Shares of Altria (NYSE:MO) had a strong first two months in early 2015, rising as much as 12%. However, the stock has since fallen around 6% and is closing in on the crucial 4% dividend yield mark. This decline may represent an entry point for investors looking to add one of the best dividend growth names out there to their portfolio.

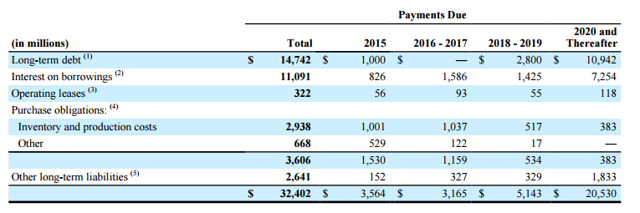

Repaying high yield debt is a good use of cash

Last week, Altria announced a cash tender offer for any and all of its senior unsecured 9.700% Notes due 2018. Of the original amount of $1.656 billion outstanding, $792.5 million was tendered. Altria was offering $1,282.76 per every $1,000 in principal. As a result, short-term EPS will take a $230 million hit.

This seems like a wise use of capital by Altria. The company currently enjoys an investment grade BBB+ credit rating from the S&P. With rates as low as they are, Altria could issue debt for much lower rates than the 9.70% on these senior notes. Indeed, more recent long-term debt has interest rates ranging from 4.00% (the 2024 notes) to 5.375% (the 2044 notes).

Assuming this high-yield debt is paid down with cash, Altria will be saving ~$77 million per year in annual interest expenses. This is around 9% of current estimated annual total of $826 million in interest for 2015.

Source: Altria's 10-K

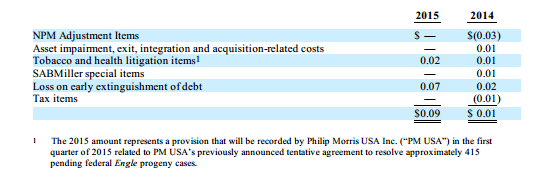

2015 guidance reaffirmed is bullish signal

In a related event, Altria has also reaffirmed its 2015 EPS guidance. The company is expecting its earnings to grow 7 to 9% from 2014 levels, adjusted for various items including the above mentioned $230 million, or $0.07 per share, loss on its debt repayment.

Source: Altria SEC filings

Given that Altria had adjusted EPS of $2.57 in 2014, this guidance calls for an EPS range of $2.75 to $2.80. This gives the company an ~18.5x PE ratio at current prices.

Settled lawsuits removes a potentially large negative catalyst

Altria also made news when it and its soon to be merged rival tobacco companies Reynolds American (RAI) and Lorillard (LO) agreed to pay a combined $100 million to settle close to 400 pending federal lawsuits in Florida. Altria and Reynolds are to pay $42.5 million while Lorillard will pay $15 million.

This is a major coup for these names, removing a large potential liability, as the companies had previously had to pay much larger sums to winning plaintiffs - $500 million in Florida over the past decade. Many of these Florida cases are known as the Engle lawsuits and have been a thorny issue for the industry. From the above linked article:

In 2000, a Florida jury ordered that the companies pay a record-breaking $145 billion in damages, but that decision was later reversed in a 2006 ruling that decertified the class but allowed former class members to file individual suits. That paved the way for more than 9,000 suits to be filed in federal and state court.

Thousands of those cases have been dismissed. Plaintiffs have won about 60% of the remaining state and federal cases brought to trial and been awarded more than $500 million in damages from approximately 124 cases, according to Morgan Stanley.

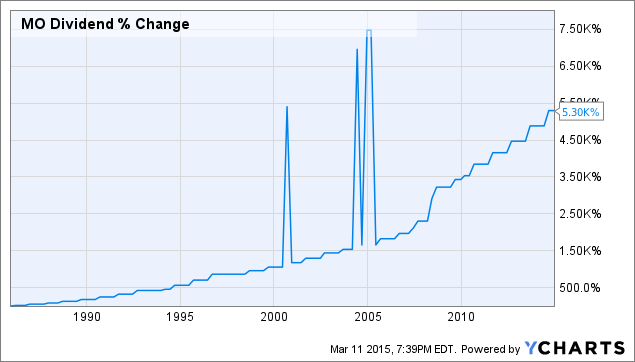

Dividend growth is Altria's name

Altria has to be one of the better known dividend growth stocks out there. The company has increased its annual dividend for 45 consecutive years. In 2014, the company rewarded its shareholders with a large 8% dividend increase. This was in line with its historical trend as the company typically aims to payout 80% of its adjusted EPS in dividends.

After this increase, Altria's payout ratio is now around 75% of its 2015 EPS guidance, leaving plenty of room for another dividend hike of a similar size. With its above average yield at 4%, Altria's level of dividend growth is impressive.

MO Dividend data by YCharts

Conclusion

For those investors looking to start a position in Altria, the recent pullback seems like a buying opportunity. The dividend yield is finally near 4%, which offers a short-term floor. Furthermore, EPS growth in 2015 seems fairly robust. At a 18.5x multiple, 7 to 9% growth makes Altria fairly valued. In addition, always keep in mind Altria's large 27% stake in frequent buyout target SABMiller (SBMRY) worth well over $23 billion when valuing the stock.

MO Total Return Price data by YCharts

Disclaimer: The opinions in this article are for informational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Please do your own due diligence before making any investment decision.