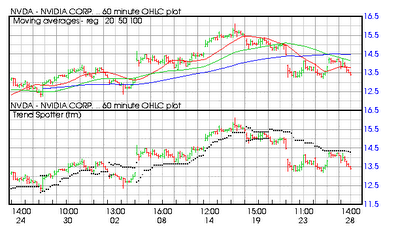

Nvidia (NASDAQ:NVDA) is one of those middle of the road stocks that has taken a small beating in the market lately and might be due for a little rebound. The stock is off its one year high by about 49% so if you have it on your watchlist this might be a nice entry point. Recent trading activity hasn't been kind as this one month hourly trading chart provided by Barchart shows:

NVIDIA Corporation provides visual computing, high performance computing, and mobile computing solutions that generate interactive graphics on various devices ranging from tablets and smart phones to notebooks and workstations. It operates in three segments: Graphic Processing Unit (GPU), Professional Solutions Business (PSB), and Consumer Products Business (CPB).

The GPU segment offers GeForce discrete and chipset products, which support desktop and notebook personal computers plus memory products.

The PSB segment provides its Quadro professional workstation products and other professional graphics products, including its NVIDIA Tesla high-performance computing products used in the manufacturing, entertainment, medical, science, and aerospace industries.

The CPB segment offers Tegra mobile products, which support tablets, smart phones, personal media players, Internet television, automotive navigation, and other similar devices. This segment also licenses video game consoles and other digital consumer electronics devices. The company sells its products to original equipment manufacturers, original design manufacturers, add-in-card manufacturers, consumer electronics companies, and system builders worldwide that utilize its processors as a core component of their entertainment, business, and professional solutions. NVIDIA Corporation was founded in 1993 and is headquartered in Santa Clara, California. (Yahoo Finance profile)

Factors to consider:

Barchart technical indicators:

- 56% Barchart technical sell signal

- Trend Spotter hold signal

- Below its 20, 50 and 100 day moving averages

- Although the stock is up 11.11% in the last year its recent weakness shows a 49.18% off its one year high

- The Relative Strength Index is 43.10% and falling

- Barchart computes a technical support level at 12.84

- Recently traded at 13.31 which is below its 50 day moving average of 13.68

Fundamental factors:

- Wall Street brokerage analysts predict sales will increase by 16.60% this year and an additional 8.70% next year

- Earnings projections are aggressive with an expected increase of 53.80% for this year, 14.00% next year and a continued increase of 15.01% annually for the next 5 years

- The sales and earnings consensuses resulted in published recommendations of 10 strong buy, 3 buy, 20 hold and 3 negative reports

- The P/E ratio of 16.07 at today's price is right in the middle of the market but about 1/2 of its median P/E of 30

General investor interest:

- This is a widely followed stock with the general investor as measured by the 5,279 Motley Fool readers expressing an opinion on this stock

- The readers voted 96% that the stock will beat the market

- The more experienced and savvy All Stars are more positive with a 98% vote for the same result

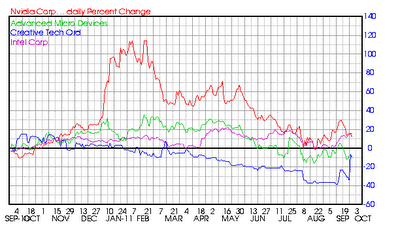

Competitors and sector leaders:

At a 1 year return of 11.45% Nvidia didn't do as well as the 15.83% return of Intel (INTC) but was better than the losses of 9.93% by both Creative Technology (OTCPK:CREAF) and Advanced Micro Devices (AMD)

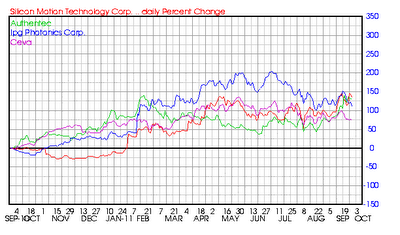

Nvidia is a member of the SIC 3674 Semiconductor and Related Devices sector. Some of the top winners in this sector for the last year have been Silicon Motion Technologies (SIMO) up 135%, Authentec (AUTH) up 129%, IPG Photonics (IPGP) up 111% and Ceva (CEVA) up 74%

Summary - The analysts sales and earnings projection for Nvidia are enough to take notice and the recent depressed price makes this a nice entry point. At today's price investors might see an annual total return of about 18% - 20% based on sales and earnings projection together with a higher P/E ratio.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.