After years of speculation, Sears Holdings (SHLD) is finally moving aggressively towards spinning off valuable real estate assets into a real estate investment trust, or REIT. The stock has recently raced higher based on this news, but a major detail needs to be cleared up before the ultimate valuation is derived.

The key thesis of bulls all along is that the vast real estate assets of Sears weren't accurately valued on the balance sheet, providing for tremendous gains in excess of the value the market assigns the stock based mostly on struggling operations. The limited REIT details have a lot of people suggesting the transaction will ultimately signal the end of Sears, but the stock continues rising. Do investors have it wrong?

Limited REIT Details

The company has informally suggested that the REIT plans to start effective June 1 with the inclusion of 200-300 stores. Sears expects to receive in excess of $2.0 billion from the transaction that will raise cash from a subscription rights offering to existing shareholders. While the details state the deal involves both Sears and Kmart stores, the actual quality of the stores is mostly unknown. Even the latest blog post by the CFO provides no details on the stores included in the transaction.

Potential Valuation

The valuation spectrum is wide and variant, probably dependent on an investor's view of Sears in general. Of all the asset spin-offs and other corporate transactions undertaken by Sears over the last few years, the REIT transaction is probably the most important by far. If the value of the real estate owned by Sears is found to be mostly in line with the values on the books, then the stock has no room to run and will likely decline. If the Baker Street Capital Management analysis is mostly in line, then the stock could easily double from the current levels around $40.

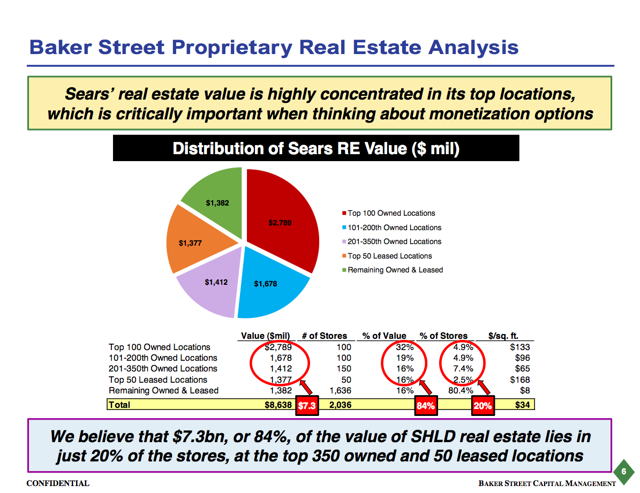

Back at the end of 2013, Baker Street appraised the real estate owned by Sears for at least $8.6 billion. The firm placed at least $4.4 billion of value on the top 200 owned locations, and up to $7.3 billion based on the top 400 locations (including leased locations).

The firm even proposed that Sears could reap over $12 billion in value from redeveloping the top 350 Sears properties. Clearly, any deal that only nets the company $2 billion for up to 300 stores is seen as negative, unless it includes a large amount of the low-quality properties. A big key, though, is that Chairman Eddie Lampert and investor Bruce Berkowitz wouldn't have continued investing in the stock if that were the case.

Worth noting is that Baker Street highlighted a couple of leasing deals that probably are more indicative of the properties included in any REIT transaction than one that only includes the high-end mall locations. Both deals were standalone stores, where a Greensboro, NC store was split into a small Sears store and a Whole Foods Market (WFM), while a San Diego store became a Zions Market. Neither store appeared worthy of much valuation other than possibly the land in San Diego; but both have outside leases attractive to a REIT, providing a prime example that this deal is likely to include the stores with leases and not just the most valuable locations.

No Better Time

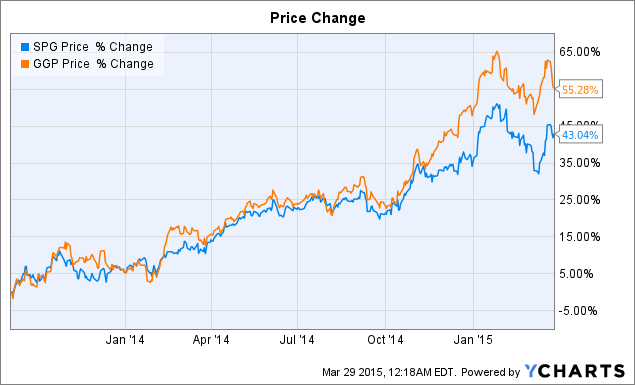

While the value of the up to 300 properties included in the REIT deal appear to have a lot of concern from investors, the mall REIT sector has never had it better. Simon Property Group (SPG) and General Growth Properties (GGP) are up about 50% since the Baker Street report on Sears.

At the same time, Simon Property Group is on the prowl for Macerich (MAC), offering up to $17 billion for an asset base that only includes 54 million square feet of real estate. Macerich mostly owns regional shopping centers, though generally in prime states. The mall operator reported that occupancy hit 95.8% as at December 31, up from 94.6% last year. At the same time, annual sales per square foot were up 4.4% and releasing spreads were up 22%.

Remember that Sears entered 2015 with 1,700 stores in operation, with over 200 million square feet of space. This doesn't even include leased space or closed-down stores.

Without doing a property-by-property analysis, one would have to assume that the Sears properties are, in fact, more valuable now. The Baker Street analysis forecast a high-end value of over $10 billion for the real estate, placing the stock's worth at an incredible $158.

Now, the spin-off of Lands End (LE) lowers the value by over $1 billion, along with continued losses during the period, but the real estate might have some upside to the $10 billion target, including redeveloped properties during that time period.

Takeaway

The evidence continues to suggest that, if anything, the real estate assets owned by Sears are worth a lot more than the stock price suggests. The bear case makes the mistake of projecting the value of the real estate based on the retailer that operates the stores, and not the value once repurposed into another retailer. Investors need to remember that the mantra for real estate values is location, location, location.

The soaring values for Simon Property Group, General Growth Properties, and Macerich suggest Eddie Lampert is unveiling the REIT strategy at the perfect point. The real estate isn't worth less than forecast. If anything, the Baker Street projection has plenty of upside.