Waddell & Reed Financial, Inc. (WDR) provides investment management, investment product underwriting and distribution, and shareholder services to mutual funds, institutional investors and select private investors. The company operates its investment advisory business through the Waddell & Reed Investment Management Company; Ivy Investment Management Company, the registered investment adviser for Ivy Funds; and Legend Advisory Corporation, the registered investment adviser for Legend. With a market cap of just under $4 billion, they are much smaller than their peers Bank of New York Mellon Corp. (BK) at $43.94 billion or Franklin Resources, Inc. (BEN) at $33.26 billion. Though notably smaller, they were able to provide great returns for their shareholders over the years thanks to having excellent fund managers at the helm.

Source: Google.com/finance

Late 2013 through early 2014, though, was the start of the Waddell & Reed reset. During this period, the stock rallied to fresh 52-week highs, but managers were already packing their bags and taking their clients with them.

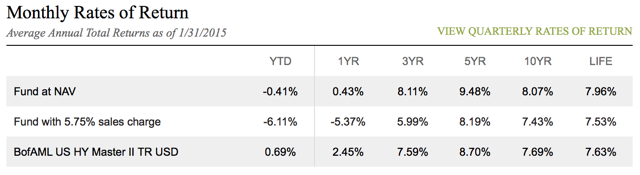

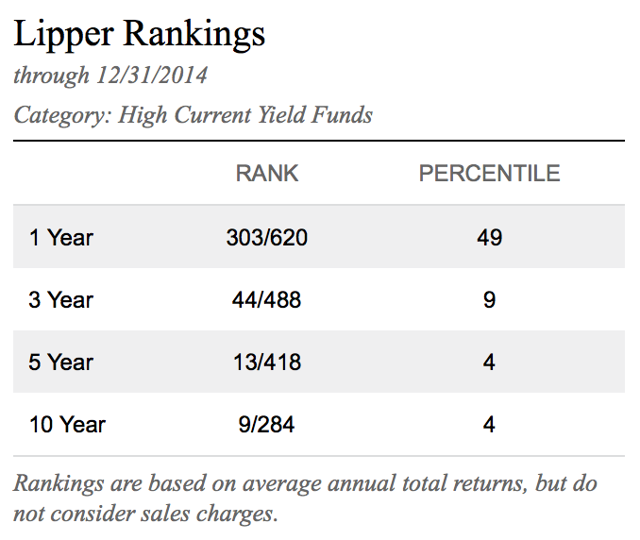

Bryan Krug was the Ivy High Income Fund (WHIAX) manager until November 2013 when he left for Artisan Partners Asset Management (APAM), where he currently is their High Income Fund manager. Chad Gunther, a 17-year veteran, took over Mr. Krug's vacancy, and time will tell if the fund can continue its past performance. The Ivy High Income Fund has experienced outflows since Mr. Krug's departure and currently has $8.3 billion in fund assets. A quick glance at the funds performance shows it's been underperforming for the past year and is well below historical performance.

Source: Ivyfunds.com

Additionally, the exceptional place it held in the Lipper rankings for many years has eroded to the middle of the pack.

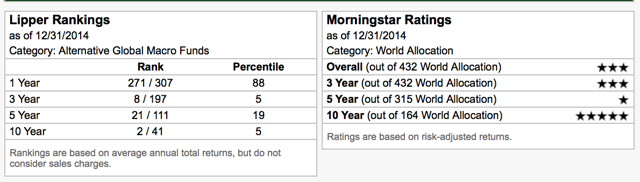

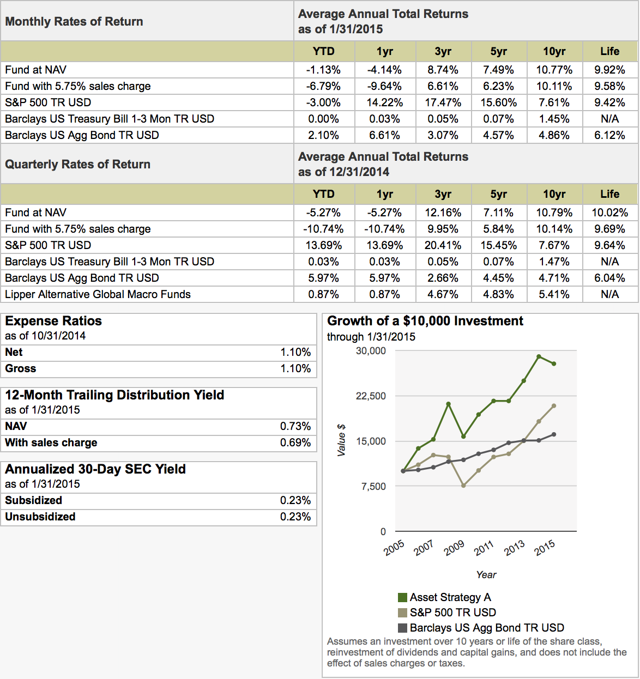

Perhaps the largest impact came from Ryan Caldwell leaving the Asset Strategy team in June 2014. He was co-portfolio manager and at the time of his departure the Asset Strategy portfolio accounted for roughly 1/3rd of the firm's $131.4 billion in assets. His departure came suddenly as he decided he was done with asset management. A falling out ensued, as he and Waddell & Reed were unable to secure a 2-year consulting deal. It's currently managed by his former co-portfolio manager and Executive Vice-President Michael Avery and two newly-appointed managers Cynthia Prince-Fox and Chace Brundige.

It's no surprise why clients are dumping the flagship Asset Strategy Fund, the past year has been dismal! The team managed to record a capital loss and a severe drop in rankings during the robust 2014 market.

Source: Waddell.com

Source: Waddell.com

The underperformance of these funds has weighed heavily on the company's stock price during the past year. After peaking at $76.26 on April 2nd, 2014, the stock has been falling and closed at $48.23 on February 9th, 2015, a drop of nearly 38%.

Q4 results

Despite the manager resignations, the Q4 earnings report saw net income of $80.9 million, or $0.97 per diluted share, beating estimates by $0.08. This was a 5.4% increase compared to net income of $78.8 million, or $0.92, during Q4 2013. Revenue of $397.2 million was a 5.9% increase YOY and beat estimates by $7.56 million. Operating income of $119.1 million was 5% higher than Q4 2013, but when compared with adjusted results from Q3 2014, operating income declined 10% due to lower assets under management. The operating margin during the quarter was 30.0%, a decrease of 60 basis points.

During the fourth quarter, management reduced share count by 1.6 million net shares and increased the quarterly dividend to $0.43 per share per quarter for a 26.5% increase. This helped put a floor under the stock price.

Even with the earnings beat and dividend increase, CEO and Chairman Henry Herrmann confirmed that after a strong start to 2014 they "…experienced significant headwinds caused by weak performance in our flagship Asset Strategy Fund and a loss of consumer fees hedging for High Yield products." He did mention that excluding the Asset Strategy and High Income funds, they had sales of 15.3 billion and net inflows of 2.9 billion. Management cautioned that fresher outflows are likely to persist until performance picks up in Asset Strategy, though they believe they have the right talent in place to succeed. Management reminded analysts multiple times that their funds have delivered well on a long-term basis.

Valuation

The stock is currently trading in the upper $40s and a P/E of 13, well below its 5-year average P/E of 18.0. Though this may be initially well received, analysts have been lowering EPS estimates for 2015. With the negative atmosphere, a 1.12 Price per Earnings to Growth ratio and a forward P/E of 12.85, the shares appear fairly valued.

Conclusion

The departure of several fund managers in the past 15 months has created significant headwinds for the company. As a result, the Ivy High Income Fund and the Waddell & Reed Asset Strategy Fund have both underperformed and seen money outflows as clients seek better returns elsewhere. Management reported a strong Q4 2014 and increased the quarterly dividend to shore up share price until fund performance picks up. Because of the lackluster performance of the Asset Strategy and High Income funds and their continued outflows, I do not recommend purchasing shares until outflow and fund performance stabilize.