I. Introduction

Mr. Market has recently bestowed upon the diligent investor in the resource space a grand buffet of cheap securities. Whereas many look at the price to dictate the company's value, the value investors look at the price of the equity as an entry point into purchasing value at a discount. It's no wonder many notorious value investors are starting to enter the mining sector itself.

"It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price." - Warren Buffet.

With such little analysis of mining equities (GDXJ) (many analysts can't take their bubbly eyes off the high flying biotech and tech stocks; we wish them luck), it may take some brilliant writing and an intriguing persuasion as to why one would even look at this beaten, almost dead, sector. In hindsight after the construction of this article, one may have rethought the title from "the" investment case to "An" investment case. Is there even "A" single case in this sector?

It's a minority opinion, but this author believes the case for buying mining equities is clearly obvious. And one in particular is painfully obvious.

That company is Gold Resource Corp (NYSE:GORO).

II. The Case Presented

Gold Resource Corp is the absolute trifecta for mining bulls: competent and proven management, high ore grades, and cash flow positive.

The company began production in 2010 of its El Aguila project in Mexico with very attractive high grade ore. It poured gold and silver, and shortly after it began producing various base metals such as zinc, copper, and lead. The mine itself is a low-cost producer, being able to generate cash flow even at $1,000 dollar gold. It has successfully replaced reserves for each year of the amount it has extracted from the ground. The company paid a very attractive $0.03 cent dividend per month only just 30 days after initial production.

Gold Resource Corp has one of the tightest share structures for a mining company: an outstanding fully diluted share structure of less than 60 million. The management owns roughly 8% of the shares outstanding. And the company to date has returned over $102,000,000 in dividends - that's over $1.90 per share returned in dividends.

It's rare to have such a shareholder-focused metals producer that is generating growth per share, not growth of the business just for growth's sake. The only rational objective for a company is to grow its per share value. And Gold Resource Corp focuses on just this - returning real, not nominal, value.

III. The Companies Focus: Return of Capital

Warren Buffett was keen on measuring his companies on relative value they returned per share - a yard stick of measurement. As stated in the book, Buffett: The Making of an American Capitalist, Roger Lowenstein (the author) had written that Buffett was not interested in how many sales, or total profit as an isolated number a company conjured. But what counted was the profit as a percentage of capital invested. The yardstick Buffet used for measuring companies performances was return on invested capital (ROIC).

ROIC - A calculation used to assess a company's efficiency at allocating the capital under its control to profitable investments. The return on invested capital measure gives a sense of how well a company is using its money to generate returns. Comparing a company's return on capital with its cost of capital (WACC) reveals whether invested capital was used effectively.

Since gold (GLD) decoupled from the US dollar in 1971, gold mining became potentially extremely profitable. In the past, each gold ounce had a price of $35, so if the costs of mining that ounce out of the ground was $25, it would yield a $10 profit. Now as soon as gold was detached from the US dollar peg, the price went well over $100/oz. Let's assume due to inflation and costs going into mining, it now costs $50 to mine that same ounce out of the ground (all gold is homogeneous; each ounce weighs and looks the same), but it could be sold for $100. The company now yields a $50 profit - a 400% increase.

Thus as the profits grew, so did incentive to mine gold, and consequently for Wall Street clamoring to begin investing in the mining equities. Promoters soon touted not profitable mines, as they could always dilute shareholders to pay their bills, but massive ounce-producing mines. The CEOs of these companies bragged of the size of their castles, regardless of the plagues within them. Investors became enamored of the sheer size of these mines and the leverage they offered as simultaneously managements were pleased with the cheap financing. It's ironic that one of the oldest professions (mining) to date is only roughly 40 years young with regards to the capital markets.

But at the end of the day, as always, cash is king. And since 2012 that has become more clear than ever in the mining sector. It matters not how large the mine is and how many hundreds of thousands of ounces can be extracted but how thick the profit margin is per ounce and consequently growing cash per share.

Gold Resource Corp has made it a philosophy of their company to have low costs and high gold grades, which gives shareholders thick profit margins.

Source: GORO Presentation - 11/2014

As one can see, the company - even in this depressed metals environment - generates a positive earnings per share and net income (most importantly free cash flow). The company's high ROIC relative to mining companies and the management's strong ambition to grow the ROIC is something that should make investors ecstatic.

IV. Mine & Property

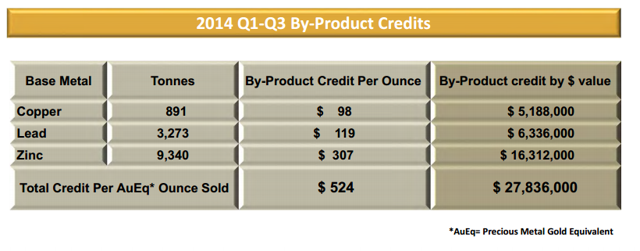

As stated above, Gold Resource Corp has high grade silver, gold, and base metals. These base metals serve as byproduct credits, meaning they are used to offset the cost of gold ounces. Observe below:

Source: Gold Resource Corp.

The higher base metal contents are favorable for the company's cost structure. This gives Gold Resource Corp a large advantage over its peers. Also as base metal prices begin to rise in the future, the company's revenues will follow - leading to high costs saved per gold ounce.

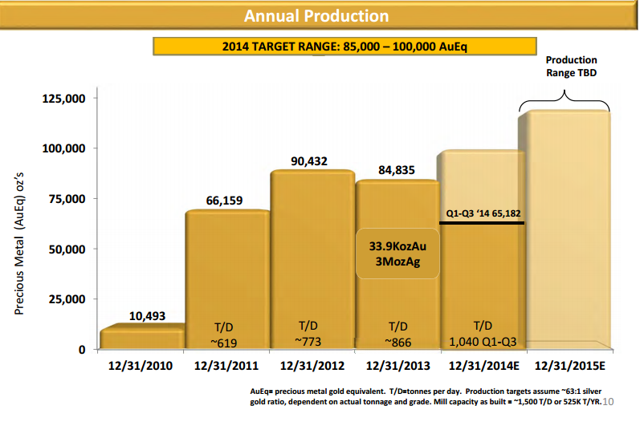

The investor will notice the trend upwards of ounces produced from the company's profile (see chart below).

Source: Gold Resource Corp.

At 100,000 gold equivalent ounces at a price of $1200/oz, the revenues for the company would be $120,000,000. And at AISC (all-in sustaining cash costs) of roughly $900 (give or take - with lower oil and stronger dollar, costs should be lower) giving the company a 25% profit margin, this would be gross profit of $30,000,000. Divide this by shares outstanding and that is about 50 cents per share in profit. In a market where companies are struggling and some even going bankrupt, such as the recent collapse of Allied Nevada Gold (ANV), this is very relieving that it can survive and even profit during this bear market.

And in this sector, if cash is King then grade is Queen. Gold Resource Corp's property contains a marvelous average of 8 grams-per-ton.

According to the World Gold Council (WGC), larger and better quality underground mines contain around 8 to 10g/t, with marginal underground mines have averages of around 4 to 6 g/t.

But what is very lucrative about Gold Resource Corp is the potential of another producing underground mine with similar qualities to the already producing El Aguila project. This is called by the company 'Switchback'. Extremely high grades have already been discovered and further drilling needs to be done, but the management is very confident and excited about this project.

V. Lower Costs and a Margin of Safety

Reading between the lines one realizes that due to falling oil prices and a strong dollar, mining companies that produce outside the US - having fixed liabilities such as salaries in other currencies - will have their costs drop significantly. Mining is heavily capital intensive, thus the reduced oil prices will greatly benefit the mining companies' balance sheets as the amount of oil it takes to make diesel (42 gallons crude to create 12 gallons of diesel) which then is used to fuel massive machines and trucks. As the price of gold has stayed steady and hovered around $1,200, any strength in the dollar itself is in real terms beneficial to mining companies. Gold Resource Corp is in Mexico which means they sell their extracted gold bullion for dollars which they then convert into Pesos. And the dollar has appreciated by over 17% so far and the Peso is falling against the dollar, further bullish for this company's already low-cost operation.

Benjamin Graham, the father of value investing, taught many to buy companies at their cheapest below intrinsic value. This is what's called a Margin of Safety - limited downside after purchase. Observe the following:

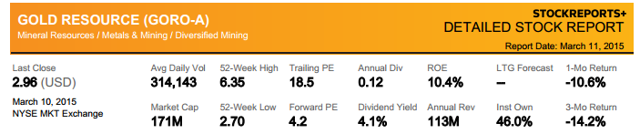

Source: StockReports

The company has a forward P/E ratio of 4.2 and a dividend yield of over 4% (about 1.5% higher than the US 10-year). It's testing multi-year lows and is over 50% off its 52-week high. This necessarily means it is 50% less risky and 50% cheaper.

With a current P/E ratio of the S&P 500 sitting at about 20 and the Dow at about 17, Gold Resource Corp looks favorably cheap.

Many investors tout the conventional wisdom of buying low to sell high, but what is low and what is high? Buying low would appear to be purchasing a company that no one else cares to even look at, a security that has a 5 or lower P/E ratio, a sector that is already down 80% since 2012 - leaving little room for further decline. This is the time to be greedy.

VI. Conclusion

Let us recap what one share of Gold Resource gives investors:

- A competent and shareholder-friendly management.

- A high ROIC philosophy; debt free; compelling margins + cash flow positive; low-cost producer.

- A treasury of roughly $30 million in cash and gold/silver bullion - capable to acquire assets in this bear market (which its already on the move to do).

- Direct benefactor of the rising dollar and lower oil prices.

- A dividend to compensate investors' patience as capital appreciation will return in the future.

- Undervalued and relatively cheap which offers an engaging point of entry.

- Friendly and safe mining jurisdiction.

- High grade producing mine with a massive land package and intriguing potential mine project known as 'Switchback".

Not only is this company an outstanding contrarian play for the hated and pessimistic mining market, but it is a phenomenal value investment. The quantitative facts show us it is cheap and the qualitative assumptions about the future of gold mining is favorable. Being bullish is an understatement.

The possibilities for this company in this market are interesting. They have enough cash to begin purchasing distressed mines and exploration projects. They can enter streaming and royalty agreements by using its cash holdings to purchase them in this buyers' market. The company could pay out a special one-time 50 cent dividend to its shareholders with its current cash. It can further buy back its shares as the prices are undervalued and cheap, increasing the value of each share for when prices rise. It could further drill its 'Switchback' property and hopefully it becomes a parallel producing mine. The company is in great position to do what most can't: take action.

All investors know what occurs during a bull market - all prices rise with a rising tide. And just as Alan Greenspan believes, this author also speculates that gold in the near future will be "measurably higher". Thus it makes sense not to worry about how high a company will go in a bull market, but in the present bear market one must worry: Can this company survive in a bear market to eventually flourish in the bull market?

Gold Resource is a company that not only will stay solvent in this brutal market, but will profit and reward shareholders. This is all that an intelligent value-laden investor could ask for and more.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.