Allstate Corp. (NYSE:ALL) presents an intriguing investment possibility for value investors, as the company has maintained very strong earnings growth over the last few years that may not be properly priced into the market price. Benjamin Graham, the father of value investing, taught that looking at the price cannot be the sole factor in investment decisions, as the most important aspect to consider is whether the company is trading at a discount relative to its intrinsic value. It is through a thorough fundamental analysis that the investor is able to make a determination about a potential investment's merits. Here is a look at how Allstate Corp. fares in the ModernGraham valuation model.

The model is inspired by the teachings of Benjamin Graham, and considers numerous metrics intended to help the investor reduce risk levels. The first part of the analysis is to determine whether the company is suitable for the very conservative Defensive Investor or the less conservative Enterprising Investor, who is willing to spend a greater amount of time conducting further research.

In addition, Graham strongly suggested that investors avoid speculation, in order to remove the subjective elements of emotion. This is best achieved by utilizing a systematic approach to analysis that will provide investors with a sense of how a specific company compares to another. By using the ModernGraham method, one can review a company's historical accomplishments and determine an intrinsic value that can be compared across industries.

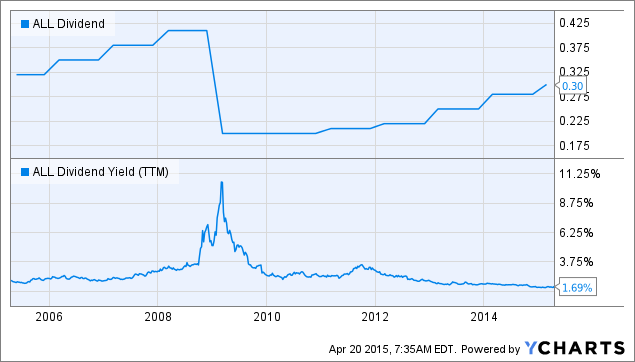

ALL data by YCharts

Defensive Investor - Must pass all 6 of the following tests: Score = 4/6

- Adequate Size of Enterprise - Market capitalization of at least $2 billion - PASS

- Earnings Stability - Positive earnings per share for at least 10 straight years - FAIL

- Dividend Record - Has paid a dividend for at least 10 straight years - PASS

- Earnings Growth - Earnings per share has increased by at least 1/3rd over the last 10 years, using 3-year averages at the beginning and end of the period - FAIL

- Moderate PEmg (price over normalized earnings) Ratio - PEmg is less than 20 - PASS

- Moderate Price-to-Assets - PB ratio is less than 2.5 or PB x PEmg is less than 50 - PASS

Enterprising Investor - Must pass all 3 of the following tests or be suitable for a Defensive Investor: Score = 3/3

- Earnings Stability - Positive earnings per share for at least 5 years - PASS

- Dividend Record - Currently pays a dividend - PASS

- Earnings Growth - EPSmg greater than 5 years ago - PASS

Valuation Summary

Key Data

| Recent Price | $70.87 |

| MG Value | $177.97 |

| MG Opinion | Undervalued |

| Value Based on 3% Growth | $67.03 |

| Value Based on 0% Growth | $39.29 |

| Market Implied Growth Rate | 3.42% |

| PEmg | 15.33 |

| PB Ratio | 1.36 |

Balance Sheet - December 2014

| Total Debt | $5,194,000,000 |

| Total Assets | $108,533,000,000 |

| Intangible Assets | $1,219,000,000 |

| Total Liabilities | $86,229,000,000 |

| Outstanding Shares | 428,000,000 |

Earnings Per Share

| 2014 | $6.27 |

| 2013 | $4.81 |

| 2012 | $4.68 |

| 2011 | $1.50 |

| 2010 | $1.71 |

| 2009 | $1.58 |

| 2008 | -$3.06 |

| 2007 | $7.77 |

| 2006 | $7.84 |

| 2005 | $2.64 |

| 2004 | $4.54 |

Earnings Per Share - ModernGraham

| 2014 | $4.62 |

| 2013 | $3.48 |

| 2012 | $2.31 |

| 2011 | $1.38 |

| 2010 | $1.94 |

| 2009 | $2.49 |

Dividend History

ALL Dividend data by YCharts

Conclusion

Allstate passes the initial requirements of the Enterprising Investor but not the more conservative Defensive Investor. The Defensive Investor has issues with the company's low level of earnings growth over the last ten years and the lack of earnings stability over that time frame. The Enterprising Investor has no initial concerns. As a result, all value investors should feel very comfortable proceeding to the next part of the analysis, which is a determination of the company's intrinsic value.

When it comes to that valuation, it is critical to consider the company's earnings history. In this case, Allstate has grown its EPSmg (normalized earnings) from $1.94 in 2010 to $4.62 for 2014. This is a very strong level of demonstrated growth, which is well above the market's implied estimate for earnings growth of only 3.42% over the next 7-10 years. In fact, the historical growth is around 28% per year, so the market is expecting a very significant drop in earnings growth. The ModernGraham valuation model reduces the historical growth to a more conservative figure, assuming that some slowdown will occur, but still returns an estimate of intrinsic value falling above the current price, indicating that the company is undervalued at the present time.