The major banks reported already without any energy loan exposure popping up into the general discussion. Along comes Zions Bancorporation (NASDAQ:ZION) and the bank brings the issue to the forefront with a Q4 credit hit from the sector.

Zions is a regional bank located in Utah with roughly $40 billion of loans and deposits of $47.8 billion at year end. The bank trades at a relatively expensive 15x forwarding earnings making the stock fully priced if more non-performing loans pop up.

Q4 Results

The Q4 results were disappointing with EPS of $0.36, compared to analyst estimates of $0.42. Revenue of $560 million was mostly inline with expectations. The results follow the general trend of large banks missing analyst estimates.

Net interest margin grew 5 basis points to 3.25% from 3.20% in the prior quarter. Net interest income grew to $430 million mostly from a reduction in interest expenses. Loans held for investment grew by $234 million to over $40 billion with growth from Texas and Utah for industrial and construction real estate loans.

Credit quality remained solid with net charge-offs of only 0.17% annualized on average loans, but this could be the low point of the cycle based on the energy sector. Despite the energy additions, nonperforming lending-assets declined 3% to $326 million in Q4, from $335 million in the prior quarter.

Energy Exposure

The biggest concern for banks located in some of the oil hotbeds is the exposure to energy loans. Zions caught our attention by already having non-performing loans in the energy sector at year end. The regional bank reported that it had $17 million in non-performing loans at year end amounting to 0.5% of loans. The number is a very small fraction of the outstanding loans, but it is a troubling occurrence with the major impact of lower oil prices not expected until 2015.

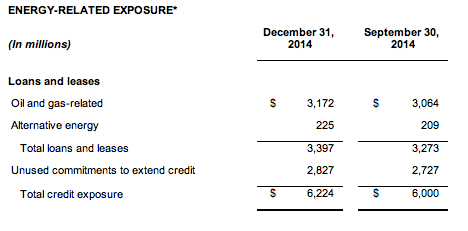

According to Zions, the bank has outstanding loan exposure in the energy sector of $3.2 billion with the potential for credit limits to increase the balance to over $6 billion. Though the bank is currently looking to adjust down the commitments in unused credit lines.

Source: Zions Q414 press release

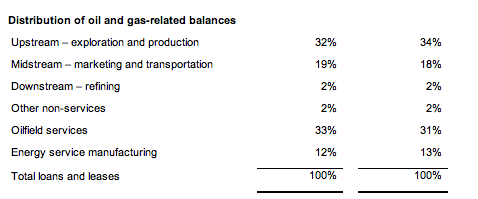

With over $40 billion in total loans, the energy exposure amounts to less than 8% of the total loan portfolio. The biggest concerning part of the equation is that roughly 65% of the exposure is into the exploration and production and oilfield services sectors. Both of these groups face the pressure of cutbacks from lower drilling and less revenue.

Source: Zions Q414 press release

The exposure is clearly in the wrong sectors, but the company does claim that historically the company has avoided large scale net charge-offs from the sector. Though that might depend highly on whether oil prices rebound similar to after the 2008-2009 pricing collapse.

Takeaway

At 15x 2015 earnings estimates, Zions was already at the high-end of the banking sector valuations with the large banks offering serious discounts to this multiple. While the energy sector exposure doesn't provide a major concern with the level below 8% of the total loan portfolio, it does provide a major headwind to the stock trading up from these levels.

Considering the abundance of information provided by the press release, Zions is worth placing on a watch list for bank stocks in order to track the energy sector impacts on loan losses for the sector.