there may be small pockets of these excesses; however, the scars and regulations associated with the 2008-2009 financial crisis have delayed the "hangover" arrival of these risk possibilities on a broader basis. Therefore, until the party ends or the cops come to break up the fun, you may want to enjoy the gift provided by Mario Draghi to global investors… and strap on the "QE beer goggles."

Disclosure: Sidoxia Capital Management ((SCM)) and some of its clients own a range of positions, including positions in certain exchange traded funds positions (JNK, HYG), and BAC, but at the time of publishing SCM had no direct position in any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.