We have seen positive growth in the for-profit education sector in select companies during recent years. We sometimes see good financials from the outside where these companies have profited, but rarely from the customer's (student's) perspective, where there is expensive tuition and lacking job opportunities, which will eventually tear these companies to rubble. One company, Apollo Education (APOL), parent company of the University of Phoenix, has earnings coming up.

Will Apollo's Earnings Disappoint?

Recently, DeVry Education Group (DV) saw earnings of $0.75 per share, just shy of its $0.77 estimate. The results of Apollo Education's earnings coming up on March 25 could be similar. The consensus estimate is $0.14; we will see if Apollo Education shadows its close competitor.

Overpriced Tuition

While Apollo Education's competitors are seen as other for-profit education companies such as DeVry University and Strayer University (STRA), its real competitors are its public education counterparts. As more affordable and more practical options are becoming available, students are starting to realize that for-profit education is not the best option. According to College Board, the average tuition at a community college for 2014-2015 was $3,347. This amount was $9,189 average for in-state tuition at public four year colleges. These amounts are increasing significantly at for-profit universities, where students pay on average $15,230 for tuition.

Job Outlook

In 2012, The Chronicle of Higher Education and American Public Media's Marketplace conducted a survey in which they sought to see how job applicants with for-profit degrees fared with applicants with degrees from other schools. The results are how most would expect. Applicants with a bachelor's degree in business from an online for-profit college were about 22% less likely to make it to the next round of the application process, than applicants from public universities.

Federal Student Loans

83% of income for the University of Phoenix was from federal financial aid, with a big slice of that being federal student loans. The University of Phoenix is even known as the largest recipient of federal financial aid when stacked up against all other universities. With interest rates on federal loans set to increase 0.8% on July 1, 2015, we can only see this shrinking Apollo Education's profit in the near future.

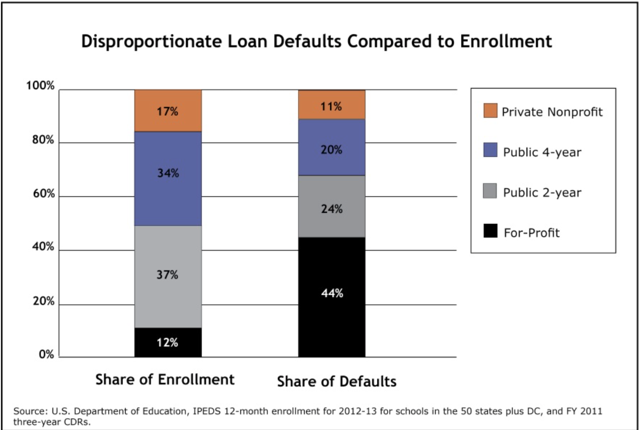

According to the chart below from The Institute for College Access, with data from the U.S. Department of Education, for-profit universities enroll 12 percent of college students nationally, yet account for 44% of student loan defaults. Once the government cracks down on for-profit colleges for taking advantage of this easy money, like hinted on by the government in the past, schools like the University of Phoenix will be in a lot of trouble.

Free Community College?

With the recent announcement of President Obama's plan to make community college free; this could potentially destroy universities like University of Phoenix. The president's plan is to provide free education through community colleges, which will allow 9 million college students to attend for free. If this initiative passes, potential students will be even less likely to attend the University of Phoenix, since they would be able to avoid student loans.

Conclusion

With public colleges being so much cheaper and giving out better quality degrees, I do not see the long-term future for for-profit education companies being positive in their current structure. The increasing interest rates on federal student loans and the possibility of free community college for millions of students, do not make their case any better. Apollo Education and similar companies must revamp their business model to have any potential in the foreseeable future. With their current and near future state, why pay much more for a nearly useless degree? Regardless of what happens in the near future, long term, there is absolutely nothing in the University of Phoenix and parent company Apollo Education's favor.