Anyone can read an earnings press release and summarize, or make general commentary on, quarterly results. Sometimes, this is enough. Sometimes, though, the tone and the carefully preened metrics are misleading. In the case of McCormick (NYSE:MKC), we think that investors need to dig a little deeper than the press release to understand what's really going on.

In the following, we outline six things that we think the market should be gleaning from MKC's 4Q14 earnings.

1. EPS beat is misleading

While everyone likes an EPS "beat," not all beats are created equal. In the case of MKC's 4Q14 statements, we encounter a low-quality beat (sort of like a "garbage goal"). Why do we say that it's low quality? Because it's meaningless, if not misleading. The beat was driven primarily by a ~2% lower tax rate than was estimated.

While management's strategic over-estimation of the tax rate is neither uncommon nor surprising, what should be disconcerting is that this method of achieving an EPS beat is unsustainable. And while misleading numbers are often a relatively benign part of the accounting game, they become problematic when they obscure important indicators of a company's health. In MKC's case, we were expecting a stronger operating profit margin by ~70 bps and with revenue of $1.195B (the real result fell ~$20M short). We were disappointed.

Looking at the EPS "beat" alone doesn't tell the whole story.

2. Continuing to lose share - but now to the small guys

Spices are commodities, and price increases have certainly weighed on the average consumer in the spice aisle. Private-label inevitably becomes more appealing in these situations. Much can be made of MKC's market share loss to private label, but by controlling about half the private-label market, these losses have been manageable.

In 4Q14, management blamed share losses on small (<3% market share) competitors. Aside from better flavor offerings, the only rational explanation for this loss of market share is price - something that we ourselves have noticed while perusing the spice aisle. While MKC can command a premium price owing to its market advantage and brand recognition, the premium pricing seems to be doing more harm than good at present.

Determining better prices is a problem that management needs to tackle - and it's a problem of short- vs. long-term benefits. Small competition can easily be stifled - with long-term benefit - by bringing MKC's spice-aisle prices back to earth. This has clearly not been attempted, and one wonders whether it has been considered at all.

We believe that MKC now has only a 41% share of the global spices market, down from mid-40s just a few years ago. With core spices and seasonings growing 3-4% in developed markets and 6% globally, MKC was only +1% in core seasonings. With a market size of $10.4B and revenues of $4.27B, it implies 41% market share. We expect this to continue down to 40% next year due to slowing sales.

3. Sales barely fall within the guided range

MKC grew sales by 3% (in constant currency [CC]) - at the low end of the guided range. Indeed, sales have been underperforming for quite some time now. The strongest segment for the quarter was the China Consumer driven by WAPC Co., but the weakest was APAC/China Industrial due to fast-food/QSRs. MKC is heavily exposed to both Yum! Brands (YUM) (especially the KFC brand) and PepsiCo (PEP). YUM's QSRs are weak in APAC due to food concerns. PEP is actually a strong customer for MKC between the beverage business and Frito-Lay. MKC management even pointed out the strength of US snacks driving industrial demand.

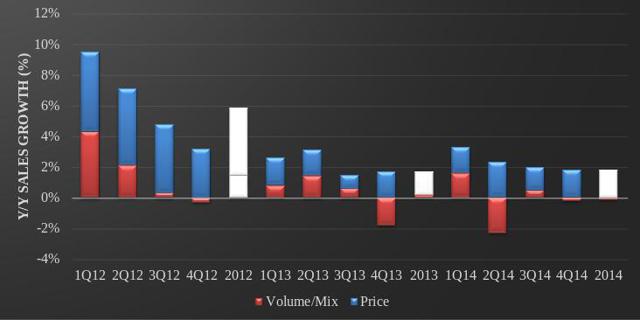

As sales have been aided by M&A in the past and FX has had a negative impact, we often have followed volume/mix as the leading indicator of healthy demand. Volumes have not grown overall in a meaningful way since 1H12. Price increases are not a sustainable way to generate growth over the longer term, especially taking into consideration MKC's aforementioned problems in retaining market share.

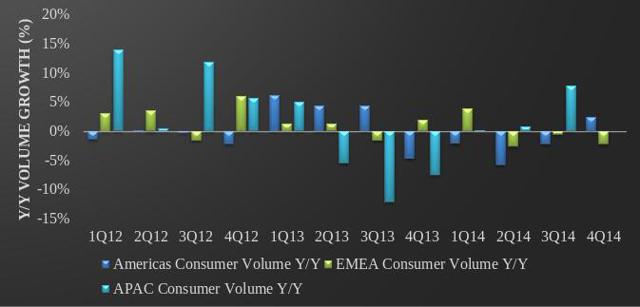

The consumer market ex-APAC has been extremely weak on volumes. WAPC Co. is likely a large component of actual volume growth, but it struggled in 4Q14.

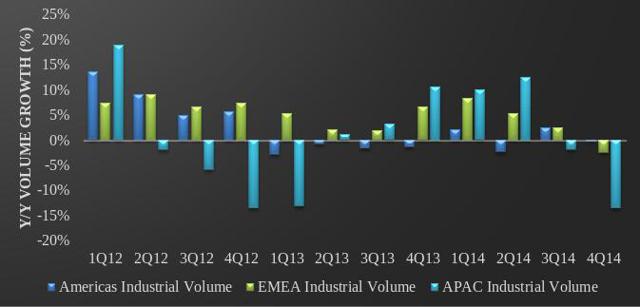

Industrial volumes were again terrible. The last time they were this bad was during the last QSR downturn in APAC (the Avian flu scare). However, this created subsequently easy comparables Y/Y, which may eventually provide an upside catalyst. EMEA has been in a downward spiral and the American consumer is a non-factor.

Management guided for 4-6% sales growth CC but with a 2% pricing increase (mainly internationally and mainly industrial) contributing (an unhealthy measure in our view) and FX headwinds of 3%. This leads to overall sales guidance of 1-3% but with volume/mix of -1% to +1%. With management consistently overestimating sales at the mid-point of guide (ex- any acquisitions at the time of guide), it makes us wonder whether it will be another disappointing year.

4. CEO Wilson outlines unconvincing reasons for a good FY15 ahead

Wilson had four reasons he believed in the company in '15, namely: (A) the rising demand for flavor projected to be mid-single digits in 2015, with emerging markets 10% and developed ~4%; (B) increasing brand marketing; (C) innovation; and (D) social media/customer intimacy.

First of all, MKC has shown us that a big market doesn't guarantee expanding, or even stable, market share. We wonder if MKC is ready to efficiently capture anticipated growth in demand for seasonings.

Second, brand recognition is not our biggest worry. As we noted already, consumers are leaving MKC-branded spices on the shelf because they're expensive, not because they don't adequately connect with the brand.

Third, can "innovation" really drive growth here? New products released in the last three years accounted for 8% of sales this quarter, below management's goal of 10%. Even with an R&D facility opened in Brazil and an anticipated customer service center in the Middle East in 2016, we don't think that a product so tied to the underlying commodity can innovate enough to differentiate.

Lastly, we are always skeptical of claims of "social media marketing" as a driver of meaningful revenue growth. Social media is incredibly useful for some marketing angles, and we understand that there is an ROI here, but we wonder if the Internet will really drive record traffic to the spice aisle. Overall, we don't find CEO Wilson's reasons all that compelling.

5. CCI savings expected to accelerate, but raw costs weigh heavily on margin

The "Comprehensive Continuous Improvements" program savings were $65M in 2014 with $4M from streamlining efforts. MKC expects $85M in savings in '15, but with continuing struggles in raw materials expected. The highlight here was that pepper raw costs have increased fivefold over the last 5 years. Pepper being MKC's crown jewel, lower margins are to be expected. According to management, prices are reaching a peak and will need to be offset with costs. Costs are expected to increase in mid-single digits again, and materials (pepper included) account for 80% of COGS. Fuel costs may be reduced from a logistics standpoint, but this is factored in with SG&A as opposed to COGS.

6. Weak FCF due to weak DPO and earnings

FCFF of $322M was well-below our $382M expected, driven by weaker working capital and earnings power (i.e., cash from operations). MKC was able to reduce share count by 3.3M shares which in turn led to an EPS boost of ~$0.07 in '14 or approximately 2.2% (accounting for 1/3 of earnings growth in 2014!).

Despite being an acquisitive company historically, and despite management commenting that the debt level provided a good opportunity for acquisition, management did not acquire a company in 2014. There was no acquisition in 2012, either. This resulted in muted sales for 2013 of 2.7% Y/Y.

At this point, the company depends on buying other smaller players for growth, especially for international growth. We highlighted 7 possible targets in our past report and believe that now is a great time to start being acquisitive given low interest rates and the need to justify valuation despite typically dilutive acquisitions in the short run. This is the only positive catalyst we see available for shares, save an increasingly unlikely return to organic growth. It's not a question of "should," but "when should." An acquisition is necessary.

The "So What"?

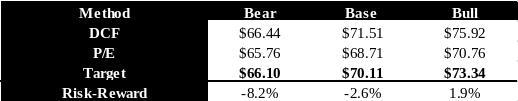

MKC simply shouldn't trade at >20x earnings. Even if management continues to under-promise on the tax rate, driving upside to EPS, it gets to our "base" case as we embed these assumptions. Our base case is $3.62, which is above the guide of $3.58 and assumes OPM expansion of 40 bps. This makes some sense as the Industrial segment (which carries lower margins) likely will be weaker and continue to underperform Consumer.

Even at 20x this EPS figure, though, we end up with $72 - the current share price. But EPS really isn't growing. We use 19x EPS, as this is ~5 year average the market has paid historically for ttm earnings, which is what we use for our future value. We also do a DCF discounting at only 7.5%, a value below what management uses for ROIC of 8%, showing our aggressiveness here.

Despite the market realizing a more bearish outlook halfway through Wednesday and bouncing back on Thursday, MKC should have further to fall. Barring an acquisition to enhance future FCF and EPS, the risk-reward is simply not compelling.

For traders seeking an opportunity in this space, we might recommend a pair trade at this time: Long Diamond Foods (DMND), or even WhiteWave (WWAV), and short MKC. While we are not generally short-sellers ourselves, there may be an opportunity for a trade here.

For value investors, we recommend that you look elsewhere at present. MKC is overvalued.