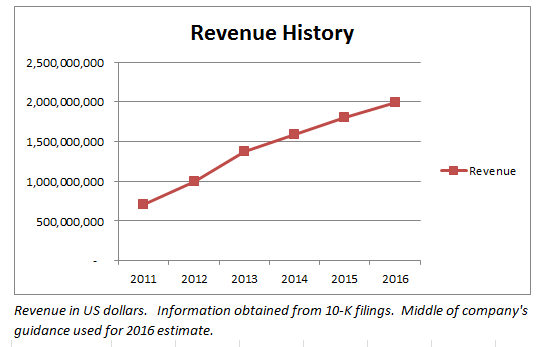

Lululemon Athletica (NASDAQ:LULU) reported that fiscal year 2014 revenues grew to $1.8 billion up 13% from $1.6 billion in 2013. Based on guidance provided by management, they expect revenue to grow to at least $1.97 billion (nearly 10% year-over-year growth) in 2015 with an upper end guidance of $2.02 billion (over 12% year-over-year growth).

This continued growth is expected to come from continued growth of their main market, women's athletic wear, while growing their men's and youth businesses. In this article, I will analyze the company's strengths and potential risks to determine whether the stock is a good long-term investment.

Strengths and Opportunities

Since the yoga-inspired athletic apparel company was founded in 1998, the company's apparel has been extremely popular amongst women. However, in order to be a complete athletic apparel company, management realized they must start to grow their other businesses to complement their core women's brand. The two markets the company decided to introduce their brand to were men and teenagers.

The men's brand has started to gain momentum with revenues growing 16% in Q4 and currently, men's products make up 17% of the total store assortment. The success was largely due to the men's pant product introduction, Anti-Ball Crushing (a.k.a ABC) Pants. Consistent with their women's brand, the company is striving to increase functionality and versatility through new technical fabric solutions in their men's brand as well. The company offers clothes in specific categories such as sweat, post-sweat, and no-sweat for men's workouts, commutes and in the office. Essentially, the company is marketing the pants as an everyday, all day type of pant made for any type of situation. They are currently priced at $128.

After the introduction of the ABC pants, Lululemon opened their first store dedicated to men in New York City in November and believes the men's market is a $1 billion opportunity. The unique in-store experience includes a tailor to customize shorts with a customer's preferred lining while he waits to check out. As the modern male is geared towards a healthy lifestyle and prefers comfortable clothing, I believe Lululemon has a great opportunity to take advantage of this untapped marketplace.

In an effort to take advantage of another untapped marketplace, the Ivivva business started in 2009 and targeted girls between the ages of 6 and 15 years old. The clothing is made from the same material as Lululemon adult apparel; however, the products are designed with bright colors and come at a slight discount from the adult-oriented brand. For example, Ivivva's yoga pants cost $64 compared to Lululemon's $98 yoga pants, but still above competitors-Under Armour (UA) $40 and Nike (NKE) $34.

Of the 48 new stores opened in fiscal year 2014, 10 of those were Ivivva stores. The increase in stores is due to the rapid revenue growth being experienced. In Q4 2015, the Ivivva business saw revenue growth of 51% year-over-year and the total count of Ivivva stores have increased to over 20. As one can determine based on this statistic, the Ivivva brand is a growing brand and management is committed to investing in it. By introducing the Lululemon brand to a young generation, they are creating loyalty to their brand for many years to come.

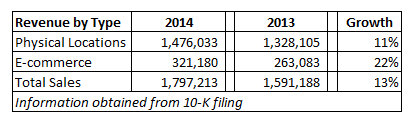

With the success in the men's and youth lines, it is important for the company to expand their distribution networks to make these products more accessible. As you can see by the above table, e-commerce sales totaled 17.9% of total sales in 2014, which was aided by the introduction of the mobile shopping application. Sales on the mobile application represented approximately 8% of their online sales in the 4th quarter.

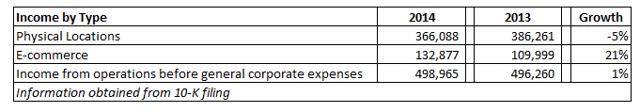

As you can see by the chart above, the income growth from e-commerce revenue is a lot larger, 21% year-over-year, compared to the income from physical locations declining during the same period. It is important for the company to continue growing their e-commerce brand through mobile applications and other innovative technologies to tap into this income growth.

In addition to growing their e-commerce platform, the company has a lot of geographical markets to advance into and has the opportunity to continue adding new stores. In 2014, there were 48 new stores opened and the company has a global expansion plan with a goal of having 20 stores each in both Europe and Asia. Based on this global expansion opportunity, management believes international expansion could eventually exceed North American revenue.

Obstacles

The company has attempted to expand internationally and failed in the past. This includes an unsuccessful expansion into Australia and Japan. After stores in these two locations underperformed, they completely pulled out of Japan and dropped their Australian stores to only five by 2009. The failures were blamed on the management efforts outweighing the benefits of the underwhelming increase in sales. Based on this track history, the international expansions are far from being a guaranteed success. However, I believe the company and brand has come a long way since the failures in Japan and Australia and has more to offer to a consumer than just their signature women's yoga pants.

As discussed earlier in the article, Lululemon charges a hefty premium for their product compared to similar products from competitors. Brands like this do well when the economy is doing well, but it is the first budget category to get reduced or cut when the economy suffers. In addition, it is important for Lululemon to continue innovating and creating superior new product offerings or another company will introduce a market disrupting product or one of the larger athletic apparel companies such as Nike or Under Armour will provide a similar product at a lower price. I believe Lululemon is showing this ability with their new men's pants product introduction.

Conclusion

Lululemon is a relatively new company that has mainly competed in a very specific market, women's athletic wear. As the company looks to expand into new markets, demographically and internationally, through new products, increased e-commerce presence, and new brick-and-mortar stores, I believe the near future for the company is very important. Will they be a one-hit wonder with the women's yoga pants line or will they be a comprehensive active apparel store? I believe their new market disrupting products in the youth and men's brand will allow them to become a comprehensive active apparel store that can serve everyone instead of just women.

Even with previous expansion attempts failing in the past, I believe the company now has a complete product mix to allow for a successful expansion internationally. With this room to grow and the economy in recovery mode, I think Lululemon is a good long-term investment. I think the company and management will see bumps along the way as they are a relatively new company, but I think they have the commitment to creating innovative products that will provide for long-term growth.