Anyone following the complaints about Mattel (NASDAQ:MAT) on places like TheLayoff.com/Mattel or my last article can note that there is a lot of tension within the company right now. They face a plethora of challenges. Declining market share, layoffs, the return of Stockton, an apparent rift between staff and management, and so much more. It's pretty clear that the company has a lot of work ahead in order to turn itself around. From the outside, it seems that they do not have a plan or vision to work towards in order to achieve a turnaround, which is quite concerning to investors, employees, and communities around the world.

A lot of employees blame senior management for the decline of the company. These employees essentially claim that management knows business, but does not understand toy making. The focus appears to be on cutting costs, not on the customer. There are reports of constant reorganization and a lack of communication that has created such uncertainty that people aren't sure what's coming next. But management wasn't exclusive scapegoat. Individuals also blamed their fellow employee for giving up on the company, posting their grievances online for the world to see, and for not doing what they could internally to change the company.

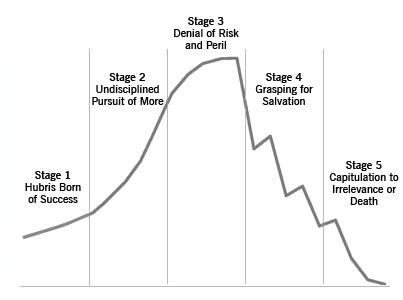

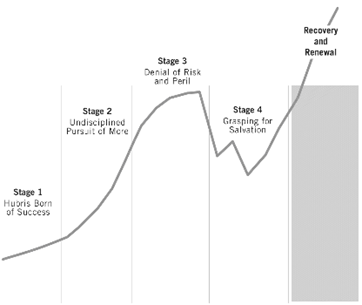

Regardless of who is to blame, I'd encourage the people at Mattel to read Jim Collins' How The Mighty Fall. It's a great book and a fast read. There's a lot to learn from it, as Collins does an amazing job of showing how companies that used to be household names no longer are around or how companies on the brink of failure managed to identify their issues and correct it before it was too late. Here are the stages Collins outlines:

Hubris Born of Success - This stage begins when a company considers success an entitlement and removes focus from their core business and places it into other areas.

Undisciplined Pursuit of More - A company pushes its limits on growth so it may obtain more of whatever upper management defines as success, such as more stores, market share, or revenue, detracting from the ability to deliver great products.

Denial of Risk and Peril - This occurs when many warning signs that the business is headed for trouble begin to surface and are often dismissed.

Grasping for Salvation - The company is in decline and will look for dramatic solutions that will solve all problems the company is having, such as a new executive, product, acquisition, restructuring, or strategy.

Capitulation to Irrelevance or Death or Recovery and Renewal - The company either ultimately fails or corrects itself by identifying the problems and moving quickly to resolve them using the appropriate strategy and focus.

Graphically, here are the stages from Collins' book:

Source: How The Mighty Fall - Jim Collins

Just to be very clear, I very much want Mattel's stage five to look like the second graph, where they renew and take on a new life as a toy company for the 21st century. However, they're very deep into stage four (bolded above). Before getting there, here's how I believe Mattel has fit this model in a 10,000 foot view. I note that this isn't all inclusive and omits some items, but gives a pretty good idea that this was a long time coming:

Hubris Born of Success - This stage begins when a company considers success an entitlement and removes focus from their core business and places it into other areas.

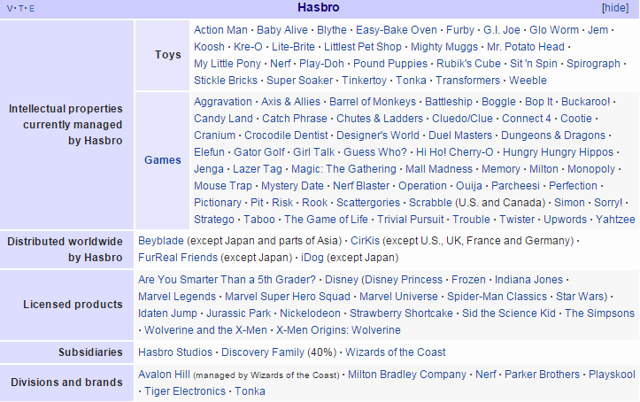

Mattel's hubris has been around for a long time. You don't have to look any further than the list at the bottom of a Wikipedia page to see it. How many of the brands and toys featured below did you play with when you were a kid? How about your parents? Even the millennials played with most of these. How much in here is new blood? If it is new, how much of it is innovative? How much of this just got cosmetic overhauls as the times changed and nothing more?

Compare it to Hasbro's (HAS) list (if you can). Sure, some of Hasbro's brands have been around for a while, but look how you can see toys and lines being added as time goes on. You can think of the evolution that some of the brands have gone through (note: evolution, not update). Mattel doesn't really have such a claim with many of its brands (if any).

The only word that can summarize the difference here is entitlement. Mattel was the toymaker for generations. They didn't have to change anything, because they were the name. They were entitled to their success because their brands were household names.

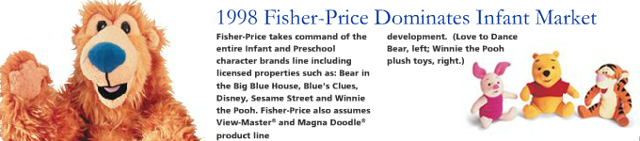

Undisciplined Pursuit of More - A company pushes its limits on growth so it may obtain more of whatever upper management defines as success, such as more stores, market share, or revenue, detracting from the ability to deliver great products.

I'd argue Mattel's stage 2 took place in the 90s. They acquired Fisher Price, Aviva Sports, International Games, Kransco, J.W. Spear & Sons, Bluebird Toys PLC, Pleasant Company, and merges with Tyco Toys. All of this happened between 1990 and 1998. Their pursuit of more got them all sorts of new brands, new IP, new products for demographics, and so much more. The pursuit lead to headlines like this, straight from the corporate history page linked above. Mattel effectively owned the early childhood of the 90s through its growth.

Source: Mattel Corporate Timeline

What Mattel doesn't mention on their corporate website is the failures they picked up along the way in their pursuit for more, such as The Learning Company. The Learning Company made educational games for kids and proved to be such a financial burden that after acquiring the brand in May of 1999, they were sold off in April of 2000. The merger was valued around $4 billion. Mattel notes this blunder with one box that has no additional information:

Side note: Mattel's timeline on their corporate site ends at 2005. A decade ago. Is someone asleep at the wheel, or has nothing worth noting happened since then?

Between the acquisitions and the merger with a company that was essentially pioneering children's learning on computers at a time when such a concept was very new and fairly uncharted, Mattel clearly only had one thing in mind: more.

Denial of Risk and Peril - This occurs when many warning signs that the business is headed for trouble begin to surface and are often dismissed.

The year 2000 is ushered in, and with it, financial troubles and difficulties that Mattel has to figure out. Acutely aware of this issue, Mattel gets into action. Mattel shakes up their management and creates a new vision for the company. Out with Jill Barad and in with Robert Eckert. They get a vision, with focus on cost cutting, making their brands stronger, and reducing some executives at the top to streamline management. For a while, it seems like Mattel is going to make an honest-to-goodness turnaround, as these actions are all critical to a turnaround.

But one thing is clearly absent from Mattel's plan in the early 2000s: what will toys for the 21st century look like? The articles about Mattel through the 2000s show denial of risk and peril. Here's the opening of an article in the NYT from 2003:

Barbie has remained the world's most popular doll by constantly tweaking an old formula. Mattel, which makes the doll, has embraced such an approach recently as an overall corporate strategy…

Meanwhile, in the same year, when the toy industry as a whole was uncertain, Hasbro was performing exceptionally well:

Shares of Hasbro, in particular, have performed spectacularly this year. They are up 85.08 percent, compared with 1.40 percent for Mattel's.

''Hasbro has probably had its best year in a decade,'' Mr. McGowan said. Its Bratz line of fashion dolls, its Beyblade tops and My Little Pony figurines have been particularly strong, he said.

Despite the stock's climb, Mr. McGowan predicted banner years in 2004 and 2005 for several Hasbro products, including ''Star Wars''- licensed toys and action figures like G.I. Joe.

On the other hand, Mr. McGowan says he thinks that investors need a three-year horizon for Mattel. In the shorter term, he said, ''I think there's a lot of risk.''

The company needs to cut costs and improve its products, he said, but he added that he had confidence in current management. For the year ended in September, Anthony Gikas, an analyst at U.S. Bancorp Piper Jaffray, estimated that Mattel's overall share of toy sales fell by three percentage points, to 20 percent.

Mattel kept focusing on cuts while Hasbro was focusing on innovation by coming out with new toys and evolving their older ones. That's a sign that the company was in denial about its brands being an issue, believing that instead that costs and the market as a whole was the issue instead.

Continue to 2007. The United States faces massive toy recalls due to tests finding lead in paint, kerosene, and other health concerns. 60 percent of the recalled toys came from China, and the amount of recalled toys had doubled since 2002. Mattel, which was manufacturing Barbie in Japan back in 1959, was far from immune to the issue. But Mattel, after blaming China, walks their comments back and instead takes the blame, stating that the vast majority recalls for Mattel's products made in China were recalled due to design flaws on Mattel's part. So the company is in denial that their long time manufacturing partners were problematic and simply dismissed the issue of China being the issue as Mattel's designs were the issue.

As the decade closes out, Mattel fails to create anything noteworthy or make any real changes. Instead, they continue along their path of tweaking old formulas to create the same toy reiterated over and over again. They progressively transition to where they are today: stage four.

Grasping for Salvation - The company is in decline and will look for dramatic solutions that will solve all problems the company is having, such as a new executive, product, acquisition, restructuring, or strategy.

It's a new decade and Mattel finally comes out with a new innovative lines of toy called Monster High. They're a hit and a huge success, as they capitalize on the trends of the time like Twilight. But what happens? While Monster High takes off, the rest of Mattel's products continue to flounder. The underlying problems at Mattel continue to go on, unaddressed. Applying Mattel's decade old formula of only updating their lines rather than innovating new ones, Mattel creates yet another line in 2013 called Ever After High, which was basically a clone of Monster High, but rather than being the children of monsters, they're the children of fairy tale characters.

In 2010, Mattel also releases "Puppy Tweets," a device which attaches to the dogs collar and sends pre-recorded tweets via a computer. Yes, this was a Mattel product.

A short while later, Mattel switches up their management, promoting Bryan Stockton to CEO. Hindsight tells us this wasn't the right move, but it should have been obvious at the time that it wasn't the right move, either. Stockton had been with Mattel since 2000, serving in various executive roles. Above, I argued that Mattel's decline started in the early 2000s. If a person holding various upper management roles who was able to be a change agent wasn't a change agent then and didn't contribute or push the company to be innovative, why would that change as CEO? At the time, the change was welcome, because the market likes to see that the company does care by ousting old management and replacing them with just about anyone. The reality was that Mattel needed new blood, not old.

A year ago, we see Mattel acquire Mega Brands, the maker behind Mega Blocks. Stockton labels it as a "growth" purchase. But what is the purchase, really? It's an acquired answer to Lego, putting Mattel in an even more competitive position against the company it is losing to. But the purchase, much like Monster High, is a small up in an otherwise spiral down. Mega wasn't going to solve the problem of Mattel neglecting its core products and being unable to innovate from within. Acquiring a company that was performing well on its own cannot mean success for a company that is performing terribly, even if it is larger.

Finally, in 2015, we see Mattel reboot the View-Master and add a new spin on Barbie. You can read about those in a previous article of mine here.

These moves are what Collins calls "silver bullets," and they're the only ammunition that Mattel has had in the last five years in fighting off its decline.

Capitulation to Irrelevance or Death or Recovery and Renewal - The company either ultimately fails or corrects itself by identifying the problems and moving quickly to resolve them using the appropriate strategy and focus.

Mattel, I hope you're still reading this. You need to take action, now. You need to find a CEO that knows something about turnarounds, retail, digital, and can learn about toys. You need to change the atmosphere around the office and get people excited to come to work and challenge them to develop the next coolest toy for kids today. You need to show the world that you're able to do more than just keep updating icons. You're at a fork and you don't have a lot of time left to make a decision. You can acknowledge you're in trouble and take corrective action in an attempt to recover, or you can stay on the path you're on and fall into a shadow of your former success while your competitors fight for the spot you once held. This problem isn't exclusive to management or staff. It is a Mattel problem. Own it. Fix it.

I'll give you a starting point in understanding corporate turnaround. Here is my thesis for my master's degree. I encourage you to read the articles I've cited in the literature review.

For the record: I don't have a position, and I haven't ever worked for Mattel, nor has anyone in my family. I'm just someone looking in from the outside.