Hunting for small-cap tech companies with strong IP protection, targeting multi-billion dollar end markets that are at the cusp of scaling up from a proof-of-concept or small contract stage to strong revenue growth has been among the recurrent themes in our investing. Among our recent finds that fits this bill is Austin, TX-based Ideal Power (NASDAQ:IPWR) that develops photovoltaic (PV) inverters and battery converter solutions.

With a TTM (trailing-twelve-month) revenue of only $1.8 million and a market cap and enterprise value of $65 and $55 million respectively, it is among the smallest players in the tech sector. But its ambitions, armed with its patented Power Packet Switching Architecture (PPSA) technology, are huge. Its technology and products target multi-billion dollar growth markets in solar and other renewable energies, electric vehicle, grid storage, and hybrid systems.

The company has as its objective to establish PPSA as the preferred technology for the $70 billion electronic power converter industry. That's as ambitious a BHAG (big, hairy, audacious goal) as we have ever heard, and at first seems kind of ridiculous. But on closer examination, it appears that this small gem of a company might just have a chance of achieving that.

As small as it is, its patent and partnership portfolio, customer list, and industry awards are extensive, giving much needed validation to its technology and business model, an imperative, given the outsized risks when considering small speculative plays in the tech sector. Add to that Ideal Power has chosen to utilize a license-based, capital-efficient, scalable business model to fuel its growth, that should flow well to the bottom line while reducing the risks associated with rapid expansion.

Analysts are projecting revenues to jump from $1.8 million in FY 2014 to $7.4 million in FY 2016, $25.1 million in FY 2017, and $52.6 million in FY 2018. We believe that future growth could be even better than currently embedded in analyst projections, given the large and high-growth nature of its end markets. The stock meanwhile trades at a very reasonable multiple to its projected sales, given the strong growth at about 2.1x FY 2017 sales while revenue could still be growing north of 50% well past that.

Although a bit extended here after the recent rally, there are catalysts on the horizon that can propel the stock even higher, and we project that it could trade up to 60% higher to $15 in the next 12-18 months. Ideally, we would recommend buying on dips, possibly near the $8 support area, but given the nature of the catalysts that could push the price up in a hurry, it might be even prudent to take a small starter position here and add on dips.

Game-Changing and Disruptive Technology

Ideal Power's PPSA technology has strong patent protection that will enable it to scale up its business model rapidly and at high gross margins, along with a comparatively lesser need for additional working capital. It has 19 U.S. and two international patents protecting its IP, with numerous pending hardware, firmware and application patents that will enable it to continue its leadership for years to come.

Without going too much into the specifics of the technology itself and sticking to the investment fundamentals, suffice it to say that its technology allows for less components than conventional power conversion systems, thereby giving it advantages of size, cost, efficiency, flexibility and reliability that are simply too hard to ignore.

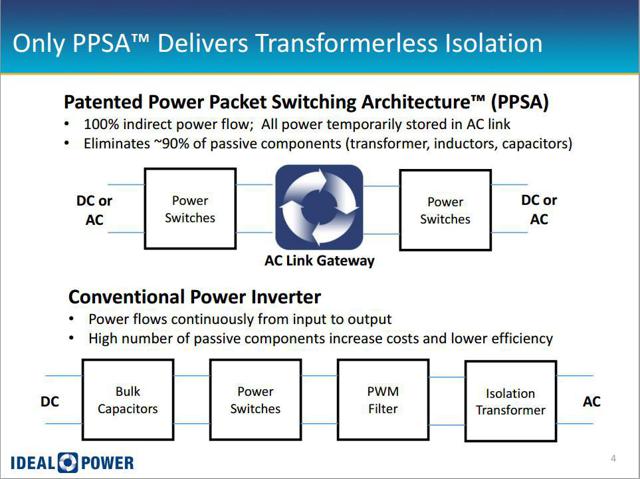

Perhaps a couple of simple illustrations from the company's own website and investor presentation will make that a bit clearer.

The figure above illustrates its PPSA-based solution that eliminates passive components such as transformers, inductors and capacitors and includes an AC Link Gateway that is a magnetic storage compartment where power is temporarily stored. The figure below illustrates how its converter offers significant form factor advantages over conventional converters.

The net effect of these differences is that not only is the Ideal Power converter smaller, but it is also less heavy (by a factor of 4 to 6) and cheaper. The small form factor enables it to be placed indoors or outdoors. Furthermore, due to less components, it has more reliability and higher efficiency, and it also has improved flexibility as the same hardware can be used for multiple applications.

Add to this the benefits of storing energy via the AC Link Gateway that allows for grid storage and micro-grid applications and bi-directional power flows that make them even more valuable as they can supply power to the grid, and you have a compelling value proposition that makes it difficult for a potential customer to choose conventional converters over Ideal Power's PPSA-based converters.

High-Growth Large Potential End Markets

The initial market targeted by Ideal Power is providing battery converters for the high-growth Electrical Energy Storage (EES) markets, particularly grid-tied commercial, utility level storage, and off-grid micro-grid tied with solar or PV-based power generation. This market alone is expected to grow to nearly $2 billion by 2020 at a 40% CAGR.

The growth in the grid-tied commercial market is tied to commercial customers wanting to reduce utility demand and time-of-use charges, the declining battery costs, and due to the need for emergency backup power. Ideal Power has teamed up with leading commercial ESS integrators, including Sharp Electronics (OTCPK:SHCAY), Green Charge Networks and CODA Energy to target this market.

The growth in off-grid micro-grid market is tied to addressing the needs of the billion-plus people that are currently not served by the electricity grid and depend on expensive diesel generation. The payback period for micro-grid ESS can be as little as two years due to the elimination of the use of diesel fuel. Ideal Power has teamed up with EnerDel to target this fast-growing market.

Next, it is expected that Ideal Power's next-generation bi-directional switch technology that is expected to further reduce the size of the box by a factor of 2 while continuing to drive further efficiencies in cost and weight will open up new mature power conversion markets for PPSA-based converter solutions. The total opportunity expected to open up in these mature markets is estimated to total $70 billion by 2002 and includes $32 billion in VFD motor drives, $10 billion in UPS market, $8 billion in EV traction, $6 billion in wind applications, and $2 billion in rail industry.

Extensive List of Partners and Customers

The micro-cap universe is stacked with companies making outsized promises, most of which are never substantiated. So, in an effort to reduce the risk of investing in micro caps, one of the checks that we like to do is look at their partners and initial customers and any industry recognition their products may have gained.

In the case of Ideal Power, it has an extensive partner and customer list, and industry recognition and awards, given Ideal's ~$65 million market cap. This gives us increased confidence in its technology, business model, and future prospects.

The following summarizes key partner and customer announcements by Ideal Power over the last four-plus years:

- March 2015 (on the 19th) - Announced a multi-year alliance with LG Chem Ltd. (LGCEY) to jointly market and sell LG Chem's lithium-ion batteries with Ideal's power conversion systems for commercial demand charge reduction and micro-grid applications.

- March 2015 (on the 17th) - Receives multi-unit order to support Green Charge Networks' intelligent energy storage for California schools.

- February 2015 - Introduced and receives initial multi-unit order for its grid-resilient 30kW power conversion system from The Boeing Company (BA).

- February 2015 - Rexel Holdings Corp. (OTCPK:RXEEY), via its subsidiary Gexpro, a leader in the distribution of electrical supplies and services, began carrying Ideal Power's converters.

- February 2015 - Eos, a developer of cost-effective energy storage solutions, names Ideal Power as an Aegis Partner and orders more than 1MW of converters.

- January 2015 - Wins critical European patent for its core PPSA power conversion technology.

- October and November 2014 - Received multiple purchase orders for over 6.5MW of its 30kW battery converter products from two market leaders in the energy storage system (ESS) industry.

- September 2014 - Received two purchase orders for six of its 30kW battery converters for use in two innovative 100kW wind turbine installations.

- September 2014 - Signed a Strategic Alliance Agreement with EnerDel, a manufacturer of lithium-ion batteries and energy storage systems for the electrical grid, transportation and industrial applications, to develop a new line of Mobile Hybrid Power Systems.

- July 2014 - Signed a multi-year purchase agreement and later received an initial and multi-unit follow-on order from Sharp Electronics, with order volumes to scale along with Sharp's SmartStorage business.

- June 2014 - Won Electrical Energy Storage Award for its 30kW Hybrid PV storage converter, presented to it at Intersolar Europe in Munich, Germany.

- May 2014 - Coritech Services orders Ideal Power's battery converters for the U.S. Dept. of Defense (DOD) Vehicle-to-Grid (V2G) program.

- April 2014 - Receives initial purchase orders for 20 of its 30kW battery converters from two Battery Energy Storage System (BESS) integration customers to be installed in commercial storage systems in California.

- February 2014 - Eos Energy selects Ideal Power battery converter to demonstrate AC-integrated Energy Storage System with Con Edison (ED) in NYC.

- May 2013 - Ideal Power's breakthrough hybrid converter wins National Innovation Award at the National Innovation Conference in Washington D.C.

- October 2012 - U.S. Dept. of Energy's National Renewable Energy Laboratory (NREL) successfully demonstrated vehicle to grid (V2G) capabilities using Ideal Power's battery converter.

- May 2012 - Agreement to co-develop a modular grid storage solution with Powin Energy (PWON).

- May 2012 - Included in the "Cool Vendors in Solar Energy, 2012" report by Gartner, Inc.

- October 2011: $2.5 million grant from the U.S. Dept. of Energy's Advanced Research Projects Agency - Energy (ARPA-E).

Capital-Efficient Business Model

Ideal Power currently uses contract manufacturers to make its products, and is selling them through channel partners, thereby leveraging system integrators, OEMs, and battery manufacturers for integration, sales and installation. However, in the future, as sales grow, backed by its strong patent portfolio, Ideal Power plans to roll out a licensing-based, capital-efficient business model that includes a purchasing license for high-volume customers, a manufacturing license for international expansion, and a technology license for customized applications, as in automotive.

The capital-efficient business model should result in higher gross margins, reduced working capital requirements, and propel it even faster towards profitability. Also, licensing out its technology may make it even more attractive, as companies can customize it to their own use for lesser costs than it would take for Ideal Power to provide the solution.

Strong Growth Projections

Although it appears that revenues have grown only slowly in the last year from $1.13 million in FY 2012 to $1.89 million in FY 2013 to $1.79 million in FY 2014, looking deeper into the 10-Ks, product revenues have been rising exponentially from $0.32 million in FY 2012 to $0.42 million in FY 2013 to $1.22 million in FY 2014, as grant revenues decline as the company moves from proof-of-concept and prototype to rapid commercialization stage.

Furthermore, looking at recent trends, in just the last six months, Ideal Power received multi-unit orders from Sharp Electronics Corp. in Sept. 2014, 3.5MW of orders in Oct. 2014, 3MW of orders in Nov. 2014, another 1MW order from Eos Energy Storage in Feb. 2015, a multi-unit order from Boeing in Feb. 2015, and another multi-unit order from Green Charge Networks just earlier last week. This is in comparison to a total of 9.5MW of orders received for all of FY 2014.

Looking forward, analyst revenue projections up to FY 2018 are like an investor's dream, rising from $1.8 million in 2014 to $7.4 million in 2016 to $25.1 million in 2017 and $52.6 million in 2018. However, profitability could be elusive in the intermediate term, as is the case with many small-growth tech companies, with losses projected by analysts to fall from 89 cents in FY 2014 to 65 cents in FY 2016.

Liquidity

Ideal Power has $7.91 million in cash and no debt. It is expected to lose about $5-$6 million each in 2015 and 2016 before turning cash flow positive sometime in late-2016/early-2017. It has 1.6 million warrants outstanding. Accordingly, we believe that current liquidity and possible proceeds from warrant conversions will be adequate before it turns cash flow positive, and that it is less likely that the company will have to announce more dilutive offerings to help finance its operations in the intermediate term.

Management Team

Ideal Power has a well-seasoned management team. Its CEO R. Daniel Brdar previously served as CEO of FuelCell Energy (FCEL) and is a former GE (GE) Executive. CTO and Founder Bill Alexander is a prolific inventor with 25+ granted U.S. patents, and other executives have management experience at Motorola (MSI), Deloitte, NextEra (NEE) and GE.

Analyst Ratings

A total of only two analysts, ROTH Capital and Northland Capital, cover the company, and have price targets of $17 and $15, respectively, well above the current trading price in the $9.20s. ROTH initiated its coverage and put its price target in Sept. 2014, and Northland did so in May 2014. Both ROTH and Northland based their bullishness on Ideal Power's strong patent portfolio, and referred to its potential in transforming the power conversion industry and capturing an outsized market share in energy storage applications for commercial and industrial buildings.

Institutional Investors Activity

At ~$65 million market cap at the end of the last quarter (4Q/2014), Ideal Power was too small to get on the radar of most institutional investors. Ownership among our hand-picked 330+ of Wall St.'s top fund managers is a paltry 0.09 million shares, not unexpected based on its small size. In the larger group, including all institutional investors, ownership is at 1.37 million shares, mostly due to the 1.15 million shares owned by just one institution, the AWM Investment Company, a NY-based hedge fund led by Austin Marxe.

Insider Activity

We view significant insider buying as another data point to influence our analysis. In the case of Ideal Power, there has been insignificant trading activity (buy/sell) within the last 24 months.

Valuation

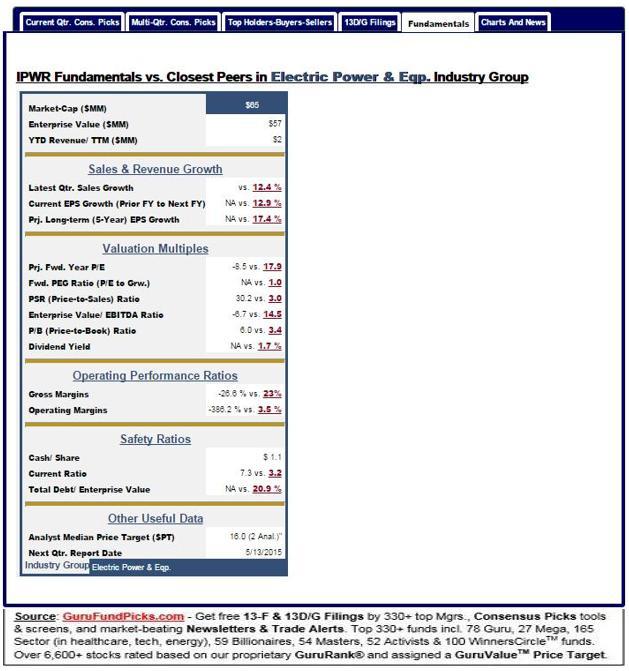

Valuing micro-cap companies with large addressable market sizes is more art than science. Ideal does not generate any earnings now, nor can it be reasonably expected to do so in the near future. Indeed, the losses will continue to be a recurrent story in its earnings reports for the foreseeable future. Valuation based on traditional Earnings (P/E) or EBITDA (EV/EBITDA) multiples is thus not possible. For such companies, looking at sales, or rather projected sales two to three years out, is much more meaningful.

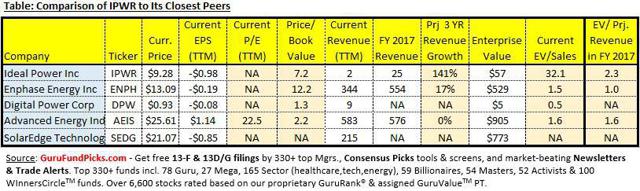

In the case of Ideal Power, shares currently trade in the $9.20s at ~$65 million in market cap (see Figure below). Revenue projections currently stand at $7.4 million for FY 2016, $25.1 million for FY 2017, and $52.6 million for FY 2018, giving us a multiple of ~7x based on next year's revenue to ~2.1x based on revenue three years out.

Sales-based Multiple

While not scientific, based on our multi-decade observation of forward sales multiples for high-growth, small-cap companies with breakthrough technology, this is well within the bottom one-third of the valuation range that you would expect. Just a couple of examples will perhaps help illustrate this point. First, cybersecurity software provider FireEye (FEYE), while generating strong growth and huge losses, traded at over $15 billion in market cap at its peak in early 2014 at ~15x projected sales three years out in the $1 billion range. Next, electric vehicle manufacturer Tesla Motors (TSLA), while generating strong growth and huge losses, traded at over $35 billion in market cap at its peak last year at ~3.5x projected sales three years out in the $10-$11 billion range.

Granted, these are much more well-known later-stage companies, but their growth was much lower than is projected for Ideal Power, and the peak sales multiple would usually be much higher for a smaller company like Ideal Power than for larger companies like FireEye and Tesla.

Our conservative valuation based on this comparison is that Ideal Power should trade at least at 4-6x FY 2017 sales of over $25 million. With 7 million in outstanding shares, this would put its valuation in the $15-$20 range.

Peer Comparison

Within its space, peers include Enphase Energy (ENPH), a provider of micro-inverter systems for the solar photovoltaic industry; Digital Power Corp. (DPW), a provider of power supplies and converters, and Advanced Energy Industries (AEIS), a provider of power conversion products. In addition, just last week, new IPO SolarEdge Technologies (SEDG), a provider of DC-optimized inverter systems for solar PV systems, made its debut on the NASDAQ.

As illustrated in the Table above, only Advanced Energy Industries generates positive EPS right now. A more appropriate peer comparison then, given the early-stage nature of these companies, is multiple to sales.

Currently, Ideal Power sells at a very high multiple to sales (as represented by Enterprise Value/Sales) vs. its closest peers. However, with projected revenue growth from less than $2 million in FY 2014 to $25 million in FY 2017 (and projected to grow another 100%+ to $53 million in FY 2018), its EV/Sales will be comparable to its peers in the near future while it would continue to grow at a much faster rate than its peers. Given that, we would argue for a target EV/Sales ratio of at least 4.0 based on based on FY 2017 revenues, giving us a target price in the $15 range.

Upcoming Catalysts

Ideal Power should report its next quarter sometime in the second week of May. Given the increased pace of orders, alliances and agreements since the end of 2014 (see earlier discussion on "Extensive List of Partners and Customers"), we expect the upcoming quarter and guidance embedded in the quarter to continue to show a strong positive and accelerating uptrend in sales. Given that the company is practically unnoticed by the larger investment community, the report may help put it on the radar of institutional investors. A major commitment by even a few major investors would help ignite a rally given the small number of outstanding shares at 7.1 million shares.

Meanwhile, the company continues on its flurry of reporting new orders, alliances and agreements, reporting two in just the last week. Many of its partners have been well-known names like Boeing and other well-known names in the alternative energy space. A major commitment of orders by any of these, or any other major partner, could also be very positive for its price.

Downside Risks

The obvious downside risk with many of these smaller capitalization companies is shareholder dilution, as many of them view any significant increase in price to be an opportunity to sell shares. Ideal Power so far has not done that since its IPO in Nov. '13, and it seems to have enough cash on hand for the next couple of years, maybe until it reaches cash flow positive. However, there is no guarantee that it won't, especially if the price rallies strongly north of say $12 or $15 per share.

Other risks include that its new partnership agreements will fail to produce the boost in revenue currently embedded in analyst projections. This is certainly possible as no company is immune to competitive and marketplace challenges. However, its products seem beyond the proof-of-concept stage, and given its leadership over traditional converters, it seems not as likely a scenario. It is more likely as a risk that the projected revenue ramp-up could be delayed due to unexpected manufacturing or competitive challenges.

Conclusion

Ideal Power is an attractive play for small-cap, growth-oriented investors based on its strong IP, product leadership, large, attractive and growing end markets, and projected strong revenue growth. The company continues to report an increased pace of orders, alliances and agreements, that validate its technology and product leadership, and give us more confidence that this small micro-cap may have the potential to live up to its outsized promises.

At $65 million market cap, it trades at just over 2x projected sales in FY 2017, three years out, while revenue growth is expected to be in the high double-digits for the foreseeable future. Based on a peer comparison and our multi-decade experience in hunting for small-cap tech leaders, we believe that the shares can easily trade at 4x sales three years out, which would give us a 12-18 month valuation target in the $15 range, about 70% above current trading prices.

The stock has rallied over 50% in the last couple of months to over $10 at its highs earlier this week, based on the string of strong positive recent news. It has since pulled back near $9, but is still a bit extended here, with downside risk to just below $8 in the short term. We bought it in the $7 range for our trade alerts portfolio last year and are looking to add more if it drops to near or below $8 again.

For newer investors, while we are tempted to argue for an entry below $8 range, the truth is that any significant positive news can cause this stock to open at a strong gap up, given its small 4.6 million share float, at which it becomes too risky to get in. It is perhaps more appropriate to buy a third to a half position at current prices near $9, and add to it if it drops below $8.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.