Top Ten For the Money

This article refines and distinguishes an earlier report that revealed Russell 2000/1000 combined index bargain stocks to buy and hold for one year.

See the Dow 30 article for explanation of the term "dogs" for stocks reported, based on Michael B. O'Higgins' book "Beating The Dow" (HarperCollins, 1991), now named Dogs of the Dow. O'Higgins' system works to find bargains in any collection of dividend-paying stocks. Utilizing analyst price upside estimates expanded the stock universe to include popular growth equities, as desired.

Dog Metrics Sorted Russell 2000/1000 Index Bargains

Ten dividend-paying stocks as of market closing April 9 were culled from the Russell 2000/1000 combo index. Yield (dividend / price) results verified by Yahoo Finance did the ranking.

Russell Investments, publisher of the Russell 2000/1000 indices states:

"The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The Russell 2000 is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

The Russell 2000 Index is constructed to provide a comprehensive and unbiased small-cap barometer and is completely reconstituted annually to ensure larger stocks do not distort the performance and characteristics of the true small-cap opportunity set."

"The Russell 1000 Index measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1000 of the largest securities based on a combination of their market cap and current index membership. The Russell 1000 represents approximately 92% of the U.S. market.

The Russell 1000 Index is constructed to provide a comprehensive and unbiased barometer for the large-cap segment and is completely reconstituted annually (in June) to ensure new and growing equities are reflected."

Ten stocks in this index offered the biggest yields for April. Nine of those ten represented the financial sector. Leading the financial pack was Western Asset Mortgage Capital Corporation (WMC) [1]. The balance of the financials included: ARMOUR Residential REIT (ARR) [2]; Arlington Asset Investment Corp. (AI) [3]; Resource Capital Corp. (RSO) [4]; New York Mortgage Trust Inc. (NYMT) [5]; CYS Investments, Inc. (CYS) [6]; AG Mortgage Investment Trust Inc. (MITT) [7]; American Capital Agency (AGNC), a large cap entity [9]; and Chimera Investment Corp. (CIM), another large cap entity [10].

The lone technology sector representative from the Russell 1000 large cap index placed eighth, Windstream Holdings Inc. (WIN) [8], which completed the Russell Combined top ten April dogs.

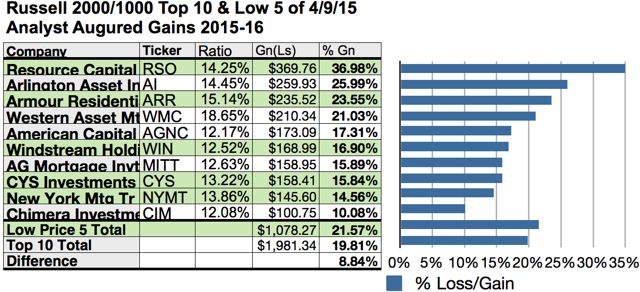

Actionable Conclusion: (1) Analysts Forecast 5 Lowest-Priced of Top Ten Highest-Yield Russell Combined Index Dogs to Deliver 21.57% Vs. (2) 19.81% Net Gains by All Ten by 4/9/16

$5000 invested as $1k March 12 in each of the five lowest-priced stocks in the top ten Russell Combo kennel by yield were predicted by analyst 1-year targets to deliver 8.84% more net gain than $5,000 invested as $.5k in each of all ten. The second-lowest priced Russell Combo index dog, Resource Capital Corp., was projected to deliver the best net gain of 36.98%.

The five lowest-priced Russell 2000/1000 combo index dogs at market close April 9 were: ARMOUR Residential REIT; Resource Capital Corp.; New York Mortgage Trust Inc.; Windstream Holdings Inc.; and CYS Investments Inc., with prices ranging from $3.17 to $9.08.

The five higher-priced Russell 2000/1000 combo index dogs for April 9 were: Western Asset Mortgage Capital; Chimera Investment Corp.; AG Mortgage Investment Trust Inc.; American Capital Agency; and Arlington Asset Investment, whose prices ranged from $14.37 to $24.22.

This distinction between the five low-priced dividend dogs and the general field of ten reflects Michael B. O'Higgins' "basic method" for beating the Dow. The added scale of projected gains based on analyst targets adds a unique element of "market sentiment" gauging upside potential. It provided a "here and now" equivalent of waiting a year to find out what will happen in the market. It's also the work analysts got paid the big bucks to do.

The stocks listed above were suggested only as reference points for a Russell 2000/1000 combined index dog dividend stock investigative process in April, 2015. These were not recommendations.

Gains/declines as reported do not factor in any tax problems resulting from dividend, profit, or return of capital distributions. Consult your tax advisor regarding the source and consequences of "dividends" from any investment.

Disclaimer: This article is for informational and educational purposes only and should not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. Prices and returns on equities in this article except as noted are listed without consideration of fees, commissions, taxes, penalties, or interest payable due to purchasing, holding, or selling same.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.russell.com/indexes; finance.yahoo.com; analyst mean target price by Thomson/First Call in Yahoo Finance.