Castlight Health (CSLT) operates in a large market with apparent growth potential. As we've mentioned already, the Affordable Care Act gives large companies a compelling opportunity to add to their bottom line through benefits spending cuts, aggressive wellness programs, and increased reimbursement limits.

CSLT is in the game of unlocking that value for enterprise clients and driving income-statement efficiency. Specifically, benefits spending cuts (e.g., through risk reassessments, lower healthcare premiums, and cash kept through punitive premium reimbursement programs) would directly affect clients' selling, general, and administrative costs (SG&A).

The irony

For a company in enterprise consulting and SaaS geared toward reducing clients' costs, CSLT is remarkably bad at reducing its own. Indeed, it appears that - rather than scaling its software - CSLT has decided to scale its workforce - and get a nice office, too.

They say that a picture is worth a thousand words, so here are three thousand words lifted from its careers page.

In addition to team-building activities, a nice view of the Oakland bridge, free bananas, and a generally flip-flop-friendly culture, Castlight offers unlimited paid time off and office happy hours. And, to intensify the irony, CSLT pays its own employee health premiums fully, providing none of the incentive-based wellness programs that it peddles as solutions to enterprise clients.

When we translate all of this into income-statement terms, the picture becomes less appealing than those presented above. Here are some highlights from last quarter:

| Total Revenue | $12.21M |

| Cost of Revenue | $7.16M |

| Gross Profit | $5.05M |

That gives us a gross margin of 27%. Okay, you say, tell me more.

| Cost of Revenue | $7.16M |

| SG&A | $19.70M |

| R&D | $5.63M |

| Total OpEx | $32.49M |

After "other" income (and taxes, if that mattered), we are left with a net income of -$20.20M. And that gives us a quarterly profit margin of -165%. The real irony in the numbers, we think, is encapsulated in the whopping quarterly SG&A of nearly $20M. In case you are hopeful that it is a one-off, the two prior quarters feature SG&A figures of $19.47M and $20.57M.

But this whopping expense isn't all just prime office space (a block away from Google San Francisco), foosball tables, and happy hours. CSLT maintains 342 employees as well. That means that per-employee revenue in the most recent quarter (to be generous) is $35,000, and per-employee profit, after cost of revenue, $14,800. Annualized, that's $59,200 in per-employee profit.

After salaries, benefits, office space, and other employment liabilities, a large hole remains.

And so, at this point, one might wonder if CSLT is nothing more than an overgrown San Francisco startup enjoying its moment in the sun, burning through cash in the meantime. At the very least, this does not seem to be the kind of company that serious investors court (except Valley VCs, vicariously yearning for their long-lost twenties, of course).

But then if this is a startup, we should give them the benefit of the doubt and talk about growth potential.

Is growth enough?

Between foosball games, management has driven some nice, linear revenue growth. Will this keep up? And if it does, is that enough to improve CSLT's prospects?

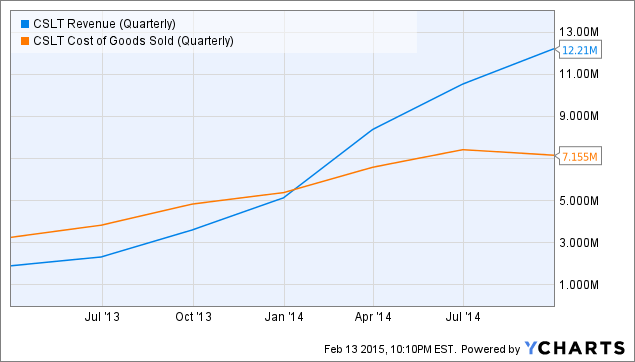

CSLT Revenue (Quarterly) data by YCharts

Analysts are anticipating a mean of $13.16M in revenue - on the high end of guidance - for the current quarter, which lends credence to management's claims of a more "cyclical" business (transcript). Meanwhile, it breaks the fairly linear progression of Q/Q revenue, so we're not sure if we should think of it positively or not.

Assuming that revenue growth continued on its linear path after the current quarter, and that OpEx were perfectly constant, we would see ~$23M in revenue by 4Q16. Assuming that the average, and relatively constant, OpEx of ~$32.51M over the past three quarters will remain constant over five quarters (a stretch), CSLT would still be operating at ~$10M loss.

So we wonder if, given expenses, higher growth or eventual profitability is even possible. Expenses will, after all, almost certainly increase proportionally, and revenue may not conform to our linear algebra.

Growth, through Castlight's eyes

To CSLT's credit, it has been attracting plenty of buyers. Ending 3Q14 with an impressive 159 customers, though, how much more growth is possible at a reasonable cost? And how many more customers can CSLT even book?

Consider that with 342 employees, CSLT maintains 2.15 employees per client. Consider also that with $12.21M in revenue, CSLT is pulling in an average of just $76,792 per client per quarter. To be more generous, suppose that the revenue came exclusively from customers booked at the end of the prior quarter, which amounted to 130, that's $93,923 per client per quarter; annualized, $375,692.

Is that the average value that CSLT is supposed to be contributing to its clients? That would imply that, on average, each CSLT employee is contributing an annual $174,740 in value to clients. Unless there were no such thing as operating expenses at all, this does not seem sustainable.

A hamster wheel

In order to become profitable, CSLT would have to commit to scaling its software rather than its workforce. Until that time, profit margins will remain abysmal.

But CSLT doesn't seem to have a real "software solution" (see castlighthealth.com/solutions) at all. Its "cloud" SaaS platform seems to be more of a means of business consulting, and if that is the case, a high ratio of employees to clients will have to be maintained, driving OpEx up proportionally and pushing off profitability indefinitely.

Under these circumstances, even an increased subscription of much-coveted Fortune 500 companies (of which, there are only 500, mind you) would do little to improve income. Without true margin expansion and the development of a more focused, standalone, scalable product, CSLT will be stuck with an impossible task - and investors with a DOA company in an albeit compelling market.

The "So What?"

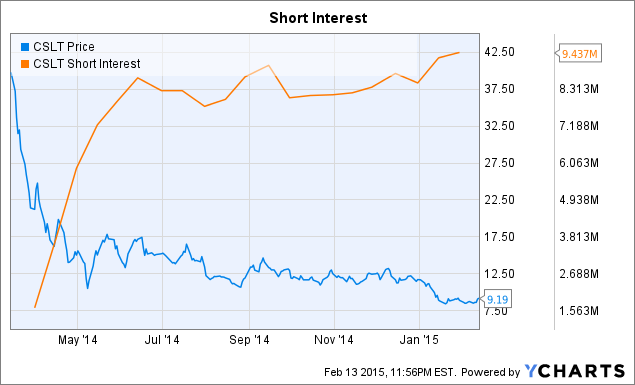

Short interest as a percentage of float stands at >70% for a reason. Due to two factors - (1) the amount of shares outstanding in relation to the float and (2) the lion's share of bearish short interest being initiated well above present price levels - this is not even a good candidate for a short squeeze in the event of an earnings beat on Feb. 18th. The shorts are entrenched and the remaining of shares outstanding are restricted.

Having gorged itself on its IPO and disproportionately overgrown its OpEx to fund a cozy startup culture, we feel that CSLT has shot itself in the proverbial foot. Recovery, if it is even possible, will be a long, arduous process. Unless management can focus on a higher-margin software product, or dramatically cut costs, we don't see any reason for optimism.

And so, in the coming months, that's exactly what we will be looking for from CSLT - focus. Until then, we advise readers to hold their shorts if they have 'em, and to stay away otherwise.

For those who remain unconvinced about the bleak outlook on broad-based SaaS health consulting, we recommend reading RAND's 2012 report on workplace wellness programs (click here for a summary), which, we feel, conclusively corroborates the need for a more focused solution.