Last January Dryships Inc. (DRYS) filed an IPO registration statement with the SEC to spin-off its tanker fleet into a separate publicly traded company. Yesterday Dryships completely reversed course and announced instead the sale of its tanker fleet to entities related to CEO George Economou. It also formally withdrew its registration statement.

What prompted such stunning reversal is anyone's guess, particularly since the transaction is between related-parties. It has been the worst kept secret on Wall Street that publicly traded shipping companies are rife with related-party transactions. I find such transactions an anathema to proper corporate governance. It is true that related-party transactions must be disclosed and executed at arm's length. But company insiders always get to choose when to do them, and in shipping timing is key to financial success.

Allegations aside, is this a good deal for shareholders or not? In this article I will analyze the transaction from an arm's length, cash flow and earnings point of view.

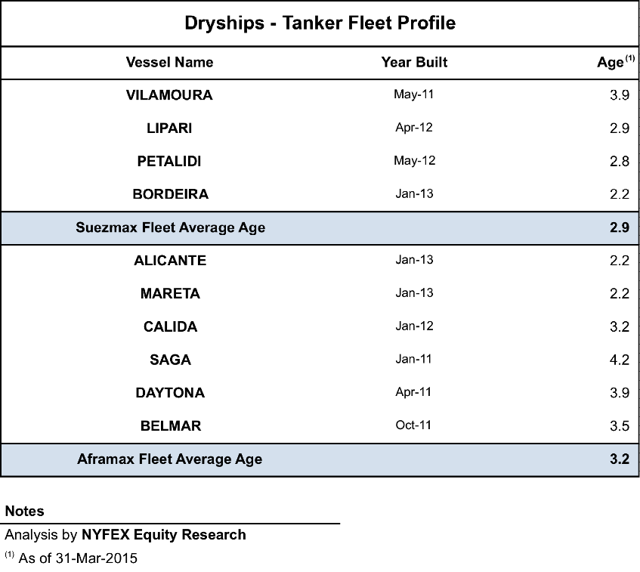

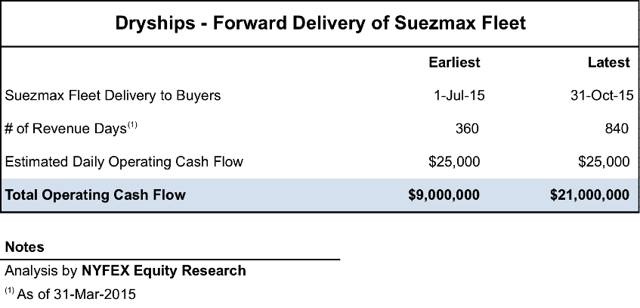

The company's tanker fleet consists of four suezmax tankers with an average age of 2.9 years, and six aframax tankers with an average age of 3.2 years. The suezxmax tankers were sold en-bloc for $245 million, or an average price of $61.25 million per vessel. The vessels will be delivered to the new buyers between July 1st and October 31st, 2015 at the company's option. Dryships will thus trade the vessels for another three to seven months, in a spot market that has been firm since the beginning of the year. Assuming conservatively a daily operating cash flow of $25,000, Dryships could rake in an additional $9 to $21 million in cash until the suezmax tankers are delivered to the new owners.

The aframax tankers were also sold en-bloc for $291 million but on a contingent basis. By allowing the buyers to confirm the agreement by June 30th, 2015, Dryships effectively wrote a three-month call option at an average strike price of $48.5 million per vessel.

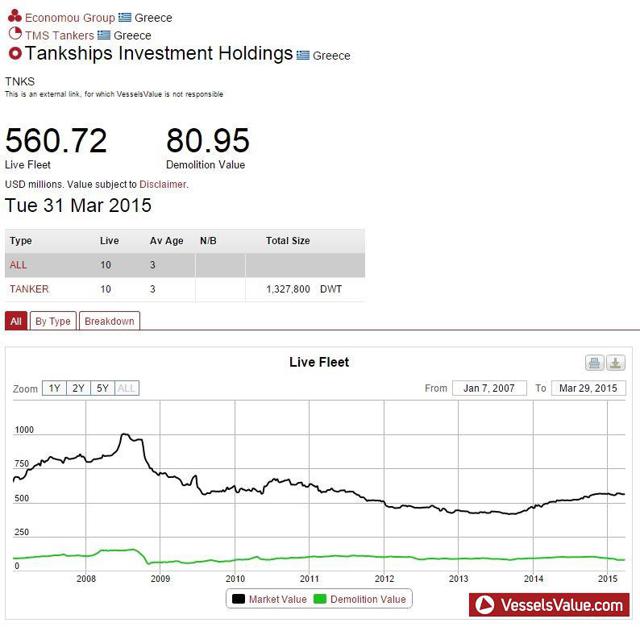

In the following table I am presenting the current fair market value of the ten tankers as per independent vessel valuation firm VesselsValue.com. The current fair market value of the fleet is $561 million, compared to total agreed price of $536 million. There appears to be a $25 million discount to the current fair market value, without counting the value of the three-month call option. On the other hand, potential earnings from the forward delivery of the fleet could make up for the discount in price. From an arm's length point of view, the combined transactions appear to be kosher.

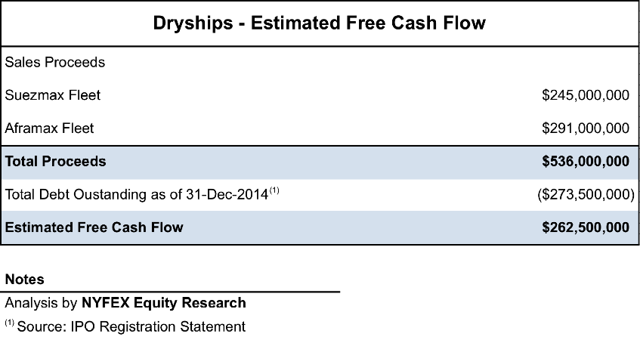

From a cash flow point of view the company has estimated a total of $275 million in free cash flow after the repayment of associated secured debt. As of December 31st, 2014, Dryships had total debt outstanding secured by its tanker fleet of $274 million. The pro-forma cash flow from the sale of the combined fleet would then be $263 million, which is in line with the company's guidance.

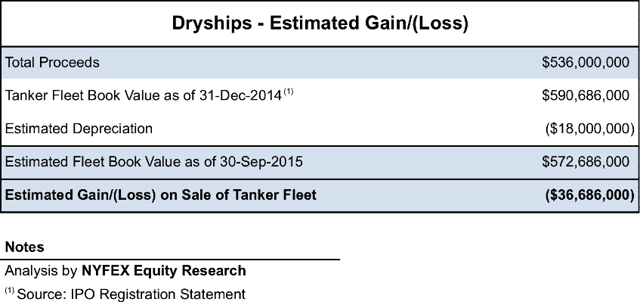

From an earnings point of view, the company did not provide any guidance on how the proposed transactions will affect its bottom line. Based on information provided in its registration statement, Dryships had ordered the tanker fleet in November 2010 for a total contract price of $631.5 million. Total delivered cost amounted to $660 million. As of December 31st 2014, the tanker fleet had a net book value of $591 million. Assuming that both deals are executed I estimate that Dryships will recognize a non-cash loss of approximately $40 million on the sale of its tanker fleet.

Dryships has been in dire financial straits for some time now. If both deals are consummated, they will provide the company with much needed free cash to the tune of $275 million, all in a relatively short amount of time. Yes, the originally proposed IPO would have alleviated any red flags from related-party transactions. It might have even achieved a better return for shareholders if the company had waited for the right timing. But I am afraid that Dryships does not have the luxury of time on its side. For this reason alone it might be better to deal with the devil you know than the devil you don't.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.