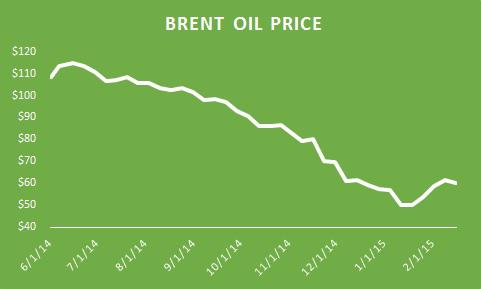

Dril-Quip (NYSE:DRQ) reports Q4 earnings before the market opens on Friday. Analysts are expecting revenue of $248.1 million and eps of $1.34. The revenue estimate assumes 3% growth sequentially, while the eps estimate is $0.06 below the $1.40 recorded in Q3 2014. The oil industry is in a state of contraction amid declining oil prices; brent prices have fallen over 50% from their peak in June 2014 and traders are still trying to predict a bottom.

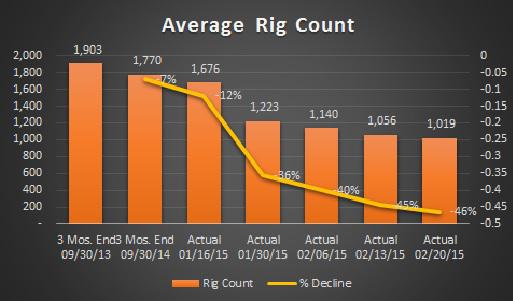

To stem cash burn big oil has been cutting exploration projects, reducing capital expenditures and taking oil rigs out of service. According to Baker Hughes (BHI) the rig count has fallen for 11 straight weeks to 1,019 for the week ending February 20th - a decline of 46% from the average of 1,770 in Q3 2014.

Source: Baker Hughes

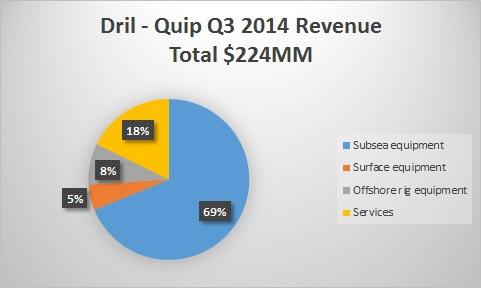

The declining rig count is also a harbinger of declining drilling activity. Oil and gas drilling activity declines, so does Dril-Quip's business prospects. The company manufactures and services offshore drilling equipment such as subsea equipment, and surface and offshore rig equipment. About 69% of total revenue is derived from the sale of subsea equipment, while 18% is derived from ancillary services like selling and renting tools used in the installation and retrieval of the company's products.

In addition to the industry contraction, investors should avoid the stock for the following reasons:

Exposure To Pretrobras

Petrobras (PBR), Brazil's state-funded petroleum company, is currently embroiled in a scandal where Petrobras executives were alleged to have approved inflated contracts from suppliers and subcontractors; in exchange, certain politicians and directors received kickbacks from the contracts. The scandal has led to a delay in Petrobras' operations and an investigation for the SEC.

Petrobras has halted payments on several contractual arrangements and shuttered new projects. That said, Dril-Quip has about $128 million in exposures to Petrobras. Dril-Quip has [i] $24 million of work that was completed but disputed by Petrobras and [ii] $104 million of purchase orders under a contract with Petrobras. The purchase orders represent about 8% of the company's $1.25 billion contract backlog. Seadrill (SDRL) recently wrote off its entire $1.1 billion Petrobras-related backlog. The worst case scenario is that Dril-Quip writes off some or all of its Petrobras exposures.

Offshore Drilling Market In Disarray

Offshore drillers - key clients of Dril-Quip - are particularly hurting. Transocean (RIG) recently cut its dividend by 80% in order to stem cash burn amid its high debt load. During its most recent quarter, utilization rates for its ultra-deepwater floaters declined to 69% from 83% in the previous quarter. UBS believes more than half of Transocean's ultra-deepwater rigs could be out of work by the end of the year. Diamond Offshore (DO) was recently notified by Pretrobras and other big oil customers that it was canceling certain contracts. More offshore contract cancellations could be in store as national oil companies look to reset rates.

Conclusion

Investors should avoid Dril-Quip amid the industry contraction. I am currently short the stock.