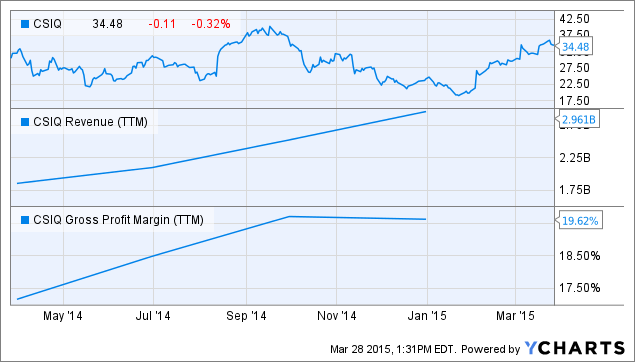

Canadian Solar (NASDAQ:CSIQ) has made an astounding comeback this year. After losing 17% of its value in 2014, the stock has appreciated an impressive 45% in 2015. This doesn't come as a surprise, since Canadian Solar's financial performance has been strong of late as shown in the chart below:

In fact, in the fourth quarter reported earlier in March, Canadian Solar's top line increased 84% year-over-year, while its earnings went up from $0.39 per share last year to $1.28 per share in the previous quarter. The company's results were driven by the record shipment of 1,125 MW of solar modules. But, the good thing is that despite this impressive run in 2015, Canadian Solar is still cheap.

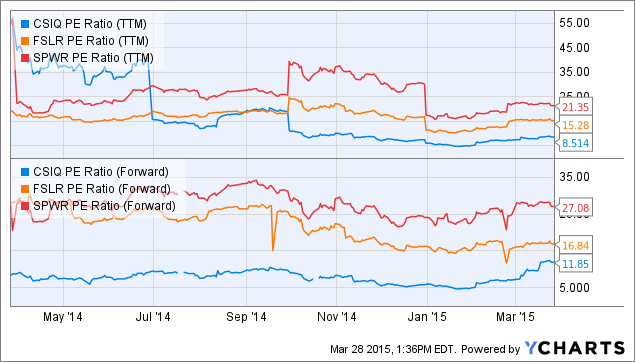

The stock trades at 8.4 times last year's earnings, which is lower than the industry average of 20.4. In addition, it is cheaper than some of its well-known peers as shown in the chart below:

CSIQ PE Ratio (NYSE:TTM) data by YCharts

A robust pipeline will help Canadian Solar get better

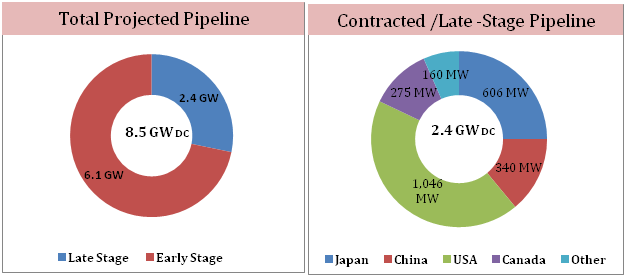

Thus, despite its strong run this year, Canadian Solar still looks like a value pick, especially considering that its earnings are growing at a rapid pace. Looking ahead, there is a strong chance that Canadian Solar will be able to sustain its momentum on the back of its strong pipeline and expansion into key markets. A look at the chart below clearly indicates Canadian Solar's robust pipeline:

Canadian Solar has strengthened its project pipeline in a strategic manner. For instance, the company recently bought Recurrent Energy, a North American solar company, for $265 million. This acquisition has added another 4 GW of downstream projects to Canadian Solar's existing project pipeline. Also, this transaction is expected to improve its late stage project pipeline by approximately 1 GW to 2.4 GW, leading to a revenue opportunity of more than $2.3 billion over the next two years.

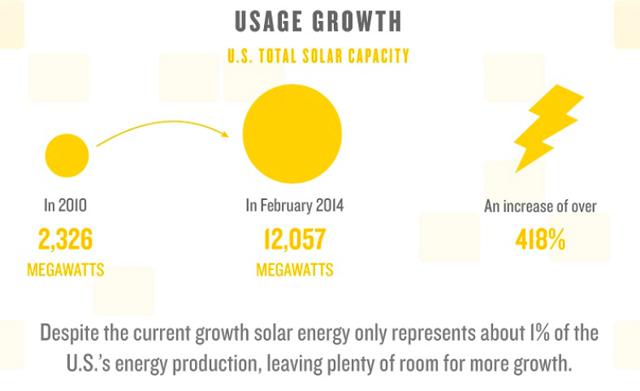

Additionally, this acquisition has strengthened Canadian Solar's footprint in North America. This is a smart move, since the North American solar market is expected to grow at a fast pace going forward as shown in the chart below:

Smart moves in China will allow Canadian Solar to tap an aggressively growing market

Moving beyond North America, Canadian Solar is also strengthening its footprint in the Chinese market, where it is has recently deployed a new manufacturing plant. At the end of last year, the factory was capable of producing 60 MW, but it is expected that Canadian Solar can ramp up the capacity to an impressive 1.2 GW. As a result, Canadian Solar should be able to save additional capital costs that are required for a new plant set up, and also increase its production capacity at the same time.

This, again, is a smart move since the Chinese solar market is expected to grow at a rapid pace this year. According to Barron's, "China's energy regulator National Energy Administration released its official solar installation target for 2015. Beijing decided to install 17.8GW, 19% higher than the 15GW mentioned in the draft circular."

Hence, equipped with a higher capacity plant in China, Canadian Solar has positioned itself to tap growth in this region.

More importantly, Canadian Solar has made impressive progress in reducing its all-in pure manufacturing costs. For example, the company has minimized the cost of its polysilicon wafers at its Chinese factories from $0.76/W to $0.21/W, the cost of solar cells from $0.22/W to $0.13/W, and the cost of modules from $0.33/W to $0.13/W in the past three years. Driven by such efforts, Canadian Solar's margins will continue improving going forward.

Risks to consider

However, an investment in Canadian Solar comes with certain risks, most of which are fundamental in nature. For example, its debt of $1.01 billion is almost twice its cash position of $549 million. The company's debt-equity ratio is high at 138, while its current ratio is low at 1.19. As a result, Canadian Solar might face short-term liquidity concerns and the burden of high interest expenses.

In addition, analysts are of the opinion that Canadian Solar's earnings growth will be slow in the next five years. They estimate that its bottom line will increase at a CAGR of 5% over the next half decade, way below the growth of 38% seen in the last five years.

Conclusion

But, investors should also note that Canadian Solar's project pipeline is growing at a fast pace, and the company is reducing its costs as well. Hence, it should be able to deliver a strong bottom line performance going forward. Moreover, as the solar market grows in key regions such as the U.S. and China, Canadian Solar's addressable opportunities will improve. Also, as mentioned earlier in the article, the stock is cheap. Thus, despite the stock's strong gains this year and fundamental challenges, Canadian Solar looks like a good investment due to its strong prospects and operational improvements.