CYS Investments (CYS) is a mortgage REIT. It invests in Agency RMBS. These are collateralized by Agency ARMs, Agency Hybrid ARMs, and Agency fixed rate mortgages. When such a company can maintain or grow its book value while paying a great dividend, it is a good investment. In FY2014, CYS grew its book value from $9.24 at Q4E 2013 per share to $10.50 per share at Q4E 2014. This +$1.26 per share growth amounts to +13.64% for FY2014. When you consider that CYS Investments pays investors a 13.4% annual dividend on top of the book value performance, that means CYS was a great investment in 2014. It generated a total return for FY2014 of about +26.6% based on the December 31, 2013 book value of $9.24. It is also likely still a good investment for 2015.

Since many MBS portfolio managers have been worried that interest rates would skyrocket at almost any time, some managers have been hedging strongly against this. CYS has been instead betting that the still strong downtrend in the 10-year US Treasury Note yield would continue. For all of FY2014, this had been a good strategy. However, the worry had increased in 2015 as the Fed had formerly said it expected to end Q4 2015 at a Fed Funds rate of 1.125%. This implied several raises, which would probably start as early as June or even April 2015. The new statement expects an end of 2015 Fed Funds rate of 0.625%, which is much less. This announcement suggests the Fed Funds rate is more likely to see the first raise in September or October of 2015 as opposed to June 2015.

The Fed lowered its inflation estimate for FY2015 from 1.0%-1.6% to 0.6%-0.8%. The Fed also lowered its FY2016 inflation estimate slightly to 1.7%-1.9%. The Fed downgraded its view of U.S. GDP growth for FY2015 from 2.6%-3.0% to 2.3%-2.7% and FY2016 GDP growth from 2.7% to 2.5%.

U.S. GDP growth in Q4 2014 was only +2.2%. Lower oil prices (lower oil revenues = lower dollar amount of goods produced = technically less goods produced), lower refined products prices, lower oil companies' CapEx's for 2015, and lower oil company employment in 2015, all argue that U.S. GDP growth in Q1 2015 will be much less than the GDP growth seen in Q4 2014. Investors should be prepared to see this; and they should strategize accordingly. The Fed could easily put off raising rates again. Near term, the U.S. economy seems sure to be much weaker than they are thus far predicting. It may be near-zero growth in Q1 2015 (or even negative).

Regardless of the exact specifics, a weaker economy should lead to lower U.S. interest rates. Further the ECB QE buying of many weak (some strong) EU country sovereign bonds is dragging their yields down. Hence you have an environment where stronger, safer, cheaper, higher yielding U.S. Treasuries should have their yields dragged downward by free market economic forces due to the weaker, more expensive, lower yielding bond of such countries as Spain and Italy.

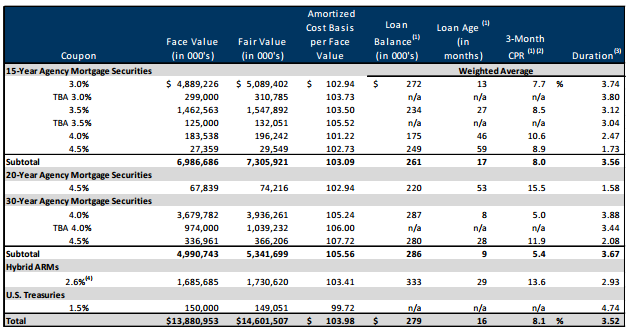

As an illustration the 10-year U.S. Treasury Note yield is 1.93% as of the close March 20, 2015. The Spanish 10-year (1.18%) and the Italian 10-year (1.20%) government Notes are far lower yielding currently; and they have been trending strongly downward for some time. CYS' current strategy is betting on lower rates. As of December 31, 2014, CYS had a fair value Agency portfolio of approximately $14.6B. For this, CYS had hedges with a notional value of $10.15B (about 70% hedged) as of December 31, 2014. This was light hedging for a situation in which many expected interest rates to possibly skyrocket.

With the Fed's March 18, 2015 dovish announcement, the possibility of skyrocketing interest rates is probably off the table for the next year or two. This should mean that CYS' strategy is a good one for the current U.S. and world economic situation. Lower cost hedging allows it to keep more of the net interest spread income. Plus it allows it to profit more from the likely gains in MBS values as interest rates decline. In a more heavily hedged case, the losses to the values of the hedges would eat virtually all of those gains.

If CYS is betting correctly, how is it likely to do in Q1 2015? We have to look at the actual portfolio to get a reasonable feel for this (see the December 31, 2014 portfolio below).

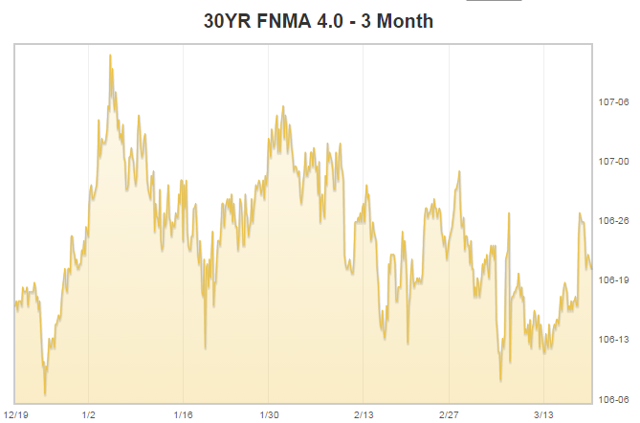

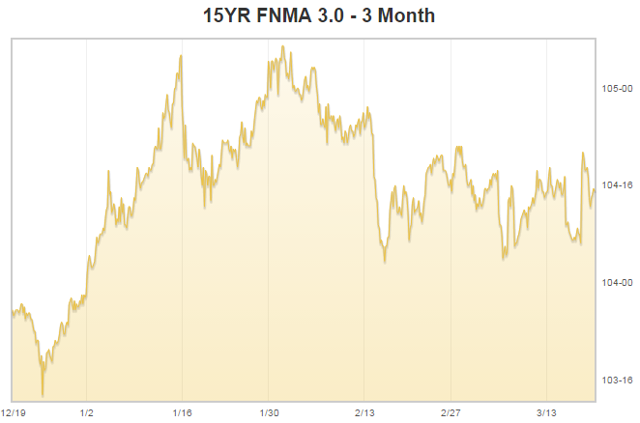

As investors can see, the two largest holdings in the portfolio are the 3.0% coupon 15-year fixed rate Agency MBS and the 4.0% coupon 30-year fixed rate Agency MBS. I will approximate the above with the 30-year fixed rate FNMA 4.0% coupon MBS (see first chart below) and the 15-year fixed rate FNMA 3.0% coupon MBS (see the second chart below).

Since the 10-year U.S. Treasury Note yield has fallen from 2.17% on December 31, 2014 to 1.93% as of the close on March 20, 2015 (-24 bps), one would think that CYS' Agency MBS would have gone up in value. Using the above charts as approximations for the largest Agency MBS holdings in the portfolio, one can see that the value of the 30-year fixed rate FNMA 4.0% coupon MBS is almost precisely the same value it was on December 31, 2014. The value of the 15-year fixed rate FNMA 3.0% coupon MBS is substantially higher than it had been on December 31, 2014. One might posit that the basis spread might be tighter for the 15-year fixed case. One might posit that the 15-year fixed case lost less value due to increasing CPRs (constant prepayment rates). With interest rates likely trending down between now and the end of Q1 2015 (March 31, 2015), both types of MBS seem likely to gain more value. This should mean that CYS will see a small book value gain for Q1 2015. The gain is likely to be less than the gain in Q4 2014 of $0.36 per common share. 15-year fixed rate Agency RMBS are approximately 50% of the portfolio. This should be good news for the book value because they are the biggest book value gainers.

Of course, the 30-year fixed rate Agency RMBS probably provide the most revenue. For the portfolio overall, this revenue likely shrank slightly in Q1 2015 as the yield on the 10-year U.S. Treasury Note fell -24 bps to the close on March 20, 2015. The net interest rate spread with Dollar Roll income was 1.55% for Q4 2014. For Q4 2014, the drop income (dollar roll income) was about $0.08 per common share of the $0.31 per common share in Core Earnings. This barely covered the $0.30 per common share dividend for Q4 2014. A drop in the net interest spread with Dollar Roll income may mean that it will be hard for CYS to cover the dividend fully for Q1 2015 out of Core Earnings. This will likely depend on how much Dollar Roll income is generated by CYS in Q1 2015.

In the case of American Capital Agency Corp. (AGNC), the drop income amounted to about 51% of total monies available to pay the dividend in Q4 2014. In CYS' case, the drop income amounted to only about 25% of the income available to pay the dividend. It is possible that CYS may have tried to make more drop income in Q1 2015. However, it is also possible that the wild swings in interest rates may have prevented this to some degree. We will have to wait for earnings to see. Regardless of the actual result, CYS might decide to continue to pay the $0.30 per common share dividend because the Fed is getting closer to raising rates. If that happens, the net interest spread should go up. In other words, CYS might not have a hard time covering future dividends of the same yield. Further, if the yield (dividend) is cut, it will likely still be above 10%.

The book value was $10.50 per common share on December 31, 2014. It seems likely to be at that level or slightly higher after Q1 2015. With a current stock price of $8.97 at the close on March 20, 2015, the stock would then have to rise at least $1.53 per share (+17%) to get to its December 31, 2014 book value. The huge discount to book value was logically due to the fear of skyrocketing interest rates. The Fed has taken the "skyrocketing" fear off the table. Plus it has delayed its raise of the Fed Funds rates by an estimated three months or more. This should help primarily Agency mortgage REITs to trade closer to their book values.

Interest rates may go up, but they will likely do so more slowly than was being previously anticipated. Mortgage REITs can "manage" through slow interest rate rises. In this scenario, CYS' stock price might logically rise about 10% from its current value. When CYS is also paying a 13.4% dividend, the stock is attractive. It is also attractive that CYS' management has been consistently making the right interest rate calls for the last year or more. CYS is a buy, although it is perhaps a low buy in the still uncertain conditions.

The two-year chart of CYS provides some technical direction for a trade/investment.

As investors can see, CYS has been consolidating sideways for more than one year. Investors can also see that the yellow rising bottoms line is a slightly positive indicator for an eventual upward movement in the stock. Some might see the current chart as a pennant formation that could push the stock either way; but I see it as more positive than negative. Plus the fundamentals back up a positive move up, especially after the dovish Fed announcement. Remember, the stock is far below its book value; and I am only postulating that CYS might erase about half of the difference between the stock price and the book value. Plus, I am seeing a flat to slightly positive book value gain for Q1 2015 for CYS.

This stock might well have a 20%+ total return for 2015. Many income investors will likely be interested in that. The RSI in CYS' sub chart is also trending upward. With management making good strategy calls, CYS is a buy.

NOTE: Some of the fundamental fiscal data above is from Yahoo Finance.

Good Luck Trading/Investing.