I recently penned an article describing my bullish thesis for AT&T (T). In the "risks" section of that piece I discussed what I believe to be a common headwind that all income oriented investments are currently facing: the market's fear of impending interest rate hikes and the potential sell-off of dividend growth names that this fear might inspire. It was a long, diverse article, though in the comment section there were several focused discussions about this assertion. Someone, somewhat incredulously asked me if I truly believed that interest rate sensitivity wasn't already priced into dividend stocks? My simple response was yes, I truly believe this; however, things are rarely simple. Although I quickly explained this to the commenter, Wednesday's big rally on the FED's generally dovish statement made it all the more clear to me that this market hasn't priced in rate changes, but is largely focused on the short-term. This is concerning for me as a dividend growth investor and I pose the question: should DGI investors worry about interest rate volatility?

Many of the high dividend names and typically interest rate sensitive stocks have sold off lately due to the assumption that rates will begin to rise in the near future. Some of these declines have been because of the impact of rising rates on a company's business operations, but I believe that others have been because of the fact that many non-traditional DGI investors, both individual and institutional, have poured into the high yielding dividend growth names in search of reliable yield. These investors don't necessarily have the long-term view that a dividend growth investor typically maintains, they are focused on the current yield that their portfolios generate. With the fixed income market offering such low yields it has become prudent for these investors to accept the inherent risk that comes with equity ownership to achieve their yield targets, because there simply aren't other viable options. It seems as though these investors are itching to get out from under this equity exposure, attempting to call a top every chance they get and move back into the fixed income space at any hint of rising rates.

Here are two images I captured in the aftermath of the post-jobs report sell-off a few weeks back showing the devastation incurred by dividend aristocrats and higher yielding, more interest rate sensitive stocks commonly followed by DGI investors:

As you can see, these were some very violent moves.

I believe this recent volatility in the income names is signaling that the market hasn't completely priced in a raise, otherwise we wouldn't be seeing these sorts of reactions. I don't like seeing these somewhat irrational swings in the stocks that I own. I've bought into the DGI mindset due, in part, to its predictable nature. My portfolio consists primarily of conservative core and value type holdings; I've made a point to avoid momentum stocks and others that move on whims rather than data driven logic. I expect the companies that I own to trade up or down on their earnings performance and the ensuing changes that occur to their fundamentals, not because of rampant speculation about monetary policy.

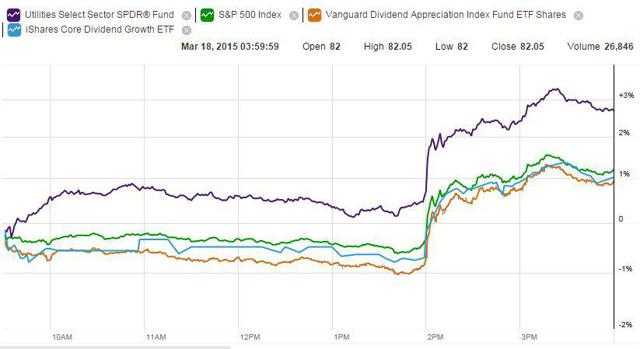

Obviously we don't live in a fundamental investor's fairy tale world, from time to time the market will move irrationally. Human nature and the basic emotions of fear and greed rule the markets, I get this. I also firmly believe in a statement originally attributed to Benjamin Graham and recently hammered home by Warren Buffett, "In the short run, the market is a voting machine but in the long run, it is a weighing machine." Even with this in mind if becomes difficult to maintain a calm and collected long-term view with such dramatics going on in the marketplace in the present. If you missed the major rally yesterday here is a graph depicting the violent uptick that the market experienced at 2 pm, just after the FED's statement and throughout Janet Yellen's post release press conference where she made it clear that although the word "patient" was dropped from the FED's language, there were not any plans in place to move quickly tighten policy or hike rates.

Relevant Tickers: Vanguard Dividend Appreciation Fund (VIG), S&P 500 ETF (SPY), iShares Core Dividend Growth ETF (DGRO), Utilities Select Sector Spider ETF (XLU)

As you can see, this 2% swing was a huge move, turning a red day in the market brightly green. I'm not complaining about this upward move, my portfolio enjoyed the news just like many others. That said, what I am complaining about is the fact that traders have seemingly forgotten their reaction to the positive jobs report a few Friday's ago that seemed to point towards the economy being strong enough to begin to raise rates. I believe Yellen when she says that when rate hikes begin they will be very slow. That makes sense and I respect the FED's willingness to ease the emotional market along, attempting to prepare it for the bumps (however slight) down the road. My main concern as a dividend growth investor is that the market won't believe her and will continue to overreact (if we're seeing 2% swings on language, I can only imagine the potential reaction that the market will have when the FED actually makes a move).

I see three primary actions that I can take as a portfolio manager moving forward to prepare for what I believe to be inevitable overreactions coinciding with rate hikes in the relatively near future.

First, and probably the easiest and most prudent thing to do would be to simply ignore the noise and continue my day to day business. I could continue to screen the market for intriguing value and add to my portfolio accordingly. I could continue to hold my current positions, monitoring earnings, cash flow, debt levels, and shareholder return policies, rather than the volatility in the stock prices. I could continue to collect my dividends and selectively re-invest them every month, slowly but surely building my portfolio and increasing my income stream. This is the sort of approach that many of the traditional DGI, buy and hold type investors that frequent this site advise and likely adhere to. That said, this isn't the only option that investors have, there are several forks in the road.

The second, and very similar option that I am beginning to consider is to begin to build a larger cash position. In the past I have always re-invested my dividends on a monthly basis. As a young investor in the accumulation phase of my portfolio's construction I have also made a point to slowly, but regularly move cash into the markets, buying value when the margin of safety becomes appealing. I have enjoyed watching my share count rise and have seen the benefits of dollar cost averaging into positions. Whether one is adding to weakness, bolstering strength, increasing yield or dividend growth potential, the constant act of re-investment allows an investor to continuously re-balance their holdings to conform with their comfort levels. What's more, in a secular bull market like we've experienced for several years now, these regular re-investments not only increase one's income stream, but have also translated into noticeable capital appreciation (something that any cash sitting on the side lines did not do).

Having said all of this, the volatility in the markets, especially in the income related spaces that DGI investors primarily operate in, and the fear that comes along with his volatility, may become an enticing enough force to cause me to increase my cash holdings. Who knows, I could be wrong about continued volatility and maybe this FED statement and rally is the end of this rate sensitivity business. I sincerely doubt it, though I don't have a crystal ball and I'm left with something that I do my best to avoid: speculation. I view cash as a hedge against my fears; in the event that I am correct there will be opportunities to add shares of high quality companies at bargain prices and I want to be prepared.

The third viable option that I see is one that requires a fair bit of active portfolio monitoring and management. The third option involves profit taking and potentially severing relationships that an investor has with companies who've become overheated through this bull market. Some might consider this to be more akin to trading and attempting to time to the market than investing, but I tend to disagree; the recent historical data seems to point clearly towards continued volatility. I am not considering a wide scale sell-off of my holdings. However, I am considering identifying those companies who are most likely to be negatively viewed by an overly emotional market in a rising rate environment and decreasing exposure if...and this is a big if, those companies are trading above their fair value calculations. Typically, I would just let these companies ride so long as they continued paying me a reliable increasing dividend. I believe that premium companies deserve premium valuations and it doesn't bother me when a company that I own begins to trade at a valuation that I wouldn't feel comfortable buying into in the present. This is because I enjoy owning quality and although I completely agree with the simple idea of selling high and buying low, the term "high" is highly subjective and only truly identifiable in hindsight.

That said, in the event that a position, regardless of its quality (remember, I don't think that a large portion of the market is concerned with the quality of business operations when it comes to DGI names, instead they're focused on yield) experiences a significant sell-off I think it is prudent to consider the potential losses in comparison to the expected dividend income. For instance, lets take a look at Realty Income (NYSE:O), a company that has become famous in dividend growth circles. Realty Income, or "The Monthly Dividend Company" (O has increased its monthly dividend 80 times since joining the NYSE in 1994) has experienced great performance throughout 2014 and early 2015. The stock is trading up 31.27% from if 52 week low and only down 6.36% from its 52 week high. O is up 5.97% YTD. Being a REIT, O is one of the more volatile names when it comes to rate related sell-offs or rallies. This stock traded down more than 4% during the post-jobs report sell-off. Yesterday, the stock climbed 2.87% on Yellen's dovish news. Right now O is trading at $52.01. The stock is yielding 4.50% with a current annual dividend of $2.27.

I originally bought O when the stock was trading in the $40/share range and yielding north of 5%. I think this is one of those stocks that has likely been over bought because of its high yield and dividend reliability. I think the stock was oversold in the $40 area but is likely overbought at today's prices. Because of this, I would potentially be willing to sell some or all of my shares in at current prices with the belief that I will eventually be able to buy back those shares at a lower prices with more reasonable valuations. I can almost hear die hard buy and hold DGIers screaming, "How could you!?" as I type this. My justification for a potential move, or at least my consideration of one, is this. Lets say that O sells off 10% the next time that a rate rise seems imminent. At current prices that would mean the stock loses $5.20 in value...or, roughly 2 years of dividend income. What if the stock sold off 20% or even 30%? Big moves like this in the REIT space have precedence, look at the sell-off of late 2013 when it was suspected that QE would begin to slow down. A 20% sell-off would mean the loss of $10.40/share (or 4.5 years of dividend income) and a 30% loss equates to a $15.60 loss per share, or almost 7 years worth of dividends.

This way of thinking isn't necessarily based off of the fundamentals, but comes from an income oriented mindset. When income is the focus, one has to ask themselves when facing a potential sell-off situation: is the risk of continuing to hold worth the wait to break even? Do the chances at potentially buying shares yielding 5% or more outweigh the stock's current 4.5% yield? The answers to this question will be different for everyone, but I believe that the questions themselves are worthy of consideration all the same.

So, in conclusion, I want to reiterate that I am not advocating for dividend growth investors to sell all of their shares, effectively severing their income streams, on the hope that they will find better value in the future. Truth be told, I am not advocating that anyone do anything. Out of the three potential ways to react to this rate sensitivity, the first option: doing nothing out of the ordinary, could very well be the best choice. There are never clear cut choices, otherwise, we'd all be rich. Investors must do what feels right in their hearts. That could be anything from doing nothing, to selling everything, to something in-between. In my case, this in-between situation is likely the path that I will trod. If yesterday's rally continues I will reevaluate my current positions and begin to determine the risk/reward scenario of continuing to hold them as valuations increase. Although I am generally opposed to attempting to time the market, I don't think there is anything wrong with an investor taking profits from time to time. I don't think this makes anyone less of an "investor", though I'm sure I'll hear otherwise in the comment section. Only time will tell what the right choice will be, and sometimes, even in hindsight, it is hard to tell. I am going to do what I deem best for my portfolio's value and the health of my income stream. I wish everyone the best of luck in these unusually volatile times.