One of the worst performing stocks over the past year is SodaStream (SODA). The once very promising growth story has fizzled out, and now the company is reporting sizable revenue declines. SodaStream recently reported its fourth quarter results, and I was not impressed at all. Today, I'll detail why the company is in more trouble than previously thought.

Q4 results:

The company announced quarterly revenues of $126.5 million. Not only did this miss analyst estimates for $127.1 million, but it was a sizable drop from last year's Q4 revenues of $168.1 million. The revenue plunge was mostly due to a result of Americas revenues being sliced in half and currencies hurting. On the bottom line, the company reported an adjusted profit of $0.35 per share, nearly double the $0.18 analysts were looking for. It is important to note, however, that estimates had dropped substantially after a major warning in 2014.

Overall, I'm more focused on the top line troubles. Sparkling water maker starter kit unit sales dropped by a third over the prior year period and flavor sales were down by 38%. The company only showed gross margin improvement and a big bottom line number thanks to the elimination of promotional activities as compared to the year ago period. The 2014 holiday season was critical for the company, and the failure to drive revenues in the quarter will have long lasting effects. I'm not completely sold at this point about this transformation to sparkling water, and the latest results don't boost an investor's confidence.

2015 not looking good:

Last year, the company finished with $511.8 million in revenues, down about $50 million from 2013. When 2014 started, analysts were looking for almost $673 million in revenues, and SodaStream finished well short of that. On the conference call, management stated that this year's revenues could be impacted by $60 million if currencies stay where they are. That's a tremendous amount given the base you are working off of. In the table below, I've detailed how 2015 estimates continue to plummet.

*Revenue growth figure based on 2014 estimate at that time. The 2/27 figure is based on actual results for last year.

These are analyst estimates because the company did not provide 2015 guidance. That's a very troubling item in my opinion given how bad things have been lately. A few years ago, this name was giving great guidance and raising its forecasts a number of times. In recent quarters, all we have seen is warnings, and now we are not even getting guidance. Management even noted that the company is reducing its presence in Wal-Mart (WMT). When you are pulling your products from shelves, your business is in trouble.

The growing problem for SodaStream is that we are getting closer to the launch of the Keurig Cold platform. Keurig Green Mountain (GMCR) has partnered with Coca-Cola (KO) and Dr. Pepper Snapple (DPS), and a launch is scheduled for later this year. Green Mountain is known more for its coffee business, but the company is trying to diversify.

In recent years, I wasn't as worried about the Keurig Cold launch because I saw the growth potential of SodaStream. I believed that SodaStream's established presence in the space would be able to overcome the Keurig Cold launch initially. However, my worries are really starting to grow. SodaStream is obviously having trouble finding customers, and a revenue decline in 2015 would come at the worst possible time. Keurig Green Mountain has some big partners lined up for this launch, and the company is already much larger than SodaStream. Add Coca-Cola and Dr. Pepper Snapple to the mix, and that's a lot of brand and marketing power to overcome.

More shorts about to enter?

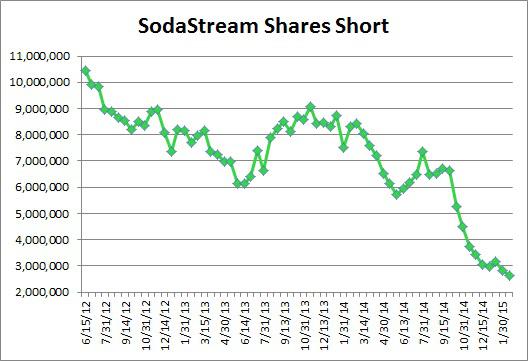

One item I follow extensively for many names is short interest. In the past, SodaStream was a very highly shorted stock, as many did not believe in the company's product and growth prospects. These shorts have done quite well in recent years. As you can see in the chart below, short interest has actually dropped along with the stock in recent months.

(Note: Last data point on chart is for settlement date of 2/13/15)

At the latest short interest update, about 2.65 million shares were short the stock. That's the lowest value that I've seen since I started tracking short interest for SodaStream in June 2012. In the past four months, we've seen nearly half of all shares short covered.

This is a two-fold problem for the stock in my opinion. First, with the stock where it is, it is a lot easier to short a larger number of shares. Back in September, the stock was at $30 a share, and now shares are under $18. One large investor or hedge fund can now short a lot more shares for the same amount of money, as compared to recent months. If you go back to when this stock was at $50 or even $80, the situation is even more dramatic. Also, what happens if short interest were to return to say 5 million shares? That would provide a lot of negative pressure on the stock and it is not unreasonable to think short interest could jump back to that level.

A lower and lower moving average:

SodaStream shares have been trending lower for the better part of two years as a number of buyout rumors have failed to materialize and growth prospects have fizzled. In the chart below, you can see how the downtrend has continued over the past six months, and I've compared the stock against its 50-day moving average.

(Source: Yahoo Finance)

The 50-day moving average continues to head lower, and many will see this key technical line as a level of resistance for the stock. I don't see too many reasons to be positive at the moment, and a lower moving average is not good.

Final thoughts:

SodaStream had a poor finish to 2014, which puts the company in a tough spot this year. Declining revenues are not a good thing when a major name is about to move into your space. If I were running this company, I'd be looking for a buyer now, because SodaStream's future is not looking so bright. With a declining 50-day moving average and the potential for short interest to skyrocket, I think this stock goes lower from here if the company is not bought out.