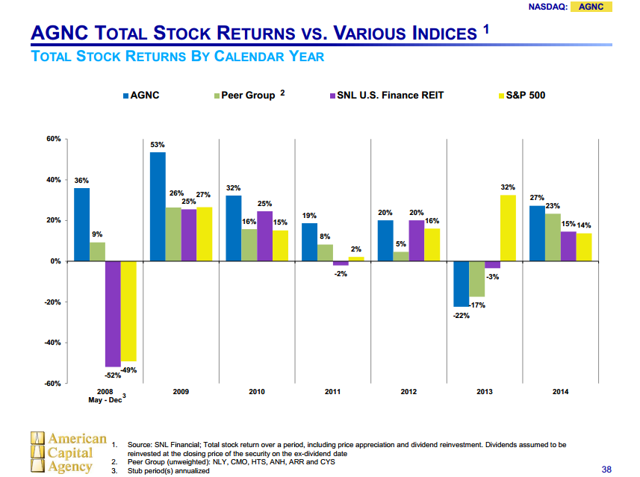

American Capital (NASDAQ:AGNC) seems to have lost some of its luster in recent quarters. Historically, the company has outperformed its agency mREIT peers by a wide margin, earning it a premium valuation. However, the stock has stagnated, with its only return recent. This is despite the company having a pretty good year, seeing its book value improve, all while paying out its impressive dividend, even managing a small 1.5% percent increase in October via a shift to monthly payouts.

Q4 2014 Overview

Earlier this month, American Capital reported its Q4 2014 results. For the quarter, the company posted total comprehensive income of $0.86 per share. This consists of a $0.94 net loss per common share as well as $1.80 per share in other comprehensive income ("OCI"). I'll cover the difference between these two metrics later in this article.

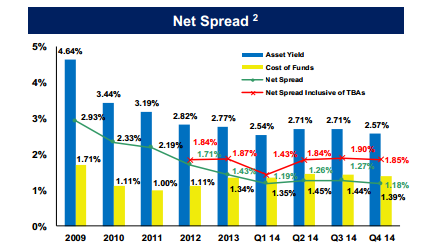

American Capital generated roughly $0.92 per share in net spread and dollar roll income in Q4, up 8% from $0.86 in Q3. This increase was almost entirely due to an improvement in dollar roll income which improved to $0.47 per share from $0.43 last quarter.

American Capital's reliance on drop income is obvious when looking at the net spread which has been dropping for years. In Q4, this key metric dipped to 1.18x, down 9 basis points from 1.27% in Q3. A few years back in 2009, this number was nearly 3x higher at 2.93%.

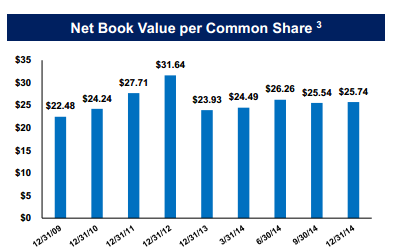

Falling interest rates do have some upside via the book value. This is due to the value of higher yielding MBS in the portfolio increasing. In Q4, American Capital's book value per share increased to $25.74, $0.20 higher compared $25.54 per share in Q3. At current prices of ~$22 per share, American Capital trades for about a 15% discount to its Q4 2014 book value.

A look at leverage and prepayments

While lower rates do have a positive impact for American Capital's book value, there are some downsides. The most obvious is a need for higher leverage to maintain earnings parity. American Capital's leverage in Q4 stood at 5.3x, up from 4.8x in Q3. When including the net TBA dollar roll position, this metric increases to 6.9x, up from 6.7x in Q3.

Another impact of lower rates would be an increase in prepayments as borrowers take advantage of lower rates to refinance. The company combated this by lowering its position in higher coupon 30-year generic securities and increasing its holdings of sub-15 year paper. For the quarter, American Capital's constant prepayment rate stood at 9%.

Were American Capital's earnings high quality?

Let us now discuss American Capital's earnings. As I noted earlier, total comprehensive income came in at $0.86 per share, well above the $0.94 GAAP net loss due to $1.80 per share in other comprehensive income, or simply OCI.

It is my opinion that comprehensive income is the go-to metric for American Capital, as it better reflects the true nature of the quarterly profitability compared to the GAAP numbers. Just to give an example, when you add together the $0.66 per share in declared dividends plus the $0.20 per share book value gain you'll come up with the $0.86 per share comprehensive income number.

The OCI metric includes some "unrealized" paper gains which are not easily converted into cash. However, the net loss number also includes non-cash paper losses, mostly due to losses in American Capital's extensive hedges. In other words, yes, American Capital posted high quality earnings in Q4.

Is the dividend sustainable?

Lastly, let us discuss the dividend. American Capital has shifted towards monthly dividends currently at a $0.22 per share rate. I think these will be sustainable short term given the income generation seen in Q4. Indeed, with $0.92 per share of net spread and dollar roll income, American Capital well exceeded its $0.66 per quarter in dividends. Looking into Q1 2015, the interest rate environment has actually improved compared to last quarter which may result in a higher net spread.

Keep in mind that as a highly leveraged mREIT, American Capital's dividends can vary greatly. While the company seems unlikely to make a change now, nothing is set in stone.

Conclusion

American Capital has long been one of my go-to income picks. Besides the quite awful 2013, the stock has historically outperformed, and 2014 was no different with the company posting a strong 27% total return (book value gains plus dividends). Given the deep 15% discount to book value and 12% yield, the stock remains a compelling choice for income.

Disclaimer: The opinions in this article are for informational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Please do your own due diligence before making any investment decision.