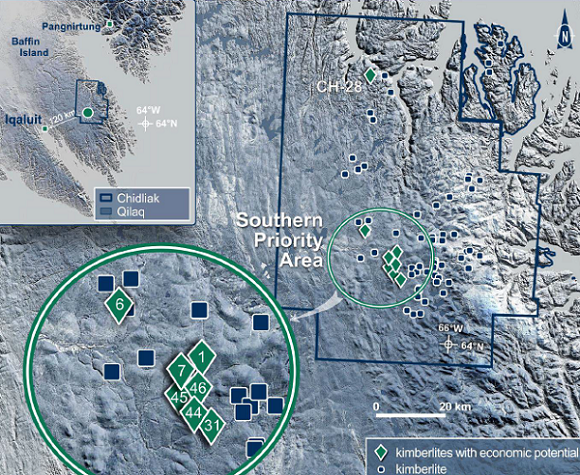

Peregrine Diamonds (OTC:PGDIF) is a Canadian exploration company engaged in the development of its Chidliak diamond project on the Hall Peninsula of Baffin Island, Nunavut. Drill results to date have uncovered 71 kimberlites on the Chidliak property, of which 47 have tested diamondiferous. Diamond results suggest that 8 of the kimberlites could hold economic diamond mining potential. The map below shows high-priority kimberlite targets on the Chidliak property (see Figure 1).

Figure 1: Shows 7 out of 8 potentially economic kimberlites (excludes CH-28) on the Chidliak property. Source: PGD

Peregrine thinks the inferred mineral resource at CH-6 kimberlite could start up Phase 1 development of a diamond mining operation that would incorporate CH-7 and CH-44 into the mine plan. This year's work program intends to define a resource base to support the project's first preliminary economic assessment ("PEA") scheduled for 2016. Peregrine has raised enough cash through a rights offering (incl. exercised warrants) to fully fund the planned work program.

Diamond bulk sampling program

The work program scheduled for this year focuses on collecting bulk samples from each of the three main kimberlite pipes, including CH-6, 7 and 44 by way of large diameter RC drilling. The bulk samples look to confirm the continuity of diamond grades at each kimberlite pipe and provide parcels of diamonds for valuations. Positive diamond results could lead to resource expansion, and form the foundation for a maiden resource statement for CH-6, 7 and 44.

Peregrine intends to use the kimberlite bulk samples and diamond results from this year's work program to carry out Chidliak's first PEA during 2016. This assessment will provide an in-depth look at the geological setting of the Chidliak diamond project, and most importantly, an economic analysis including net present value (NPV) and internal rate of return (IRR) valuations. This is where the diamond valuations from the bulk samples come into play.

Diamond valuations will be a key input in the derivation of total revenues, profits and cash flows over the mine life. A previous CH-6 bulk sample (Feb. 2014) returned 2.58 carats per tonne. Diamond valuations averaged US$213 per carat for a 1,013 carat parcel. Chidliak's financial outlook looks promising if new valuations match or beat US$213 per carat. Anything short of the previous result will disappoint existing shareholders. Diamond results should arrive in late 2015, with valuations released in early 2016.

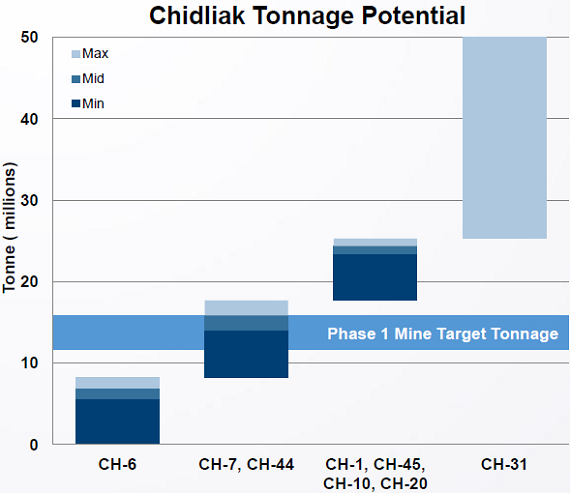

Peregrine roughly estimates Phase 1 mining at Chidliak will target on average ~15 million tonnes (see Figure 2). Phase 1 could possibly contain ~30 million carats assuming a diamond grade of 2.00 carats per tonne. Drill work started in March. All the necessary permits and licenses required to complete the work program are in place.

Figure 2: Chidliak tonnage estimates. Source: PGD

Fully funded work programs

Peregrine, like most explorers and developers, raises financial resources from equity financing to fund work programs since the company does not generate any cash from its assets. Peregrine stated in a recent quarterly report that it did not have "sufficient financial resources to complete all of its currently planned exploration programs." The estimated cost is ~$15 million to complete the planned work programs in 2015 and the first half of 2016.

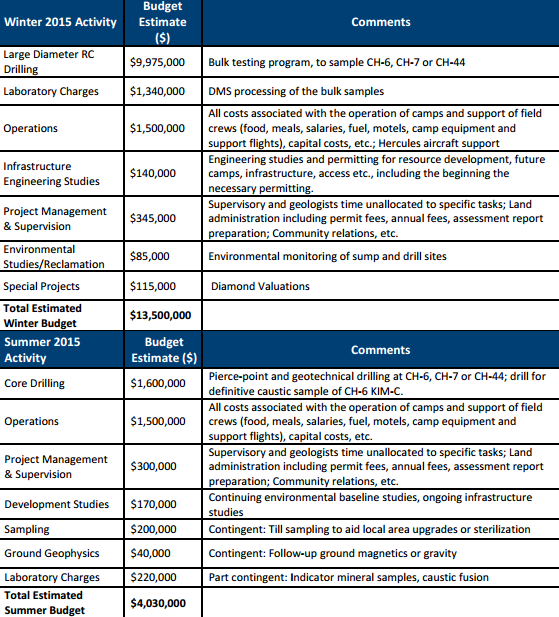

The NI 43-101 technical report (Feb. 2015) estimates the winter work program (current) will cost ~13.5 million. A summer program (recommended) consisting of core drilling at CH-6, 7 and 44 will cost ~4 million (see Figure 3). Peregrine ended the first quarter ending Dec. 31 with $12.7 million in cash resources, comprised largely of short-term deposits ($12 million). Cash declined subsequently after paying the last $2.5 million debt payment to BHP Billiton (BHP) in late January.

Figure 3: Cost structure of the recommended work programs presented in the 2015 technical report for the Chidliak diamond project. Source: PGD

The debt payment(s) trace back to Peregrine's agreement to acquire BHP Billiton's 51% interest in the Chidliak project in late 2011. Cash stood at $9.1 million (Feb. 2015), but clearly not sufficient to fully carry out the planned work programs. The cash position improved greatly with the proceeds from the latest rights offering (incl. exercised warrants).

The rights offering (Oct. 2014) included the issuance of 71.9 million share purchase warrants, with each warrant exercisable for one common share at a price of 21 cents for proceeds of $15.1 million. The warrant exercise period expired on April 6.

Peregrine collected proceeds of $11.9 million from 56.4 million (of the 71.9 issued) exercised warrants at a price of 21 cents. Peregrine shares reacted positive to the news as the company now has sufficient funding. Shares on the TSX swelled even though shareholder dilution (~25%) was present. Drill and diamond results over the next couple of months could act as leading catalysts to attract institutional and retails bids.

We have no position in Peregrine Diamonds, but we reiterate our speculative buy and long-term hold rating.

Editor's Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.