By Justin Dove

Which country has the most shale gas reserves outside of the United States and China?

Canada? Nope.

Australia? Wrong again.

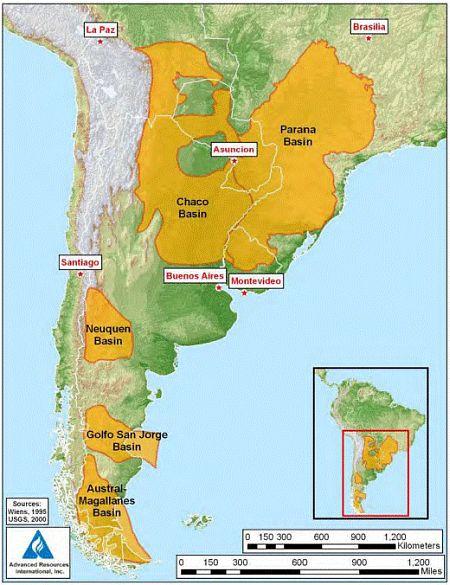

According to the U.S. Energy Information Administration (EIA), Argentina ranks third in recoverable shale gas reserves. Argentina has 774 trillion cubic feet (Tcf) of technically recoverable shale gas resources, with more than half of that in the Neuquén Basin on the western side of the country.

(Courtesy: EIA, Advanced Resources International, Inc.)

Political Intervention

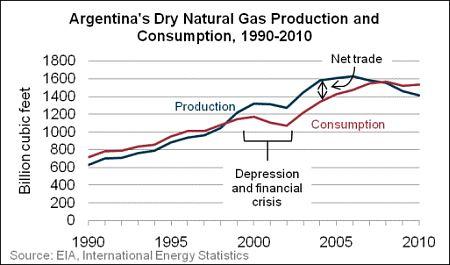

Following the economic crisis it weathered in the early 2000s, Argentina imposed strict regulations and price controls on its oil and gas production. Since Argentina’s currency devalued incredibly in a short period of time, Argentinians couldn’t afford exported oil and gas. Thus the government put strict price controls on production within the country to keep the economy moving.

Over the last decade, however, the sanctions diminished competition and production has since flat-lined in the region. In 1999, Spanish-based Repsol (OTC: REPYY.PK) bought a controlling stake in Argentina’s YPF S.A. (NYSE: YPF).

As Thomas Lott wrote for Seeking Alpha, “Given the difficulty of selling natural gas and oil at international market prices, it comes as no surprise that Repsol, as owners, spent little on developing hydrocarbon reserves. In fact, they let fields mature, milked YPF for dividends and invested little in the business.”

Due to growing consumption and falling production, Argentina began ramping up in 2008 and 2009 to recover some of that lost production and competition.

Oil and Gas Plus Programs

By passing the Oil Plus and Gas Plus programs in 2008, the Argentina government is allowing exporters to sell oil and gas at much higher prices than previously possible. Last year the Oil Plus program proved its benefit for the first time, and it is possible the Gas Plus program could begin improving gas production very soon.

The vast reserves and improved political climate have already attracted major players, such as:

- ExxonMobil (NYSE: XOM)

- Chevron (NYSE: CVX)

- Total S.A (NYSE: TOT)

- Petrobras (NYSE: PBR)

- Apache (NYSE: APA)

But there are a few smaller companies that could benefit.

- Transportadora de Gas Del Sur S.A. (NYSE: TGS) – According to the EIA, TGS is “the leading natural gas transportation company” in Argentina. It “claims to operate the most extensive pipeline system in Latin America.” Its pipelines connect the “Neuquén, San Jorge and Austral basins with Buenos Aires and other demand centers.” It has an inconsistent dividend record, however, it paid out $1.505 per share in May – quite substantial considering the stock price was $3.71 at the time.

- Gran Tierra Energy Inc. (AMEX: GTE) – Gran Tierra Energy is an oil and gas exploration and production company based in Calgary, Canada and operating in South America. Gran Tierra has projects in Columbia, Brazil, Peru and Argentina. It recently announced a joint venture with Petrobras in the sub-salt fields play off the coast of Brazil. It also recently acquired Petrolifera Petroleum Ltd., from which it inherited land in the Neuquén Basin. It’s a mid-cap company valued at about $1.37 billion.

The Future of Argentinian Shale Production

Although things look good for the future of Argentinian shale production, not everyone is convinced.

“Shale gas could develop very quickly in Argentina, but only at the right price and we’re not there yet,” Halliburton Co. (NYSE: HAL) Chief Executive David Lesar told investors in September.

It’s important to keep in mind the politics involved with Argentina, but the third-most shale gas reserves in the world are nothing to shrug off. When big players like Exxon and Chevron take notice, investors should, too.

Disclosure: Investment U expressly forbids its writers from having a financial interest in any security they recommend to our subscribers. All employees and agents of Investment U (and affiliated companies) must wait 24 hours after an initial trade recommendation is published on online - or 72 hours after a direct mail publication is sent - before acting on that recommendation.