Introduction

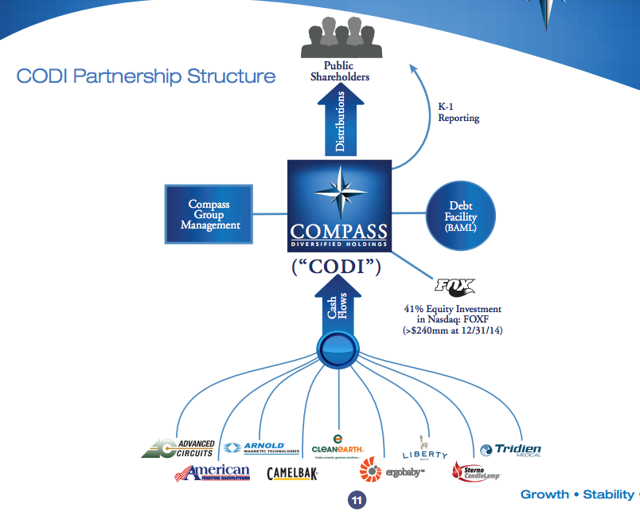

Compass Diversified Holdings (NYSE:CODI) is an "acquirer, owner and manager of high cash flow, niche leading businesses operating in attractive industries." CODI's public structure provides investors with an opportunity to participate in the ownership and growth of companies that have historically been owned by private equity firms. Before we continue, it's important to note that CODI operates as an MLP (Master Limited Partnership) meaning any investor must be aware of the tax implications of owning equity (you'll have to deal with K-1 Reporting). Also, it's important to note that Compass Group Management is paid 2% of book value as a management fee -- with no mark-to-market increases in fee level as the value of businesses increase -- and also receives 20% of realized gains after a 7% hurdle. A diagram of the basic structure of CODI ownership is shown below:

Analysts at independent rating agencies have contrasting opinions on the stock. The three analysts rating the stock at Zacks Investment Research all came up with different conclusions. One analyst rates it a "1-Strong Buy," another a "3-Hold," and the third rates it a "4-Sell," for an average score of "2-Buy" according to the firm. Keefe Bruyette & Woods maintain a "Market Perform" rating on the stock but has a price target set at $18.5 (13% higher than its current price). Finally, TheStreet has rated it a B (Buy). We agree with the general consensus of these rating agencies and recommend CODI to any dividend-focused investor who's comfortable with the company's MLP capital structure.

Value Breakdown

We take a quantitative approach to investing, preferring to focus our analysis on metrics that have strong predictive ability. Thus, we tend to analyze academic papers and perform historical back tests on different metrics before including them in our analysis. We will provide links to the academic papers we draw inspiration from as we progress through our breakdown of the stock, so investors can see for themselves what we base our conclusions on. We'll start by analyzing Compass' value profile. This is important to look at, as Nobel laureate Eugene Fama found that, "Value stocks have higher average returns than growth stocks."

CODI' valuation profile is shown below:

It's clear from the value metrics provided above that CODI is undervalued. To us, CODI is most attractive because of its dividend yield of 8.72%. Not only is this in the 95th percentile of the market, but also the dividend yield is very likely to remain consistent over the coming years. Since 2007, management at Compass has made the distribution of dividends a priority, evidenced by the chart below:

If CODI was paying strong dividends throughout the financial crisis, there's little reason to believe that they will stop anytime soon. With a sales yield of 106% and an earnings yield of 31.55% over the last 4 quarters, it's clear that CODI is a strong, stable company with good management. At a price-to-book ratio of 1.17, Compass is not overvalued on a book-value basis and is relatively cheap in today's expensive market.

Growth Breakdown

There are a number of different growth metrics that have been academically proven to predict stock returns. Most important among them is price momentum. Winning stocks keep winning, and losing stocks tend to keep losing. While we believe CODI should be bought because of its value and dividends, one should never ignore metrics that have been proven to have predictive ability. CODI's growth profile is shown below:

Although CODI has weak price momentum over both the 6-month and 12-month horizons, investors have reason to be optimistic as the current price is still reflecting the 6% price drop from the 6m share offering of November. There's still a chance that the stock will return to the $18.00 price that it was selling at before this latest offering. Though we're not bullish on the stock because of its growth prospects, the ROE of 49.50% and ROA of 22.10% (placing it in the 94th and 97th percentile of the market, respectively) provides some level of opportunity for investment on a growth basis.

Smart Money Breakdown

In addition to value and momentum, we will also analyze how the "smart money" on the Street is playing Compass. "Smart money" stakeholders are short sellers, company insiders, and institutions. Each of these stakeholders tends to be much more sophisticated than the average investor due to their inherent advantages. Company insiders know their company inside out while institutions and short sellers spend millions of dollars on research. We have found loads of academic research showing that short sellers, company insiders, and institutions all predict stock returns. CODI's "smart money" breakdown is shown below:

Before I start the analysis, it's important to note that we will not be placing a heavy emphasis on insider transactions due to the capital structure of the company. With that said, an increase in institutional ownership of 11.16% over the last 6 months is a good sign. Pair that with a short float of 0.70% and it's clear that the smart money doesn't expect to see CODI drop much lower than the $16.34 that it trades at today.

Qualitative Analysis

For our qualitative analysis, we will take a look into the financials of Compass' portfolio. This portfolio consists of 3 branded consumer companies, 6 niche industrial businesses, and Fox Factory Holdings (NASDAQ: FOXF) -- which CODI maintains 41% ownership of.

Branded consumer:

- Camelbak: Revenues grew 6.3% ($139.9M to $148.7M) over the last year, but remain 5.6% below the $157.6M revenue posted in 2012. Adjusted EBITDA also grew marginally over the last year, but also remains well below the $40M posted in 2012.

- ErgoBaby: Revenues and adjusted EBITDA grew impressively at 22% and 26% over the last year.

- Liberty Safe: Had an abysmal year. Adjusted EBITDA dropped 77% as revenue dropped 28%. Compass is looking to reduce inventory levels and is working with management to "right-size the business" this year.

As a whole, the three branded consumer companies dropped 3.8% in revenue (to $321.1M) and 12.3% in adjusted EBITDA (to $60.8M) this past year. However, management is expecting a rebound of 11% in revenue and 13% EBITDA in the coming year.

Niche Industrial:

- Advanced Circuits: Revenues dropped 1.05% (to $85.9M) and EBITDA dropped 2.04% (to $27.6M) from 2013.

- American Furniture Manufacturing: Revenues gained 23.6% (to $129.7M) and EBITDA gained 875% (to $3.9M).

- Arnold Magnetic Technologies: Revenues dropped 2.7% (to $123.2M) and EBITDA dropped 8% (to $16.3M).

- Clean Earth: Proforma statements show a 5.5% gain in revenue (to $164.5M) and a 26.4% gain in EBITDA (to $33.0M).

- SternoCandleLamp: Proforma statements show a 4.7% gain in revenue (to $140.9M) and 36% gain in EBITDA (to $18.7M).

- Tridien Medical: Revenues gained 11.9% (to $67.3M) and EBITDA dropped 1.8% (to $5.2M).

As a whole, the six niche-industrial companies gained 6.4% in revenue (to $711.5M) and 14.5% adjusted EBITDA (to $104.6M) over the past year. They also added two companies, Clean Earth and SternoCandleLamp, to their portfolio last year.

Fox Factory Holding Corp.:

Revenues gained 13.6% to $74.1M compared to $65.3 million in the same period last fiscal year. Adjusted EBITDA gained 12.1% to $12.1 million compared to $10.8 million in the same period last fiscal year. However, the stock is trading at 12.28% discount compared to what it was at this time last year.

Conclusion

Having considered the recent trends in each of Compass' portfolio companies, we've come to the conclusion that there is reason to be optimistic about CODI going forward. Other than the cyclical, boom-bust nature of the Liberty Safe business, none of the portfolio companies took a major hit over the last year and a number of them prospered. The acquisitions of Clean Earth and SternoCandleLamp provide even more opportunity for Compass to continue growing.

Our final conclusion is that CODI is an attractive, safe purchase for a dividend-focused investor who is comfortable with the MLP capital structure.